Alabama 2023 Sales Tax Guide

Alabama Sales Tax in a Word Alabama, the Heart of Dixie, is the 22nd state in the union and undeniably a place of many great American inventions and...

Under the endless Arizona sky, small businesses like yours are thriving and making their mark. But while the entrepreneurial possibilities may seem limitless here, you still have to play by the rules - sales tax rules, that is.

Sales tax compliance is a complex chore, especially in a state with multiple tax jurisdictions like Arizona. Things can get confusing fast if you don't understand the specific requirements. Where do you register? Which goods and services are taxable? When do you file and pay? The questions seem endless.

Well, take a deep breath and relax. We're here to unravel the mystery of Arizona sales tax, so you can get back to doing what you do best - running an amazing business.

In this comprehensive guide, we'll walk through everything you need to know as an Arizona business owner. You'll learn the ins and outs of obtaining sales tax licenses, charging the correct rates, claiming exemptions, filing returns, and more. Whether you're a new or existing business, our expert content will help you avoid common mistakes and keep your business compliant.

|

Table of Contents |

✔️ Do you need to contact the Arizona Department of Revenue ?

✔️Are you unsure if you should call, email, mail, or visit in person?

✔️ Do you ever wondered what information to have ready before contacting them?

Well, you're in luck!

Here's how to get in touch with the Arizona Department of Revenue.

|

Call |

(602) 255-3381 |

|

Online |

|

|

|

|

|

Visit |

Arizona DOR has three offices that you can visit IRL, but you must email AZTaxHelp@azdor.gov first. Phoenix Office: 1600 W. Monroe Phoenix, AZ 85007 Mesa Office: 55 N. Center Mesa, AZ 85201 Tucson Office: 400 W. Congress Tucson, AZ 85701 |

If you wish to have someone call on behalf of the owners or principles, whomever is calling must have an Arizona Power of Attorney (PDF) active before calling or else they will be wasting their time. Representatives at ADOR will not be authorized to talk to someone unless they have a Power of Attorney established. Learn how to complete an Arizona Form 385 - Power of Attorney Form - here.

Well... it's complicated especially since, like many other states, Arizona has enacted laws in response to the South Dakota vs Wayfair case. Read on, so you can learn if you and your business are affected.

Effective October 1, 2019, remote sellers and marketplace facilitators are required to file and pay transaction privilege tax (TPT) in Arizona as a result of House Bill (H.B.) 2757 signed into law by Arizona Governor Doug Ducey on May 31, 2019. This legislation follows the U.S. Supreme Court's 2018 ruling in the South Dakota v. Wayfair case, allowing states to enforce tax collection on sales from out-of-state businesses without a physical presence. This law is not retroactive, but if you sell in Arizona you will need to pay attention to the thresholds that the State of Arizona has set.

H.B. 2757 establishes an economic nexus standard based on dollar thresholds for businesses without a physical presence in the state.

Economic nexus is triggered if either of the following thresholds were met in the previous calendar year or are projected to be met in the current year:

A marketplace facilitator has economic nexus if it facilitates a gross amount of sales exceeding $100,000, either for remote sellers or on its own behalf.

A remote seller has economic nexus if the gross sales from direct sales into Arizona in the previous or current year exceed:

|

Year |

2019 |

2020 |

2021 and beyond |

|

Gross sales threshold |

$200,000 |

$150,000 |

$100,000 |

|

Measurement Date |

Previous or current calendar year |

Previous or current calendar year |

Previous or current calendar year |

Establishing physical nexus, or a physical presence, in Arizona is an important consideration for businesses regarding their tax obligations. The following factors indicate the likelihood of physical nexus:

Assets or Property in Arizona: If your business has control over assets or property stored in Arizona, indicating the ability to determine their location and storage conditions, it is likely that physical nexus exists.

Conducting Taxable Business Activity in Arizona: When your business engages in taxable business activities in Arizona, irrespective of the duration, physical nexus is typically established.

Ongoing Business-Related Activities in Arizona: If your business regularly conducts other ongoing business-related activities in Arizona, physical nexus is likely present. These activities contribute to establishing and maintaining a market presence in the state, supporting sales and customer relations.

Activities and factors that, individually or in combination, contribute to establishing physical presence in Arizona include:

Maintaining an office or another business location within Arizona, regardless of the specific function performed at that location.

Owning or leasing real estate or personal property in Arizona.

Storing inventory in Arizona under the retailer's direction and control.

Regularly delivering merchandise or goods into Arizona using vehicles owned or leased by the retailer.

Undertaking local activities within Arizona by employees, agents, representatives, contractors, or affiliated persons that contribute to name recognition, market share, sales volume, goodwill, and customer relations. These activities should be ongoing and not transitory, such as soliciting sales through local marketing contracts, providing ongoing delivery, installation, or repair services through contracts, or offering training or support services to customers, employees, or representatives on a consistent basis.

Retailers meeting the criteria for physical presence described above are considered liable for transaction privilege tax as taxpayers located within Arizona.

If you are temporarily storing property with a third-party fulfillment center and have no control over the storage facility, it is unlikely that this arrangement constitutes physical nexus. In such cases, where you lack control over the storage location, the level of physical nexus is typically not met.

No, transitory (short-term) business activities conducted within Arizona generally do not establish physical nexus. It is important to note that activities are not considered transitory if they generate gross receipts, are ongoing, and regularly conducted within Arizona.

Similarly, if a retailer conducts the same business outside of Arizona and generates gross receipts from activities performed in the state, those activities are not considered transitory either. Understanding the distinction between transitory and non-transitory activities is crucial in determining the presence of physical nexus for tax purposes.

If you have a salesperson who is a resident of another state but regularly travels to Arizona to sell your products or provide support for previously sold products, it is highly likely that your business establishes physical nexus in Arizona. Since your sales activities are ongoing and conducted within the state, it indicates a significant connection with Arizona.

As a result, you are generally required to pay transaction privilege tax (TPT) on all sales made into Arizona, considering your business as a retailer located within the state. Adhering to these tax obligations ensures compliance with Arizona's tax regulations.

The presence of an employee living in Arizona and working remotely from a home office, specifically engaged in non-sales related activities such as accounting functions or other administrative tasks (e.g., bookkeeping, clerical work), typically does not establish physical nexus. These activities are not directly related to establishing or maintaining a market presence in Arizona.

However, it's important to note that if your company meets the economic nexus thresholds outlined by Arizona, you may still be required to report transaction privilege tax (TPT) on sales made to Arizona customers. Economic nexus criteria, based on sales volume or other factors, determine your tax obligations regardless of physical presence.

If you bring inventory to sell at a trade show in Arizona, the presence of physical nexus depends on various factors. Consider the following:

Sales Activity: If you make sales at the trade show and regularly engage in similar sales outside of Arizona, your activity is not considered transitory. In such cases, you will require a seasonal Transaction Privilege Tax (TPT) license. Additionally, you must pay TPT on all sales made at the trade show.

Duration of Physical Nexus: Your physical nexus will cease once you leave the state after the trade show. At that point, you may choose to cancel your TPT license after reporting all sales from Arizona customers for the month during which you were present at the trade show.

Post-Trade Show Sales: If you continue to sell to Arizona customers from your home state after the trade show, and you meet the threshold requirements for economic nexus, you should contact the ECCO team to update your license accordingly. It's important to note that the sales made at the Arizona trade show do not count towards meeting the economic nexus threshold.

A marketplace seller refers to an individual or business that exclusively sells their products or services through one or more online marketplaces operated by marketplace facilitators, like Amazon or eBay. Unlike traditional sellers who operate their own websites or physical storefronts, marketplace sellers rely solely on these platforms to connect with customers and facilitate their sales transactions. By leveraging the reach and infrastructure of marketplace facilitators, these sellers can expand their market presence and reach a broader audience of potential buyers.

In Arizona, marketplace sellers making sales through platforms like Amazon, eBay, Etsy, etc. have different sales tax obligations depending on certain factors:

If the marketplace facilitator handles all payments, transactions, and deliveries, the facilitator will collect and remit the sales tax on the seller's behalf. The seller does not need their own sales tax permit.

If the marketplace seller makes sales outside the marketplace by directing customers to their own website, they likely meet Arizona's economic nexus thresholds and must register for a sales tax permit.

If the marketplace seller stores inventory in Arizona or performs other activities creating physical nexus, they need their own sales tax permit.

Marketplace sellers with an Arizona sales tax permit must charge, collect, report, and remit sales tax on taxable sales, including those made through the marketplace.

The marketplace may provide documentation about their tax collection role for sellers' records. Sellers should review marketplace agreements for specifics.

Marketplace sellers with a permit should report taxable marketplace sales on their Arizona sales tax returns, typically under the Retail or Wholesale Tax Classifications.

An affiliated party refers to a person or company that holds more than a 5% ownership in the other party or is considered related due to a third person or company (or group) having an ownership interest exceeding 5%.

While economic nexus can be established by combining the income of affiliated parties, it is important to know that once nexus is established, each affiliated party must obtain a license and may choose to report their taxes individually or on a consolidated basis. However, filing consolidated returns is not mandatory for affiliated parties.

Arizona does not have a click-through nexus law at this time.

The first thing to say about Sales Tax in Arizona is the most surprising and confusing: that there is no such thing! Say whaaat? Ok, article over, thanks for coming everybody…. :) If only!

There is, of course, a tax liability for conducting business in Arizona, it’s just not transaction-based and it is levied against the vendor for the privilege of doing business. Are you a business with a physical presence or selling tangible items in the state of Arizona? If so, you likely need to register for a Transaction Privilege Tax (TPT) License.

There are four ways to register for an Arizona Transaction Privilege (TPT) License in Arizona.

AZTaxes.gov - This option enables businesses to register, file and pay TPT online. The State of Arizona has provided a detailed guide explaining how to set up your AZTaxes.gov account here.

Arizona Business One Stop - You can only use this to set up a license and not file and pay sales tax.

Paper Form - You will use the JT-1 Joint Tax Application.

In Person - Use the addresses listed above.

When registering for an Arizona Transaction Privilege Tax (TPT) license, you will need to have the following information ready:

Legal business name

Business ownership structure (sole proprietor, LLC, corporation, etc.)

Physical business location including street address, city, state, and zip code

Mailing address if different from physical address

Email address and phone number

Names, titles, and personal addresses of all business owners/officers

Social Security Numbers or Employer Identification Numbers (EIN)

Start date of Arizona business activities or projected start date

Description of business activities that will be conducted in Arizona

North American Industry Classification System (NAICS) code that best fits your business

Estimated monthly or annual sales/revenue

If you will have employees, your federal employer identification number (EIN)

AZ withholding tax number if you plan to hire employees

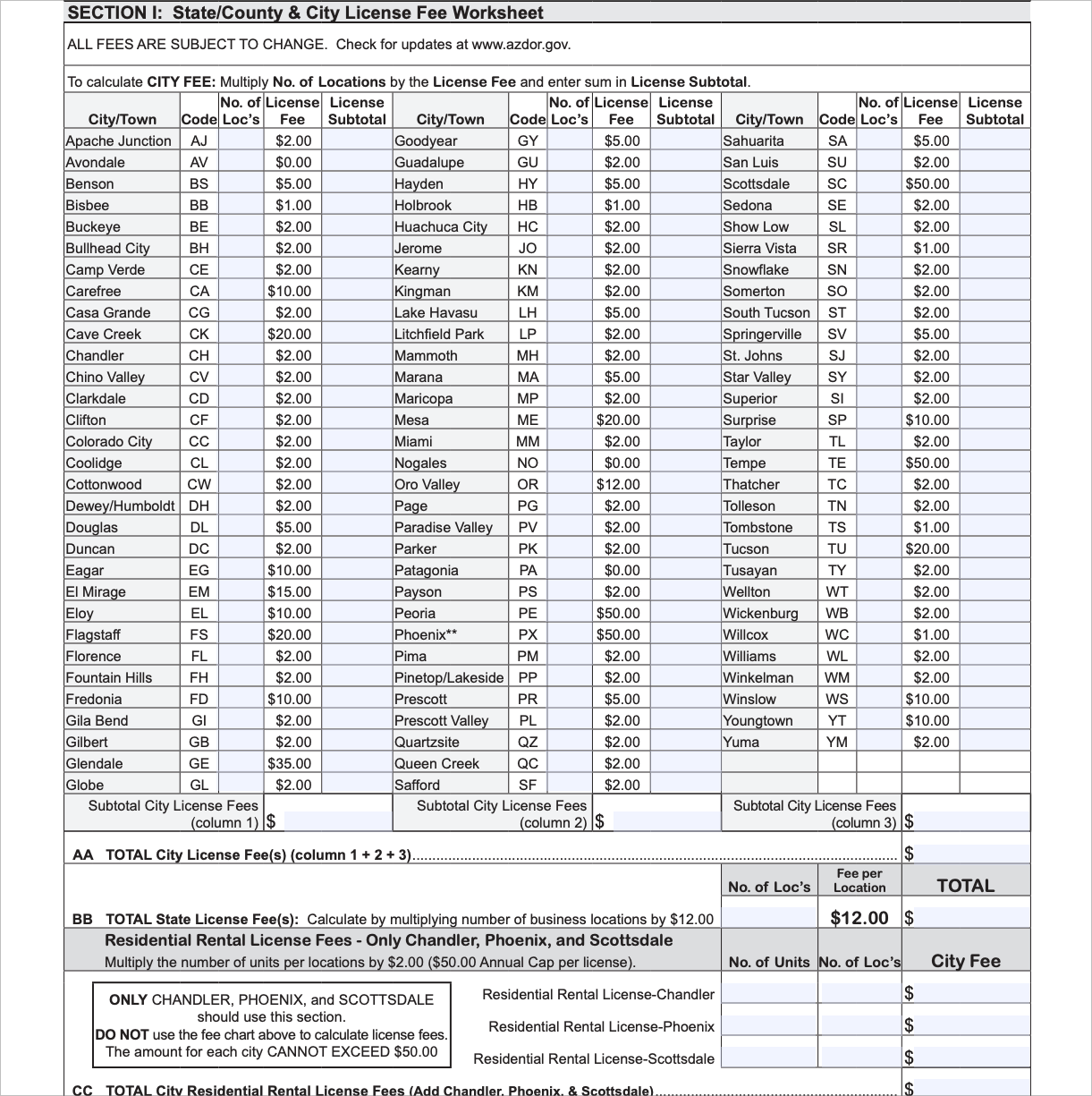

To register for an Arizona Transaction Privilege Tax (TPT) license, there are set fees you will need to pay:

TPT License Registration Fee: The registration fee for a standard TPT license is $12.

Local Registration Fees: Depending on your location, additional registration fees may apply at the city or county level. These range from $2 - $20 per jurisdiction.

Accounting System Fee: If registered with the state for less than 12 months, a one-time $25 accounting system fee is due.

Tenant Registration Fee: Businesses operating from a commercial property location must pay a $5 tenant registration fee when applying.

In total, the upfront costs to register typically range from $12 - $62. Arizona does not charge an annual fee to renew a TPT license.

Monthly or Quarterly Reporting: Most businesses will need to file regular sales tax returns. Online filing fees are $1 per jurisdiction per period.

Transaction Fees: If paying by credit card, transaction fees of 2.5% apply. Electronic Funds Transfer (EFT) costs $1 per payment.

Expect to pay between $12-$62 to initially register, plus nominal costs for online filing and payment fees going forward. Contact the Arizona Department of Revenue if you need help estimating your specific costs.

Here is the current fee schedule:

Absolutely, unless you are registering as a sole proprietor in which case you may opt to use your Social Security Number.

You can easily register for a Federal EIN here.

I promise that it will be the least stressful encounter with the IRS; it is quick and easy to apply for an EIN number.

Depending on your business type, it may be necessary to comply with other regulatory bodies such as:

City or County Licensing Departments

This will require some investigation on your end. Since every business is unique, there are different rules, regulations, and laws may apply.

We suggest contacting to the Arizona Department of Revenue’s License Compliance Program at their email to verify which additional government agencies you will be required to register with.

If you are a business who has established a nexus with Arizona, you are required to collect sales tax in Arizona. Knowing this is just half the battle. Now, We are going to help you navigate the process of how to go about that.

We are going to review some common questions our clients have ask regarding their Arizona sales tax obligations.

How do I collect Arizona sales tax?

Who is eligible for Arizona Sales Tax Exemptions?

What should I do if my customer is exempt from sales tax in Arizona?

What happens if I lose an Arizona sales tax exemption certificate?

After reading this, you will be better equipped to collect sales taxes.

Arizona is a destination-based sales tax state. This means that sales tax is determined based on the location where the product or service is delivered to the customer (the destination), rather than where the seller is located (the origin).

Some key things to know about Arizona being a destination-based sales tax state:

Sellers are required to charge the sales tax rate that applies to the customer's ship-to or delivery address.

Rates can vary by city and county across Arizona, so sellers need to determine the correct localized rate for each sale.

Sellers collect and remit sales tax based on where the customer receives the product or service, not where the seller is physically located.

Arizona sellers with no physical presence in a destination jurisdiction may still be required to collect tax for sales into that area.

Sellers need to manage tax rates and rules for multiple destination jurisdictions across Arizona. Rates and product taxability may vary.

Sales tax reporting and remittance is based on the jurisdictions where the seller made taxable sales in the filing period, even if the seller has no physical presence there.

Destination sourcing rules apply to both internet sales and sales made from brick-and-mortar locations.

The key characteristic of a destination-based sales tax state like Arizona is that the buyer's delivery location determines the taxability of the transaction, not the seller's location.

Remember when we said that Arizona is a Destination-Based and a Transaction Privilege Tax State? This means your business pays for the privilege of conducting business in Arizona, based on the revenue received. No need to collect taxes based on transactions; purely the location of the purchase. Your eCommerce software should be able to calculate this for you on the fly.

Here are some tips on how to properly collect sales tax in Arizona:

Use an up-to-date tax rate lookup tool to determine the correct sales tax rate based on each customer's ship-to or delivery address. Rates vary across the state.

Integrate sales tax calculation and collection into your point-of-sale system and e-commerce platform. Automated software can lookup rates and collect tax.

If collecting manually, use Arizona's jurisdiction codes to assign the right tax rate. Apply the combined state and any local/city rates.

Taxable goods and services include retail sales, food and beverage, lodging, telecom, etc. Exemptions include groceries, prescription medicine, and some business inputs.

Save all sales invoices and certificates of exemption to have proper documentation of tax collection and exemptions.

Update your rates and taxability rules if Arizona tax laws change. Sign up for alerts from the Arizona Dept of Revenue.

Carefully track all taxable, exempt, and out-of-state sales each filing period to complete your sales tax returns.

Remit all tax collected to the state when you file your returns. Returns are due monthly or quarterly depending on sales volume.

Keep detailed sales and sales tax records for at least 4 years in case of an Arizona tax audit.

Adhering to Arizona's destination-based tax rules, collecting at the correct rates, documenting exemptions, and remitting on time will help your business stay sales tax compliant. Reach out to sales and local tax expert or the AZ Dept of Revenue if you need help!

Arizona has a statewide sales tax rate of 5.6%. However, actual sales tax rates can vary significantly across Arizona since counties, cities, and tribal areas may also impose local taxes.

Here are some key things to know about Arizona's current sales tax rates:

State Sales Tax Rate: Arizona charges a 5.6% statewide sales tax on taxable goods and services.

Local Tax Rates: In addition to the state tax, there are over 100 cities and counties that collect local sales taxes ranging from 0.1% to 5.6%.

Combined Tax Rates: When state, county, and city rates are combined, the total sales tax due can range from 5.6% to over 11% depending on the jurisdiction.

Tribal Taxes: Sales made on Native American reservations may be subject to additional tribal taxes ranging from 1% to 16%.

Tax Rate Lookup: The AZ Dept of Revenue provides an online Tax Rate Lookup Tool to find the exact rate based on any address.

Use Tax: Arizona's use tax rate matches the statewide sales tax rate of 5.6% and applies to out-of-state purchases.

Sales tax rates can vary widely across Arizona. Sellers must use accurate rate lookup tools and apply the combined state and local taxes for each customer's delivery jurisdiction. The Arizona Sales Tax Look Up Tool that can be found here.

In the state of Arizona, various goods, services, and transactions are generally subject to sales tax. Here are some common taxable items and activities in Arizona:

Retail sales of tangible personal property - This includes clothing, furniture, electronics, jewelry, toys, etc.

Food and beverages - Taxable unless it is for home consumption and unprepared. Restaurant meals are taxable.

Lodging - Hotel rooms, motels, RV parks, vacation rentals, etc.

Vehicle sales and leasing

Alcohol and tobacco products

Telecommunications - Phone, internet, cable TV, streaming services, etc.

Amusements and recreation - Ticket sales, membership fees, etc. for events/activities.

Personal services - Pet grooming, dry cleaning, car washes, etc.

Printing and publishing

Leasing of tangible goods - Rentals of equipment, furniture, electronics, etc.

Transportation services - Taxi, limo, shuttle services, etc.

Utilities - Electricity, gas, water for commercial use. Residential utilities are exempt.

There are some exemptions to the above like prescription medicine, certain groceries, and some business inputs. Sellers need to be aware of all the nuances of what is and is not taxable in Arizona. The Department of Revenue provides rules and guides for reference. Consulting a tax professional is advisable as well.

Yes.

Software as a Service (SaaS) is generally subject to sales tax in Arizona. Here are some key points on the taxability of SaaS in Arizona:

Prewritten or "canned" software accessed via the cloud is considered tangible personal property and is taxable in AZ. This applies to most SaaS solutions.

The taxability of SaaS applies whether the software is downloaded or remotely accessed. The method of delivery does not determine taxability.

Ongoing access fees, subscriptions fees, license fees, etc. for using or accessing the SaaS software are taxable.

Custom software specifically designed for a client may be exempt from tax as a professional service. But generic SaaS software is not custom.

Maintenance, support, training, customization, etc. may be exempt if separately stated on the invoice from the taxable software charges.

SaaS delivered to AZ businesses is taxable. Sales tax may or may not apply for SaaS sold to individual consumers for personal use.

Out-of-state SaaS sellers that exceed the AZ economic nexus threshold still owe tax on sales to AZ customers.

SaaS is generally considered taxable software and is subject to Arizona sales tax regardless of whether it is delivered via download or over the internet. Sellers of SaaS to AZ buyers should collect and remit sales tax.

In Arizona, certain items and transactions are exempt from sales tax. Here are some common exemptions from sales tax in Arizona:

Food for home consumption: Sales of unprepared food, such as groceries and raw food items intended for home consumption, are generally exempt from sales tax in Arizona.

Prescription medications: Prescription drugs and medications prescribed by licensed healthcare professionals are exempt from sales tax in Arizona.

Medical equipment and supplies: Sales of medical equipment, prosthetic devices, and supplies that are prescribed for use by a licensed healthcare professional are exempt from sales tax.

Agricultural and farming products: Certain agricultural and farming products, including livestock, feed, seeds, fertilizers, and machinery used in agricultural production, may be exempt from sales tax in Arizona.

Utilities and residential rent: Residential utilities, such as electricity and natural gas, and residential rent are generally exempt from sales tax in Arizona.

Nonprofit and charitable organizations: Sales made by qualified nonprofit and charitable organizations may be exempt from sales tax in Arizona, provided they meet specific criteria.

Government and educational institutions: Purchases made by government agencies, public schools, and certain educational institutions may be exempt from sales tax in Arizona.

Manufacturing and certain commercial activities: Some machinery, equipment, and chemicals used in manufacturing, as well as certain commercial activities like printing and publishing, may be eligible for sales tax exemptions in Arizona.

In Arizona, various entities may be eligible for sales tax exemptions based on certain criteria. Here are some examples of entities that may qualify for sales tax exemptions in Arizona:

Nonprofit Organizations: Qualified nonprofit organizations that meet specific criteria, such as charitable, religious, or educational organizations, may be eligible for sales tax exemptions on purchases related to their exempt activities.

Government Agencies: Purchases made by federal, state, and local government agencies are generally exempt from sales tax in Arizona. This includes government departments, agencies, and institutions.

Schools and Educational Institutions: Public schools, colleges, universities, and certain educational institutions recognized by the state may qualify for sales tax exemptions on eligible purchases.

Native American Tribes: Purchases made by Native American tribes or tribal entities for tribal government activities or for the benefit of tribal members may be exempt from sales tax.

Qualifying Manufacturers: Certain machinery, equipment, and raw materials used in manufacturing or processing activities may be eligible for sales tax exemptions in Arizona. These exemptions are typically designed to support and promote manufacturing operations in the state.

Each exemption category may have specific requirements, limitations, or documentation that needs to be provided to claim the exemption. Eligible entities should review the guidelines provided by the Arizona Department of Revenue or consult a tax professional to determine their eligibility and ensure compliance with the sales tax exemption provisions.

If you have a customer who is exempt from paying sales tax in Arizona, here are some tips:

Obtain a completed Arizona exemption certificate from the customer. This certifies their tax-exempt status.

Verify that the exemption certificate is fully filled out and includes the customer's name/address, exemption reason (e.g. resale, nonprofit), and signature.

Keep the certificate on file in your records. Exemption certificates are valid for 5 years.

Do not collect or charge sales tax on invoices to this exempt customer. Write "Tax Exempt" on the invoices.

Report the sales to exempt customers separately on your sales tax return, under non-taxable transaction amounts.

Be prepared to provide the exemption certificates if requested during a tax audit to validate exempted sales.

If an exemption certificate expires, obtain a new one from the customer to continue exempting their purchases.

If a customer who is exempt makes a taxable purchase for personal use, you do need to collect tax on that sale.

Reach out to the Arizona Department of Revenue if you have any doubts about the validity of a claimed exemption.

Following these steps allows you to properly document tax exempted sales, exclude them from taxable gross revenue, and avoid issues or penalties for improper exemptions.

If you lose or misplace an Arizona sales tax exemption certificate, it is important to take steps to obtain a replacement certificate and ensure compliance.

First, contact the customer and request they provide a new certificate to continue the tax-exempt status of their purchases. If your unable to reach the customer, contact the Arizona Department of Revenue, explain that an exemption certificate was lost, and request their guidance. The Department of Revenue may allow you to retain records that the initial certificate was issued while waiting for a new one. Until a new certificate is provided, begin collecting sales tax from that customer again to avoid potential penalties for non-payment of tax.

Review your internal procedures to make sure exemption certificates are properly stored and accessible digitally. If the lost certificate spanned a long period, the Department of Revenue may work with you to determine past tax liability on formerly exempted sales and provide time to pay any tax due. Once you receive the new replacement exemption certificate, keep it on file and immediately stop collecting sales tax from that customer again. Make notes in your system documenting the certificate loss and replacement for your records.

It is time to talk about filing and paying your sales taxes in Arizona. In this section, We are going to cover the following frequently asked questions from our clients:

When is Arizona sales tax due?

What are the Arizona sales tax thresholds?

What if an Arizona sales tax filing date falls on a weekend or holiday?

How do I file an Arizona Sales Tax Return?

How do I correct an Arizona sales tax return?

What happens if I file or pay my sales tax return late?

Do I need to file a return if I don’t collect any sales tax in Arizona?

Does the Arizona Department of Revenue offer a discount for filing on time?

By the time you finish reading this, you will feel confident enough to file and pay your Arizona sales tax.

The filing frequency for Transaction Privilege Tax (TPT) in Arizona is based on the total estimated annual combined TPT liability of a business.

More than $8,000 estimated annual combined tax liability.

$2,000 - $8,000 estimated annual combined tax liability

Less than $2,000 estimated annual combined tax liability

Businesses with a duration of 8 months or less, such as those operating during specific seasons or limited periods.

If a business wants to change its filing frequency, they can download the Business Account Update Form, complete it, and mail it to the designated address mentioned on the form.

These filing frequency categories help businesses determine how often they need to submit TPT returns and remit the taxes owed to the Arizona Department of Revenue. It is important for businesses to accurately assess their estimated annual combined tax liability to ensure compliance with the appropriate filing frequency.

You must file and pay your sales tax no later than the 20th day of the month following the period being reported. For example, you will need to pay December sales tax by January 20th to avoid penalties and interest. You can download a printable filing schedule here.

The deadline is moved to the next business day, typically the Monday following the weekend or the day after the holiday. However, we always suggest filing before the holiday.

Let me ask you a question before I answer this one.

Are you a business who prepares your own tax returns, uses the computer to do so, and has internet access?

If the answer is “Yes, Yes, Yes”, Arizona offers an easy way to file online. Simply head to ADOR’s AZTaxes site and file the TPT-2 form online through the portal.

If you get stuck and need a hand, AZ Department of Revenue created this handy guide (PDF) to get through the online filing process.

You can also watch this video that walks you through how to file a sales tax return, one step at a time.

Paper submittal is also permitted, if you’re into that sort of thing. You can download form TPT2, fill out, enclose payment, and mail to:

Arizona Department of Revenue

PO Box 29010

Phoenix AZ 85038-9010

To correct an Arizona sales tax return, follow these steps:

Identify the error: Determine the specific mistake or error that needs to be corrected on your sales tax return. This could include incorrect sales amounts, tax calculations, or reporting of exemptions or deductions.

Complete a new return: Prepare a new sales tax return with the corrected information. Use the same reporting period as the original return that contained the error.

Explain the correction: Clearly indicate on the new return that it is a correction for a previous return. Include a brief explanation of the error and the changes made to rectify it.

Calculate the adjustments: Calculate the necessary adjustments to correct the error. If you underreported sales or tax owed, include the additional amount in the new return. If you over reported sales or tax owed, subtract the excess amount from the new return.

Submit the corrected return: File the corrected sales tax return with the Arizona Department of Revenue. Ensure that the corrected return is submitted by the specified deadline to avoid penalties or interest charges.

Maintain records: Keep thorough records of the corrected return, including any supporting documentation or explanations provided. These records will serve as evidence of the correction made in case of future audits or inquiries.

Make payment or request refund: If the correction results in additional tax owed, submit the payment to the Arizona Department of Revenue. If the correction leads to an overpayment, you may be eligible for a refund. Follow the appropriate procedures outlined by the department to request a refund.

If the error requires significant changes or adjustments, or if it involves multiple reporting periods, you may need to consult with the Arizona Department of Revenue or a tax professional for guidance on the specific correction process. They can provide assistance and ensure compliance with the applicable regulations.

Businesses with an annual transaction privilege tax and use tax liability of $500 or more during the prior calendar year are required to file and pay electronically.

Failure to comply with the electronic filing and payment requirements may result in penalties.

Penalty for not filing and paying electronically:

Taxpayers required to file an electronic return will be subject to a penalty of 5% of the tax amount due for filing a paper return. The minimum penalty is $25, including filings with zero liability.

Taxpayers required to pay electronically will be subject to a penalty of 5% of the amount of payment made by check or cash.

Taxpayers who file their tax return late will be subject to a late file penalty of 4.5% of the tax required to be shown on the return for each month or fraction of a month the return is late. There is a minimum of $25 and a maximum 25% of the tax due or $100, per return, whichever is greater.

The Arizona Department of Revenue is pleased to update transaction privilege tax (TPT) taxpayers who e-file using the department’s electronic filing programs.

Taxpayers who file electronically during a calendar year are now able to claim an increased accounting credit from 1 percent to 1.2 percent; this increases the total calendar year credit limit from $10,000 to $12,000.

TPT taxpayers who have already e-filed can file an amended return to claim the increased accounting credit.

The increased accounting credit for electronic TPT filers is in accordance with the Arizona Department of Revenue’s commitment to expanding electronic filing of individual, corporate and TPT as e-filing is a more secure and efficient process.

For taxpayers who file paper TPT returns, the accounting credit remains unchanged at 1 percent and a total calendar year credit of $10,000.

TPT filers can confirm the electronic or paper accounting credit rate for each TPT business code by going to AZ DOR resource page.

Arizona does not currently have any sales tax holidays.

Navigating Arizona sales tax regulations can be a challenging endeavor for small business owners. To help you stay on track and avoid common mistakes, we've compiled a list of the top 5 Arizona sales tax pitfalls and how you can steer clear of them.

Not registering for a Transaction Privilege Tax (TPT) License: In Arizona, businesses need a TPT License to collect and remit sales tax. Failing to obtain this license can result in penalties and fines. To avoid this mistake, apply for a TPT License through the Arizona Department of Revenue (ADOR) before you start collecting sales tax.

Incorrectly determining tax rates: Arizona is a destination-based sales tax state, which means you must collect sales tax based on the buyer's location. Many businesses mistakenly charge a flat rate or use their location's rate. To avoid this error, use an up-to-date sales tax rate lookup tool or sales tax automation software to ensure you're calculating the correct rates for each transaction.

Failing to keep accurate sales records: Maintaining organized and accurate sales records is vital for error-free sales tax filings. Some businesses overlook this and end up with discrepancies in their tax returns. To sidestep this mistake, use accounting software or enlist the help of a trusted bookkeeping partner like Accountingprose to keep your records in check.

Missing filing deadlines: Late filings can lead to penalties and interest charges, causing financial strain on your business. To avoid this, mark your calendar with the relevant filing due dates and set reminders to ensure you file and pay on time. Remember, if a deadline falls on a weekend or holiday, it's automatically extended to the next business day.

Neglecting sales tax exemptions: Arizona offers various sales tax exemptions, and failing to account for these can lead to overcharging customers or underreporting your sales tax liability. To avoid this mistake, familiarize yourself with Arizona's exemption rules, collect valid exemption certificates from eligible customers, and keep these well-organized and readily accessible.

By staying vigilant and implementing these strategies, you can successfully navigate Arizona sales tax regulations and maintain your small business superhero status. Remember, your trusty partners at Accountingprose are here to support you every step of the way, offering expert advice and guidance in your small business journey. Together, we can conquer Arizona sales tax and help your business thrive!

Arizona is a destination-based sales tax state. In destination-based sales tax states, the sales tax rate and rules are based on the location where the buyer receives the goods or services. This means that the sales tax rate and regulations are determined by the destination address where the product is delivered or the service is provided, rather than the location of the seller. As a seller, you are responsible for charging and collecting sales tax based on the specific destination within Arizona where the customer receives the taxable goods or services. It's important to correctly determine the applicable sales tax rate based on the destination address and comply with the reporting and remittance requirements set by the Arizona Department of Revenue.

Arizona is not a Streamlined Member State.

|

Alaska Sales Tax Guide (N/A) |

||||

|

Montana Sales Tax Guide (NA) |

||||

|

Oregon Sales Tax Guide (N/A) |

||||

|

Delaware Sales Tax Guide (N/A) |

||||

|

New Hampshire Sales Tax Guide (NA) |

||||

And don't forget to check out our blog about Economic Nexus, which serves as an invaluable resource for businesses who have sales that are subject to sales tax.

This blog is for informational purposes only and the information is accurate as of 2023-05-29 If you want legal advice on sales tax law for your business, please contact a Sales Tax professional. Keep in mind that sales tax regulations and laws are subject to change at any time. While we strive to keep our blog current, this blog possibly may be out of date by the time you review it.

Alabama Sales Tax in a Word Alabama, the Heart of Dixie, is the 22nd state in the union and undeniably a place of many great American inventions and...

Running a business is already challenging, and then there’s sales tax nexus—an issue that can turn things upside down if you’re not careful. ...

Vermont Sales Tax in a Word Welcome to the world of Vermont sales tax, where the maple syrup flows freely and the tax guidelines are as...