Xero vs Quickbooks: Which is Best for Your Business?

Are you a small business owner looking for the right accounting software to manage your finances? Choosing the right accounting software for your...

Hey there, fellow small business owners! We know that managing your accounts is like juggling a bag of squirrels—tricky, unpredictable, and downright exhausting. But what if we told you there's a way to tame those squirrels and make your accounting life a whole lot easier? That's right, we're talking about making the leap from QuickBooks to the oh-so-sleek world of Xero.

|

Table of Contents |

In the thrilling world of small business accounting, two names often rise above the rest: QuickBooks and Xero. Each platform boasts its own set of powerful features, loyal followers, and distinct advantages. But which one will emerge as the true champion for your business? In this epic showdown we'll take you on a journey through the strengths and weaknesses of each contender, helping you make an informed decision about which accounting superhero is best suited to help your business soar to new heights.

Grab your popcorn and let the battle begin!

User-friendly interface: Xero's modern, intuitive design makes it easy for users to navigate the platform and manage their finances. This user-friendliness can help reduce the learning curve and make the accounting process more enjoyable, even for those without a background in accounting. In contrast, some users might find QuickBooks' interface less intuitive and more challenging to navigate.

Automation features: Xero offers powerful automation tools, such as bank reconciliation, invoicing, and expense management, that help save time and reduce errors. These tools can streamline your accounting processes, giving you more time to focus on growing your business. Although QuickBooks also offers automation features, many users find Xero's tools to be more efficient and user-friendly.

Real-time financial data: With Xero, you have access to your financial data in real-time, allowing you to make informed business decisions on the fly. This can help you stay on top of your finances and be more proactive in managing your business. Xero has something that really sets them apart– Xero Analytics Plus. With Xero Analytics Plus you can use their predictive cash flow analysis and business snapshot to see where you stand, and make adjustments on the fly, whenever you want and wherever you are.

Collaboration: Xero's cloud-based platform enables real-time collaboration between you and your accountant or team members. This feature simplifies communication and makes working together on your financials more efficient, which means your financials are accurate and on-time, saving you from the dreaded end-of-month waiting game.

Integration with third-party apps: Xero integrates smoothly with a wide range of third-party apps and services, allowing you to create a tailored ecosystem that meets your specific business needs. If there isn't already a feature that covers your needs, the app marketplace is outstanding..

Customer support: Xero is known for its responsive and helpful customer support, which can be crucial when you're dealing with accounting issues. Users often report positive experiences with Xero's support team, while some QuickBooks users have reported less-than-stellar experiences with their support.

Scalability: Xero is designed to grow with your business, making it easy to add new users, manage multiple business entities, and adapt to your evolving needs.

Xero's user-friendly interface, powerful automation tools, real-time financial data, seamless collaboration features, and robust integrations make it an attractive alternative to QuickBooks. If you're considering a migration to Xero, rest assured that the Accountingprose team will be with you every step of the way, providing guidance and support to ensure a smooth transition and help you unlock the full potential of your new accounting superhero.

Absolutely, let's get down to the brass tacks. The decision to migrate from QuickBooks to Xero is an important one and should be made after carefully evaluating your business requirements.

Firstly, QuickBooks, particularly the Desktop version, offers a comprehensive set of features that your business may rely on heavily. These include industry-specific editions and advanced job-costing functionalities. Xero, while user-friendly and innovative, might not support these features to the same extent. If these QuickBooks-specific capabilities are critical to your operations, a migration to Xero could potentially hinder your business processes.

Secondly, the ecosystem of your business's digital tools and software is another key consideration. QuickBooks has been around for a while and enjoys a wide range of third-party integrations. If your current business operations seamlessly integrate with QuickBooks, but those tools do not support Xero, switching could create compatibility issues.

The decision to transition from QuickBooks to Xero should be based on an analysis of your business needs and the potential impacts of such a migration. It's crucial to balance the potential benefits of a new platform against the possible disruption of your current business operations. Here at Accountingprose, we're committed to guiding you through these decisions, ensuring your accounting processes support your business's success.

There are a handful of ways to get your Quickbooks Data into Xero, ranging from hyper manual to super automated. Working with Xero advisor will definitely make the process go more smoothly because they have seen it all and can help you avoid any of the common pitfalls. Xero's preferred partner, Jet Convert, is great, but you may want to shop around and find the right solution to fit your needs. Though, it's hard to beat converting from Quickbooks to Xero for free. Yes! Free! Xero covers the cost of converting current and prior year's data when you make the switch!

Let's dive in to the Jet Convert process, and then we'll dive into other options.

Before you begin the migration process, it's crucial to prepare your data and gather essential information:

Make sure your QuickBooks file is up-to-date and reconciled. Any issues that are present in your Quickbooks file will follow you to Xero, so be mindful of the current state of your accounts. Match payments to bills and invoices, apply credit notes, and clear out Undeposited Funds since Xero does not have that feature and leaving an open balance will be a bit of headache to fix post conversion. Taking the time to clean up any of those older, legacy issues because they will follow you into your new Xero account if you are not careful.

Update the accounting method to accrual-basis, if your file is set up to report on a cash-basis. You can switch the reports to whatever you like once you are done, but its recommended to start off on cash-basis.

Export key financial reports, including the Balance Sheet, Profit & Loss, and Trial Balance on an accrual-basis. This will help you to compare the data in your Quickbooks and Xero file at a point in time, and while Xero does offer cash-basis reports, it defaults to accrual-basis. This secondary check will help you identify if there were any issues migrating your data, and will put your mind at ease during this transition.

Prepare your Chart of Accounts by turning on account numbers and adding any missing account numbers. Be sure to also remove any special characters like colons, semicolons, quotation marks, or tildes which will cause the migration to fail. Also, if you have more 699 accounts within your Chart of Accounts, you must merge accounts or delete inactive accounts, as this is the limit within Xero.

Merge multiple A/R and A/P accounts/ If you have more than one Accounts Receivable account, or more than one Accounts Payable account, merge them all into one.

If you are using Quickbooks Desktop, be sure that you are using a compatible edition, which means that your edition must be 2014 or newer and must have never had multi-currency turned on.

Save your Quickbooks Desktop file in the correct format. Save your file as QBB, QBW or QBXML format. Your file size must be less than 1GB.

You may want to run a verify & rebuild before saving your file, to clear out any of the crud. Also be sure to keep the admin username and password, because you will need to provide it during the conversion process.

Be prepared to give Jet Convert admin level access with your QBO file.

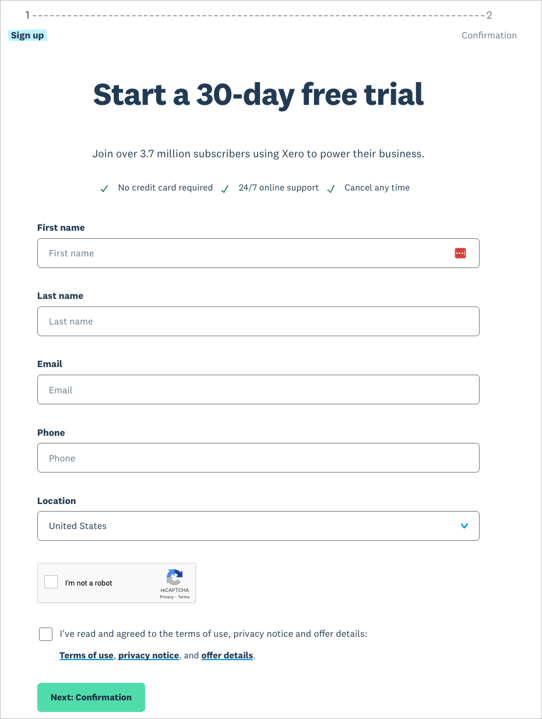

After your data is ready to go, it’s time to make the leap into Xero. You can create a Xero account and set up your organization by following these simple steps.

Visit the Xero website and sign up for a free 30-day trial courtesy of Accountingprose.

All you need to enter is your first and last name, email, phone, and location to get started.

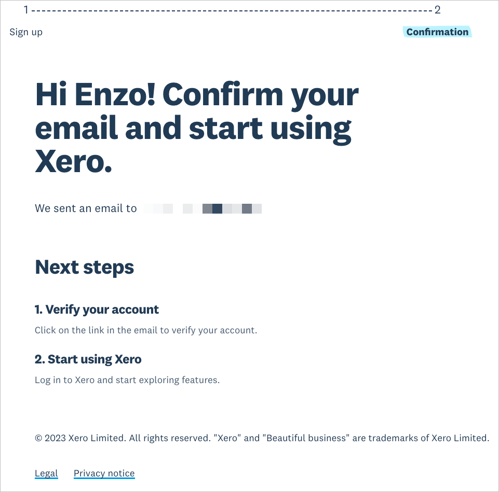

Once you click, "Next: Confirmation", Xero will email a link to you so that you can verify your account.

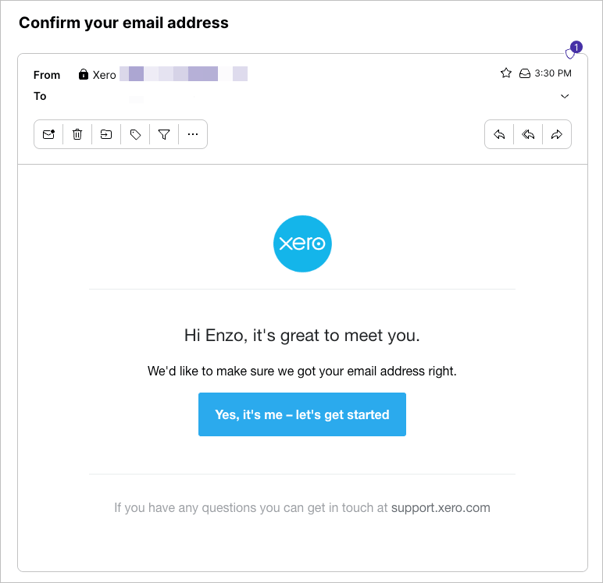

Head over to your email to find that link.

Click, "Yes, it's me - let's get started" to keep on truckin'.

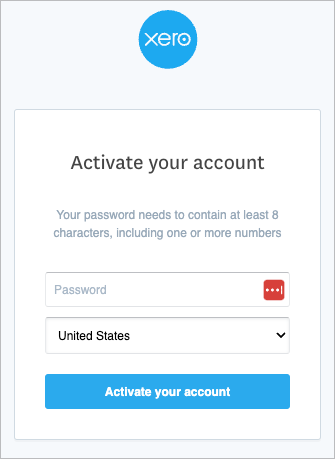

To activate your account, create a complex password. We suggest using something like LastPass or 1Password to safely create and store your passwords.

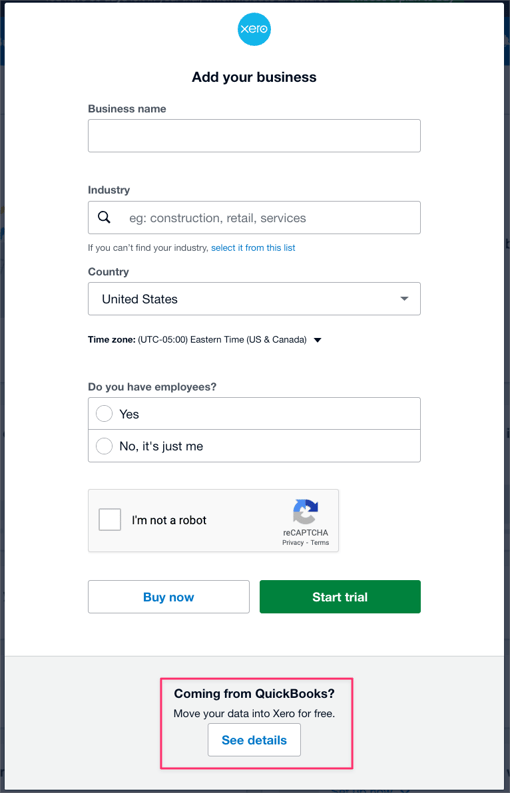

Next you will enter your business name, select your industry, check whether or not you have employees. See that big red box around "Coming from Quickbooks?" Click that to begin converting your file using Xero's partner, JetConvert.

If you choose to use Jet Convert, you may have a few questions before you get started. Here are the most common ones we hear.

Conversions typically take around 5 business days, but they usually have a faster turn time.

Business information, such as:

Accounts

Contacts

Items

Organizational and financial settings

Transaction history, including:

Bank transactions

Sales

Bills

Payments

Journals

Company information, like your EIN - if we are handling your conversion, we will add your EIN and other company info to Xero.

Templates - for example, purchase orders, sales orders, quotes, and invoices.

Repeating transactions - this super easy to set up in Xero and even has more capabilities that what Quickbooks offers.

Employee payroll information - if we are handling your conversion, we will archive all employee data and payroll reports for you.

Tracked Inventory

PDF Attachments - if we are handling your conversion, we will archive all of these for you.

Non-posting transactions, including:

Estimates (outstanding)

Purchase orders (outstanding)

Quotes (closed)

Bill reference numbers

QuickBooks US editions from 2014 and QuickBooks Online (that do not use multiple currencies). More conversion applications can also be found in our App Marketplace.

The current and previous fiscal year's line item details will come over as part of the typical conversion. You may go as far back as 10 years, but this will come at an additional cost.

In addition to Jet Convert, there are a handful of other tools that have worked well for us and our clients.

MMC Convert is a great option that not only has great reviews, but is budget friendly with conversions starting at $289. The main reason that a business owner would choose to use MMC Convert vs Jet Convert is their range of supported platforms. Suppose you need to move from a less popular platform, like Sage, Wave, Freshbooks, Bench, etc – MMC Convert will handle that with ease.

Also should you decide that Xero isn't the perfect fit, you can use MMC Convert to import data from Xero to Quickbooks and a slew of other supported software. While we don't recommend switching back to the dark side, it's nice to know that you have the option.

Business Importer is a tool that will allow you to export data from Quickbooks and import it into Xero without breaking a sweat. You can set up a one-time import, or if have a lot of data that you'd like to import and reconcile on an ongoing basis, you can even set up pre-mapped recurring imports that will save you a ton of time.

Importing invoices payments and purchase orders is an especially handy feature, because this is not something that can easily be done or undone. Yes, you can undo and fix errors if you made a mistake the first time– something that used to take hours (or longer).

Xero also allows you to download templates that can imported in through the software. For example, you can import:

Precoded bank statements - this saves you from having to reconcile within Xero. Handy if you have years of banking data to import.

Choosing this option will be the most time intensive, but will give you a lot of control over how the data converts from Quickbooks to Xero. If your file was a jumbled up mess prior to switching to Xero, this option may be the right choice for you.

Transitioning your financial data from QuickBooks Online (QBO) to Xero is a significant undertaking, so ensuring the conversion's success is crucial. This checklist will ensure that you've left no stone unturned when making the switch.

Review and update settings: Check your new accounting software's settings and preferences to ensure they align with your business requirements, such as financial year start dates, base currency, tax rates, and user permissions.

Review Your Financial Reports: Remember those reports that you downloaded earlier? Now is the time to compare the two to ensure the figures match. Any discrepancies could indicate a problem with the conversion.

Check Accounts Receivable and Payable: Review your outstanding invoices and bills. The total amount of your Accounts Receivable and Accounts Payable in Xero should match the figures in QBO.

Update your invoicing and payment processes: Ensure that your invoicing templates, payment gateways, and online payment links have been updated to work with your new accounting software.

Validate Taxes: Ensure your tax balances and settings have been correctly transferred. Your sales tax liability in Xero should match the one in QBO.

Cross-Check Fixed Assets: If you maintain a list of fixed assets, confirm that the details and accumulated depreciation of each asset have been correctly imported.

Review Contact Details: Look over your customer and supplier information to verify all details (addresses, contact information, terms) match the data in QBO.

Look Over Classes - which are tracking categories in Xero: If you've been using classes or locations in QBO, check these details have migrated accurately.

Update your accounting processes: Review and update your accounting processes and procedures to align with the new software's features and functionality. This may include updating your chart of accounts, expense tracking, and budgeting processes.

Train your team: Provide training and support to your team members, helping them become familiar with the new accounting software and its features. This includes sharing any relevant documentation and resources.

It's also advisable to have your accountant or financial advisor review the migrated data and run their own checks. Remember, confirming a successful conversion is crucial for ensuring the integrity of your financial data and the smooth operation of your business going forward.

Migrating your accounting data from QuickBooks to Xero can be a smooth process when you follow some best practices and carefully plan the transition. Here are some tips for a successful QuickBooks to Xero migration:

Assess your needs: Before starting the migration, evaluate your current accounting setup, and identify your specific needs and goals. This assessment will help you determine the best approach for the migration and identify any additional services or customization you may require.

Clean up your data: Review your QuickBooks data and address any issues, such as incorrect transactions, duplicate entries, and outdated records. Cleaning up your data before the migration ensures a more accurate and efficient data transfer.

Choose the right conversion service: Research and compare different data conversion services, such as MMC Convert or Jet Convert, to find the one that best suits your needs, budget, and timeline. Look for a service that supports both your current and target accounting software and offers the required level of support and customization.

Plan the migration: Develop a detailed migration plan, including a timeline, milestones, responsibilities, and contingency plans. This plan will help you manage the migration process, track progress, and ensure that all necessary tasks are completed.

Communicate with your team: Inform your team about the migration and its potential impact on their work. Provide training and resources to help them familiarize themselves with Xero and its features. Clear communication and support can help minimize disruption and ensure a smoother transition.

Backup your QuickBooks data: Before starting the migration, create a backup of your QuickBooks data to ensure you have a safety net in case issues arise during the conversion process.

Validate the imported data: After the migration, thoroughly review the imported data in Xero to ensure accuracy and completeness. Check components like chart of accounts, customer and supplier details, invoice and bill balances, bank account transactions, tax rates, and financial reports.

Perform a parallel run: Consider running both QuickBooks and Xero concurrently for a short period. This approach allows you to compare the results and identify any discrepancies or issues, ensuring the accuracy of your financial data in Xero.

Address post-migration tasks: After the migration, complete any necessary post-migration tasks, such as setting up bank feeds, reconnecting third-party integrations, updating invoicing and payment processes, and reconciling bank accounts.

Seek professional advice: Consult with a Xero Certified Advisor or your accountant to ensure you are following best practices and taking full advantage of Xero's features. Their expertise can help you optimize your financial management processes and address any potential issues.

By following these tips, you can help ensure a successful QuickBooks to Xero migration and a seamless transition to your new accounting software.

And there you have it, folks! By now, you've walked through each twist and turn of the journey from QuickBooks to Xero. Armed with this knowledge, you're now ready to make the switch and step confidently into a new era of streamlined, efficient accounting.

Switching platforms may seem daunting, but remember, each step brings you closer to a more organized and efficient financial future. Xero's innovative and user-friendly platform stands ready to transform your day-to-day accounting, giving you back precious time to focus on growing your business.

As you venture forward, know that the Accountingprose team is with you every step of the way. We're here to ensure your journey is smooth and that your business continues to flourish in its new Xero-powered environment. So here's to you and your business - to new beginnings and to a bright, Xero-illuminated financial future!

Are you a small business owner looking for the right accounting software to manage your finances? Choosing the right accounting software for your...

For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details...

1 min read

Have you ever looked under the hood of your car and marveled at how all those parts work together to get you from Point A to Point B? Your business's...