Unlocking the Power of Xero Accounting Software

For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details...

17 min read

Enzo O'Hara Garza

:

Updated on November 22, 2023

Keeping tabs on your accounts receivable is an absolute must for entrepreneurs. Xero invoice reminders are an effective way to ensure you're getting paid in a timely manner and avoiding any unnecessary delays or missed payments. When you pair Xero's invoice reminders with payment services and use a handy add on for collections, the days of not getting paid on time will be a thing of the past. Need a little help crafting the perfect payment reminder and setting them up in Xero? We've got you covered with our example email templates and a handy Xero invoice reminder set up guide.

Running a small business involves juggling various responsibilities, and one that can often be tricky is managing invoices. But with Xero's Invoice Reminders, you have a powerful tool that takes care of this task, ensuring a steady cash flow and maintaining good relationships with your customers. You can set up reminders easily, personalize them, and check their status right from your dashboard. Even when issues arise with your reminders, troubleshooting can help you identify and rectify these problems promptly. Think of Invoice Reminders as your silent partners, working tirelessly to support your business growth. So, give them a try - even the best juggler appreciates a helping hand!

Automated invoice reminders are a great way to get paid faster and stay organized with your invoicing. With Xero, you can quickly set up automated reminders to be sent regularly, helping ensure customers stay on top of their payments and keeping your cash flow steady.

One of the challenges of running a small business is managing the cash flow cycle, which involves ensuring that there is enough money coming in to cover expenses and invest in growth. Late payments from clients can create cash flow gaps that can be challenging to overcome, particularly for small businesses that may not have large cash reserves. By automating the process of sending payment reminders, small business owners can ensure that their clients are reminded to pay their invoices promptly and consistently, without adding more work to the business owner's plate.

Manually sending payment reminders to clients who haven't paid their invoices on time can be a time-consuming process. By automating the process of sending payment reminders, you can save valuable time that can be better spent on other aspects of your business, such as marketing, product development, and customer service. This can help you to work more efficiently and effectively, and ultimately contribute to the growth and success of your business.

As a business owner, you know that even small errors can have a significant impact on your business. When it comes to invoicing, errors can result in late payments, misunderstandings, and damaged client relationships. By automating the process of sending payment reminders, you can reduce the risk of errors and ensure that your invoicing process runs smoothly. You can customize the reminders to include the correct payment details, due dates, and other relevant information, ensuring that clients have all the information they need to pay their invoices on time.

The way you communicate with your clients can have a significant impact on your business relationships and overall success. Sending payment reminders manually can sometimes come across as confrontational or unprofessional, which can damage client relationships and make it difficult to do business in the future. Invoice Reminders can be customized to match your brand identity and tone, helping to maintain positive relationships with clients.

Setting up automated invoice reminders in Xero is a great way to ensure your clients are always aware of their payment obligations. With just a few simple steps, you can quickly configure these helpful notifications and save yourself time and energy.

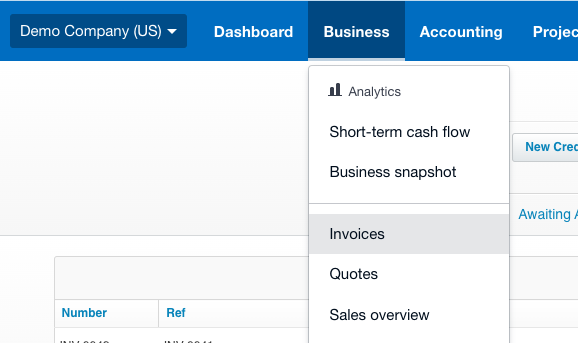

To begin, log into your Xero account, click on Business and then select Invoices.

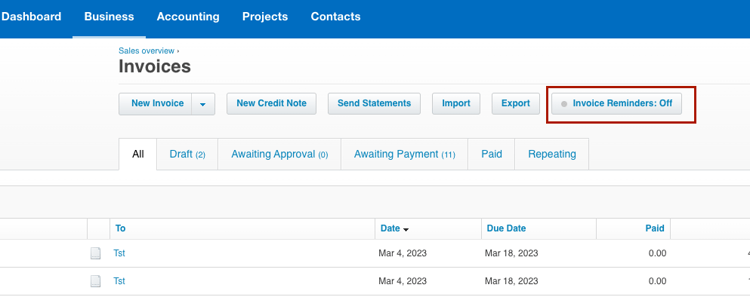

From there, click "Invoice Reminders: Off".

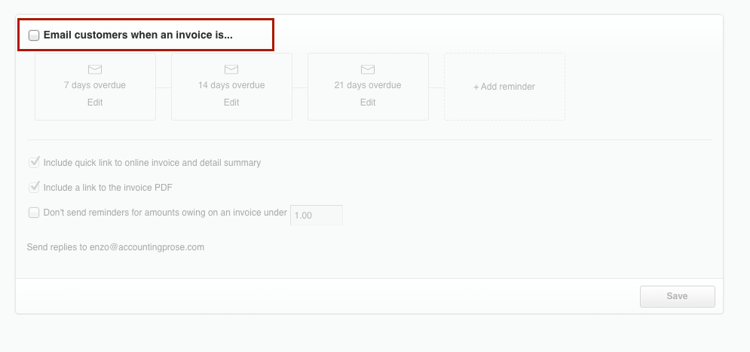

Tick the box next to, "Email customers when an invoice is..."

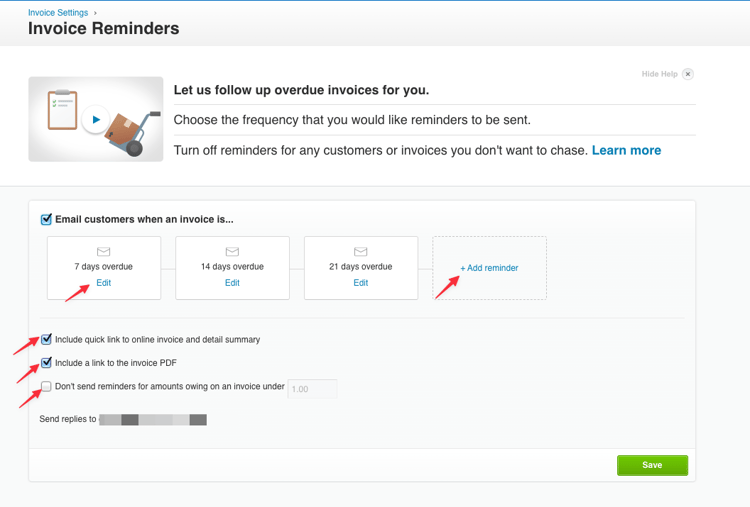

Here you can edit the

Total number of reminders to be sent: Up to 4 available

Email Frequency: You can set a reminder to be sent out when it is "Due in X number of days" or "Past due by X number of days"

Edit the email message and include placeholders (more on that below)

Include a link for the online invoice

Include an invoice PDF

Chose to not send a reminder if the balance is under a certain amount.

You can use placeholders within the Xero's email templates to personalize the content and make it more relevant to each individual invoice. This information is pulled from different parts of Xero, including the Invoice Module and Contact Module, and allow you to send customized emails to your clients without having to do any extra work.

Here are the placeholders can be used within Xero's Invoice Reminders

| Placeholder | Description | |

|

Amount Due Without Currency |

The amount due on the invoice, or remaining credit on the prepayment, including tax, without the currency code. |

|

|

Amount Due |

The amount due on the invoice, or remaining credit on the prepayment, with the currency code included. |

|

|

Contact / Customer First Name |

The first name of the contact/customer stored in your contact's details. |

|

|

Contact/Customer Last Name |

The last name of the contact/customer stored in your contact's details. |

|

|

Contact/Customer Name |

The name of the contact/customer stored in your contact's details. |

|

|

Currency Code |

The 3-letter code that represents the currency type. |

|

|

Currency Symbol |

The symbol representing the currency type. |

|

|

Due Date |

The due date from the invoice. |

|

|

Invoice Number |

The number of the credit note, invoice etc. |

|

|

Invoice Total Without Currency |

The total invoice amount, including tax, without the currency code. |

|

|

Invoice Total |

The total invoice amount, including tax, with the currency code included. |

|

|

Month Year |

The current month and year, for example, October 2014. For example, if the current month is December 2014, [Month Year+1] will display January 2015. |

|

|

Month |

The current month of the year, for example, October. For example, [Month+1] will display the month after the invoice date. |

|

|

Online Invoice/Quote Link |

The link to the online credit note, invoice, or quote. |

|

|

Reference |

The reference from the credit note, invoice or quote etc |

|

|

Trading Name |

Your organization's legal/trading name set up in Organization Settings. |

|

|

Week Year |

The current week and year, for example, 46 2014. Weeks start on Monday. |

|

|

Week |

The current week of the calendar year, for example, Week 8. Weeks start on Monday. |

|

|

Year |

The current year. |

By default, Xero sets up three reminders for 7, 14, and 21 days after each invoice due date. But don't worry, you're not stuck with these. You can customise or delete these reminders to match your business needs, from jazzing up the email message to changing the timing.

Reminders are emailed to the primary contact and anyone else in your customer's contact record who has the 'Include in emails' option checked. If a customer replies to a reminder, the response goes to the email of the person who first enabled the reminders. But hey, we know things change, so you can also switch this address up as needed.

Want to know if a reminder has been sent or not? No problem! You can check the status and history of each invoice reminder to see if, or when, it has flown the coop.

So, you've got your invoice reminders set up. Now what? Well, you can:

Edit or delete any reminder, even the defaults. Want to change the 7-day reminder to 10 days overdue? Go for it! Want to add payment details to the email? No problem!

Add a reminder for before an invoice is due. You can specify how many days in advance you'd like this sent.

Add up to five new reminders.

Toggle reminders on and off for your whole organization.

Stop reminders for certain customers or specific invoices. Very handy if an invoice is partly paid or you've already been in touch with your customer about it.

If reminders are turned off, or the invoice isn't marked as sent, and a 7-day reminder slips through the cracks, simply changing the due date to the future won't spawn a catch-up reminder. However, Xero will generate upcoming reminders based on the new due date.

Xero sends out invoice reminders every day between 4am and 8am, as per your organization's time zone. The time you choose to switch reminders on or off can affect their sending schedule.

If you turn on reminders before 4am, that day's reminders will go out the same day. If you turn them on after 8am, they'll go out the following morning. If you turn off reminders between 4-8am and then turn them on later, the day's reminders won't be sent and they won't play catch up, even if you change the invoice due date. The next day's reminders will go out as usual.

Here's an example. Let's say you have a reminder set for 7 days overdue, but you turn off reminders when an invoice is 6 days overdue. If you switch reminders back on when the invoice is 8 days overdue, Xero won't send the 7-day reminder. The 14 and 21-day reminders will proceed as normal.

Invoice reminders can save you a ton of time chasing invoices. For more tips on how to streamline your invoicing and get paid faster, check out our guide Get your invoices paid faster.

Here's how to control reminders for your entire organization:

Click the organization name, go to 'Settings', and then click 'Invoice Settings'.

Click 'Invoice Reminders'.

Check the 'Email customers when an invoice is' box to turn on reminders for your organization. Uncheck it to turn them off.

Don't forget to click 'Save'!

Before you start, ensure that reminders are enabled for your organization.

Here's how you can manage reminders for individual customers:

In the 'Contacts' menu, select 'Customers'.

Click the customer’s name to open their contact record.

Click 'Options', then select 'Turn off invoice reminders' or 'Turn on invoice reminders'.

Before you start, verify that reminders are turned on for the customer.

Here's how to control reminders for specific invoices:

In the 'Business' menu, select 'Invoices'.

Select the 'Awaiting Payment' tab.

Check the box(es) for the invoice(s) you want to manage reminders for.

Click 'More', then select 'Turn reminders on' or 'Turn reminders off'.

You can also manage reminders for a single invoice while viewing it:

Find and open the invoice you want to manage reminders for.

If you're using new invoicing, click the menu icon (it looks like three vertical dots). If you're using classic invoicing, click 'Invoice Options'.

Select 'Turn invoice reminders on' or 'Turn invoice reminders off'.

Staying on top of your invoices is a critical part of managing your business finances, and Xero makes this task easier with its automated invoice reminders. But how do you know if these reminders are doing their job? That's where checking the status of your invoice reminders comes in handy

Let's dive into how you can do this:

Step 1: Log into your Xero account and navigate to the 'Invoices' section under the 'Business' menu.

Step 2: Click on the 'Awaiting Payment' tab. Here you'll find a 'Reminders' column that shows the status of each invoice reminder.

The 'Reminders' column will only appear if Xero has attempted to send a reminder or if at least one customer has turned off their invoice reminders. If you've recently activated reminders, or if all customers have reminders enabled, the column will appear the next time Xero tries to send a reminder.

The status of an invoice reminder can be one of the following:

[Number] sent: This shows the number of reminders sent for the invoice, with some still pending.

All sent: This indicates that all scheduled reminders for the invoice have been dispatched.

Email missing: This status means the customer's email address is missing, so the reminder couldn't be sent. You can click on the customer's name to check and update their email address.

Invoice not sent: This status indicates that the invoice hasn't been marked as 'sent', so the reminder wasn't dispatched. You can mark the invoice as sent to activate reminders for it.

Turned off: This means that the last time Xero tried to send a reminder, the reminders were turned off for the customer or invoice. You'll need to turn them back on.

Remember, the 'Reminders' column doesn't update in real-time. If you edit an invoice, you'll see the update when Xero attempts to send the next reminder.

If a reminder wasn't sent as expected, there could be several reasons. For instance, you might have activated a reminder on the day it was due, or after the invoice passed its reminder date. The invoice could have been accidentally marked as paid, or you might have changed the invoice due date and the reminder date has passed.

Everyone loves a good tune-up, and your Xero invoice reminders are no different. Tailoring these reminders to match your business's unique needs can make your invoicing process smoother and more effective. Whether you want to make some tweaks, delete a reminder completely, or even add some nifty features like links to PDF invoices, this guide has got you covered.

Customizing your invoice reminders is a breeze with Xero. Whether you're an advisor or a standard user, you can easily make changes to individual reminders or adjust settings that apply across the board. Here's how:

To change an individual reminder's email template or its timing:

Click your organization name, choose 'Settings', and then hit 'Invoice Settings'.

Find 'Invoice Reminders' and give that a click.

Make sure 'Email customers when an invoice is' checkbox is selected (if it's clear).

Find the reminder you want to edit and click 'Edit'.

Make your changes. You can even edit the email template and insert placeholders. Just click 'Insert placeholder' and select the one you need.

When you're done, hit 'Save'.

There are some settings that apply to all reminders. These include adding invoice links, not sending reminders for small amounts, or changing the 'reply to' address for reminders.

For these settings:

Go to 'Invoice Settings' from 'Settings' under your organization name.

Click 'Invoice Reminders'.

To include online invoice links in all reminders, select the 'Include quick link to online invoice and detail summary' checkbox.

To include PDF invoice links in all reminders, choose the 'Include a link to the invoice PDF' checkbox.

If you don't want to send reminders for small amounts, select the 'Don’t send reminders for amounts owing on an invoice under' checkbox and enter your preferred amount.

From 'Send replies to', select the email address where you want replies sent. The available addresses come from your users' individual settings in Xero.

Don't forget to hit 'Save' to apply these changes to all reminders.

Sometimes, you might want to get rid of a reminder. Here's how:

Navigate to 'Invoice Settings' from 'Settings' under your organization name.

Click 'Invoice Reminders'.

Make sure 'Email customers when an invoice is' checkbox is selected (if it's clear).

Find the reminder you want to remove, click 'Edit', then hit 'Delete'.

Keep in mind, once you delete a reminder, it's gone for good. But don't worry, you can always add a new one if you change your mind.

There you have it! With these steps, you can fine-tune your Xero invoice reminders to make them work even harder for your small business. Remember, your invoice system should work for you, not the other way around!

When sending invoice reminders, the language you use can make a big difference in how customers respond. It’s important to be professional and polite while still making sure your message is clear and concise. Here are some best practices for crafting effective emails:

Your tone should always be respectful when communicating with customers about payment. Use phrases like “please” and “thank you” to show that you value their business. Avoid using aggressive or threatening language as this will only lead to frustration on both sides.

Keep your messages short and sweet - no one likes to read long emails. Make sure all of the necessary information is included but avoid going into too much detail or getting sidetracked by other topics unrelated to payment.

When writing an email, use plain language that anyone can understand easily without having specialized knowledge or experience in accounting or finance. Avoid industry jargon as this could confuse customers who may not be familiar with the terminology used in your field of work.

Clearly explain what payment options are available so there is no confusion about how they can pay their invoice (e.g., credit card, PayPal, etc.). Include any relevant links for online payments if applicable and provide instructions on where/how they should send checks if that's an option as well.

Let customers know when payment needs to be received by providing a deadline date along with any potential consequences such as late fees if they miss it (this should also be stated clearly on the invoice itself). This helps ensure prompt payments from clients who may otherwise procrastinate until reminded again at a later date.

Subject: Payment Due for Invoice # [Insert Invoice Number]

Dear [Insert Client Name],

This is a friendly reminder that your payment for Invoice # [Insert Invoice Number] is now due. You can easily pay your invoice online using the link provided below:

[Insert payment link]

Thank you for being a valued customer. If you have any questions or if there is anything that we can help with, please don't hesitate to contact us.

Best,

[Insert Your Name]

Subject: Payment Reminder for Invoice # [Insert Invoice Number]

Dear [Insert Client Name],

We wanted to reach out and let you know that we have not yet received payment for your Invoice # [Insert Invoice Number], which was due seven days ago.

You can pay your invoice securely by clicking on the link below and following the simple prompts:

[Insert payment link]

If you have already submitted payment or have any questions about your invoice, please do not hesitate to contact us at [Insert Contact Information].

We value our partnership and would like to thank you for your attention to this matter.

Best regards,

[Insert Your Name]

Subject: Urgent Payment Reminder for Invoice # [Insert Invoice Number]

Dear [Insert Client Name],

Unfortunately, it has come to our attention that your payment for Invoice # [Insert Invoice Number] is now 21 days past due.

We value our partnership and understand that delays can occur due to unforeseen circumstances. We would like to assist you in resolving any issues that you may be facing with the payment of this invoice. If you are having any difficulties paying the invoice or have any questions regarding the payment or outstanding balance, please do not hesitate to contact us at [Insert Contact Information]. We will do our best to assist you in resolving any issues.

You can pay your invoice securely by clicking on the link below and following the simple prompts:

[Insert payment link]

Please be advised that invoices over 30 days will incur a late fee, and we'd like to settle this matter before a late fee is applied.

Thank you for your attention and cooperation in this matter, and we look forward to your continued patronage.

Best regards,

[Insert Your Name]

Subject: Final Notice of Payment for Invoice # [Insert Invoice Number]

Dear [Insert Client Name],

Unfortunately, your payment for Invoice # [Insert Invoice Number] is now 30 days past due and a late fee of [$ Late Fee Amount] has been applied to your balance.

Failure to receive payment may result in the suspension or termination of our services, and we would like to avoid this from occurring.

To make payment as easy as possible, we offer the convenience of paying online. You can pay your invoice securely by clicking on the link below and following the simple prompts:

[Insert payment link]

Please note that if we do not receive payment soon, we may have to take additional legal and procedural measures to ensure that this outstanding balance is resolved.

Best,

[Insert Your Name]

Subject: Invoice # [Insert Invoice Number] Will Been Sent to Collections

Dear [Insert Client Name],

We regret to inform you that your payment for Invoice # [Insert Invoice Number] is now 45 days past due. Despite our previous requests for payment, we have yet to receive any communication or payment from you in this regard.

Per our terms of service, we must remind you that if payment is not made by the end of this week, we will be forced to send the outstanding invoice to a collections agency for resolution. Unfortunately, this will also result in the termination of our working relationship, and we are sure that is not an outcome we would want to consider.

We understand that unforeseen circumstances may arise, and we are here to assist you in resolving any issues that you may be facing with payment. We urge you to arrange payment for this invoice as soon as possible to avoid any legal or collections actions.

To make payment as easy as possible, we offer the convenience of paying online through our secure payment portal, powered by Xero. You can pay your invoice securely by clicking on the link below and following the simple prompts:

[Insert payment link]

We urge you to take prompt action to make payment and avoid any further escalation. If you have any questions, please contact us at [Insert Contact Information], and we will do everything we can to assist you.

Thank you for your attention and cooperation in this matter.

Best regards,

[Insert Your Name]

Understanding the importance of language in your emails is key to successful communication. Moving forward, we will discuss how payments work with Xero Invoice Reminders and how you can set up automated reminders for customers who are overdue on their invoices.

The Idea: Be polite and concise when crafting invoice reminder emails - use plain language that anyone can understand, provide clear payment options with a deadline date, and remind customers of any potential late fees. Express your gratitude for their patronage while keeping the message succinct and prompt by utilizing terms like "please" and "thank you".

Including payment services to invoices is key for streamlining the collection of payments from customers. Automated invoice reminders with payment options can help reduce the amount of time and effort spent on tracking down payments from clients. With Xero, you can easily add payment services like Stripe, GoCardless, and Paypal to your invoices for a frictionless way to get paid.

Stripe is a widely-used payment processing platform that offers convenience and cost-effectiveness for small businesses. It’s easy to set up and integrates seamlessly with Xero so that customers can pay their invoices directly through Stripe’s secure system without having to leave your website or log in anywhere else. Plus, Stripe offers competitive rates and no setup fees so it’s a great option for small businesses looking for an affordable solution.

GoCardless also makes it easy for customers to pay their invoices directly through its secure platform without leaving your website or logging in elsewhere. It supports multiple currencies so international customers won't have any trouble paying their bills either. Additionally, GoCardless has lower transaction fees than other providers making it ideal if you want to save money on processing costs while still offering convenient payment methods for customers.

PayPal is another popular choice when adding payment services to your invoices as many people already have PayPal accounts set up which makes checkout faster and easier than ever before. PayPal also offers fraud protection and advanced security measures so you know that customer data will remain safe at all times when using this service too.

When setting up these automated invoice reminders with integrated payments systems, be sure that all language used in emails sent out is clear and concise yet friendly enough not to sound robotic or overly formal. This helps ensure that clients understand what they need to do to complete their transactions quickly without confusion or frustration. Also make sure you include instructions on how payments work within each email reminder - such as what currency they should use etc., as well as details about refunds/return policies just in case something goes wrong during the transaction process. Finally don't forget to provide links back directly into Xero where applicable (e.g., view/pay invoice). This allows customers access everything they need right away without having to search around different websites trying to figure out how to complete their purchase/payment.

Integrating payment services into your invoicing system can help expedite the collection of payments, saving time and effort. To ensure that your customers are reminded about their due invoices in a timely manner, it is important to use best practices for language when sending out emails.

The Idea: Adding payment services to invoices can help streamline the process of getting paid and Xero makes it easy to do with platforms like Stripe, GoCardless, and Paypal. Automated invoice reminders should include clear language, instructions on how payments work, as well as links back into Xero for a hassle-free experience.

Ideally, you'd receive full payment promptly; however, if this isn't the case, there are measures to take in order to recoup what's owed. Regrettably, this isn't always the reality. If you find yourself unable to collect payment from a customer, there are several steps you can take to try and recover what's owed.

First off, make sure your invoices clearly outline all terms of payment including due dates and any late fees or interest associated with nonpayment. This will help set expectations for when payments should be made so customers know exactly what they owe and when it needs to be paid by. Additionally, sending out friendly reminders before an invoice is due can help encourage timely payments as well as build trust between both parties.

If these strategies don't work then it may be necessary to turn over unpaid invoices to a collections service like Collbox which specializes in recovering delinquent accounts receivable (AR). Collbox helps businesses streamline their collections process by automating tasks such as creating collection letters, tracking communication with debtors and reporting on progress toward recovery goals—all while helping maintain strong relationships with customers throughout the process.

Here is a quick demo explaining how Collbox works:

The Idea: It's important to set expectations with customers by outlining payment terms and due dates on invoices, as well as sending out friendly reminders before an invoice is due. If these strategies fail then it may be necessary to turn unpaid debts over to a collections service like Collbox in order for businesses to get their money back.

Managing accounts receivable and ensuring timely payments is crucial for the success and growth of your business. By leveraging Xero's invoice reminders, integrating payment services, and utilizing best practices for communication, you can streamline your invoicing process and improve cash flow.

Invoicing might not be the most thrilling part of running a small business, but it sure is crucial. With Xero's invoice reminders, you can streamline your process, get paid faster, and put your focus back where it belongs - on growing your business. It’s like having a personal assistant who never sleeps, helping you keep your cash flow healthy and your stress levels low.

Remember, behind every successful business is a well-maintained invoicing system. So, don't let late payments slow you down. Harness the power of Xero's invoice reminders to keep your cash flow steady and your business thriving.

Ready to take your invoicing game to the next level? Hop into your Xero account and start fine-tuning your invoice reminders. And if you need a helping hand, Accountingprose is here to provide expert support. Our team has the Xero know-how to guide you every step of the way.

So, let's do this! Give us a call, send us an email, or drop by our office today. Let's make your invoicing process the best it can be, together. After all, we're not just accountants—we're your steadfast partners in business success.

For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details...

1 min read

Have you ever looked under the hood of your car and marveled at how all those parts work together to get you from Point A to Point B? Your business's...

1 min read

Every superhero needs a sidekick. Batman has Robin. Sherlock has Watson. And for law firms looking to streamline their financial management, the...