Unlocking the Power of Xero Accounting Software

For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details...

14 min read

Enzo O'Hara Garza

:

Updated on January 26, 2024

Are you a small business owner looking for the right accounting software to manage your finances? Choosing the right accounting software for your small business can be a daunting task with so many options available. In this blog post, we will compare two popular accounting solutions: QuickBooks Online and Xero.

We will take a closer look at each platform's plans, user interface, inventory management features, tax tools, and app store integrations. You'll learn about key differences between QuickBooks Online and Xero that could impact your decision-making process when choosing an accounting solution.

By the end of this article, you should have a clearer comprehension of which platform is better suited to your small business taking into consideration criteria like pricing and features available. Let's dive in!

Winner: Xero

Xero and Quickbooks Online are two of the most popular accounting software solutions for small businesses. When comparing Xero to Quickbooks Online, it's clear that Xero is simpler and easier to use than its competitor.

Quickbooks Online offers a variety of plans, each with different features. Depending on your selection, you can get access to anything from fundamental invoicing and stock tracking up to advanced tax utilities. In comparison, Xero’s early plan provides all the same features as Quickbooks Online’s more expensive plans – but at a fraction of the cost. Unlike Quickbooks Online, Xero requires no setup or training time – so you can get started right away without any hassle.

When it comes to user interface design, there's really no competition between these two platforms: Xero wins hands down. The app store makes it easy to find additional integrations and add-ons like bank feeds or quarterly taxes quickly and easily. Should you require any aid in resolving problems, Xero's customer service team is available through email or phone.

In short, when comparing Xero vs QuickBooks online for small business accounting solutions - both have their advantages; however in terms of ease of use and price, choosing Xero over QuickBooks will be your best option.

Pros |

Cons |

|

|

Pros |

Cons |

|

|

Winner: Xero

QuickBooks Online lets you connect your accounts from more than 500 financial institutions, making it easy to stay on top of your transactions. It also offers dozens of apps in its App Store that can help streamline processes like inventory management and payroll processing.

Xero’s allows you to connect to over 800 third-party apps — far more than what QuickBooks Online's App Store provides.

Xero offers an impressive array of integrations that can help streamline your business processes, such as Avalara and TaxJar for filing quarterly taxes in a jiffy; Zoho Books for inventory management; TSheets for tracking time spent on projects; Gusto to handle payroll processing with ease; Stripe or PayPal Here to accept payments online seamlessly; Constant Contact or MailChimp for automating email marketing campaigns - just to name a few. With Xero, you get the benefit of high-quality integrations over quantity like QuickBooks Online.

Integrations are a key factor to consider when choosing between Xero and Quickbooks, as both offer various tools for connecting with other services. When selecting a financial platform, it is essential to consider the reporting capabilities each offers; both Xero and Quickbooks offer distinctive sets of characteristics that can assist in decision-making.

Pros |

Cons |

|

|

Pros |

Cons |

|

|

The Idea: Small businesses have a multitude of selections when it comes to accounting software. QuickBooks Online provides users with access to over 500 financial institutions and dozens of apps in its App Store, however Xero offers an even more impressive array of integrations such as Avalara and TaxJar for filing taxes quickly, Zoho Books for inventory management; TSheets for tracking time spent on projects; Gusto to handle payroll processing with ease - all these bells & whistles make Xero the clear winner when considering quality vs quantity.

Winner: Xero

When it comes to reporting features, both QuickBooks Online (QBO) and Xero offer a variety of options to help businesses make data-driven decisions. However, there are some key differences between the two platforms that set Xero apart as the superior choice for many small businesses. To start with, Xero provides a more comprehensive range of financial reports out of the box, including profit and loss, balance sheet, cash flow statements, aged receivables/payables, and more. This extensive array of reports ensures that businesses have access to all the critical financial insights they need for informed decision-making. In contrast, QBO's standard reporting suite, while still robust, may require users to invest additional time and effort into customizing reports to achieve the same level of detail.

Another advantage of Xero's reporting features is its user-friendly interface and intuitive design. Xero's reports are not only visually appealing but also easy to navigate and understand, making it simpler for business owners to get a clear picture of their financial health. QuickBooks Online, on the other hand, has made improvements in recent years, but some users may still find the platform's reporting interface to be less intuitive and more cumbersome to navigate.

Xero's customization options for reports also set it apart from QBO. While both platforms allow users to customize reports, Xero's approach to report customization is more flexible and straightforward, enabling users to easily tailor reports to their specific needs. This is particularly important for small business owners who may not have the resources to invest in specialized accounting software or hire a professional accountant.

Moreover, Xero has a powerful report tracking feature that allows users to track financial data across multiple dimensions, such as by location, department, or project. This feature is especially useful for businesses that need to keep a close eye on the performance of different segments, enabling them to make informed decisions for growth and expansion. Although QuickBooks Online does offer a similar feature called 'Classes,' it is not as comprehensive or flexible as Xero's tracking capabilities.

While both Xero and QuickBooks Online offer valuable reporting features, Xero emerges as the better choice for many small businesses due to its comprehensive range of reports, user-friendly interface, flexible customization options, and powerful tracking capabilities. By choosing Xero, businesses can gain deeper insights into their financial health and make more informed decisions to drive growth and success.

Pros |

Cons |

|

|

Pros |

Cons |

|

|

Winner: Xero

When evaluating accounting software, the quality of customer service can be a significant factor in determining the best choice for small businesses. Both QuickBooks Online (QBO) and Xero offer customer support options, but there are notable differences in their approaches that make Xero stand out as a more reliable and accessible choice for many users.

One of the main advantages of Xero's customer service is its extensive online knowledge base, which is easily accessible and comprehensive. Xero Central, as it is known, contains a wealth of articles, how-to guides, videos, and FAQs, allowing users to quickly find answers to common questions or troubleshoot issues independently. In addition to its knowledge base, Xero offers a responsive community forum where users can engage with other Xero customers and experts, share tips, and receive valuable advice. This combination of resources empowers users to resolve issues or find answers quickly, without the need for direct support.

In contrast, while QuickBooks Online also provides an online knowledge base and community forum, some users may find these resources to be less comprehensive and more challenging to navigate compared to Xero's offerings. Additionally, QBO's help articles are often more focused on promoting their services rather than providing detailed step-by-step guides, which can be frustrating for users seeking quick solutions.

When it comes to direct customer support, Xero provides email-based support, which is available 24/7 to all users, regardless of their subscription level. Xero's support team is known for its timely responses, often addressing customer inquiries within a few hours. This is especially beneficial for small businesses operating outside regular business hours or in different time zones.

On the other hand, QuickBooks Online offers phone and chat support, but only during specific hours and days, which may not be convenient for some users. Furthermore, phone support is primarily available for customers on higher-tier subscription plans, making it less accessible for businesses on a budget. While chat support is available for all subscription levels, response times can be slow during peak hours.

In summary, Xero's customer service stands out as a superior option for many small businesses due to its comprehensive online resources, accessible email support, and swift response times. While both platforms provide customer support, Xero's commitment to helping users succeed through a variety of channels and its dedication to timely assistance make it a more reliable and user-friendly choice compared to QuickBooks Online.

Pros |

Cons |

|

|

Pros |

Cons |

|

|

Winner: Xero

In today's fast-paced business environment, having on-the-go access to financial data and accounting tools is essential for small business owners. Both QuickBooks Online (QBO) and Xero recognize the importance of mobile accessibility and offer mobile apps to help users manage their finances from anywhere. However, there are some key differences between the two platforms that make Xero a more user-friendly and feature-rich choice for mobile access.

First and foremost, Xero's mobile app, known as Xero Touch, is designed with simplicity and ease of use in mind. The app offers a clean, intuitive interface that makes it easy for users to navigate and perform essential tasks, such as creating and sending invoices, capturing receipts, reconciling bank transactions, and managing contacts. The app's design focuses on providing a seamless experience for users, minimizing the learning curve and making it easier for small business owners to stay on top of their finances, even while on the go.

In comparison, the QuickBooks Online mobile app does provide similar functionality, but some users may find the interface to be more cluttered and less intuitive than Xero's app. This can make it more challenging to perform tasks quickly and efficiently, which is critical when managing finances from a mobile device.

Another advantage of Xero's mobile app is its compatibility across a wide range of devices, including both iOS and Android. This ensures that users can access their financial data and perform critical tasks from virtually any mobile device. While QuickBooks Online also offers apps for both iOS and Android, there have been reports of occasional compatibility issues and app crashes on certain devices, which can hinder the user experience.

Xero's mobile accessibility stands out as a superior option for many small businesses due to its user-friendly design, broad device compatibility, and robust offline functionality. While both Xero and QuickBooks Online offer mobile apps to help users manage their finances on the go, Xero's commitment to delivering a seamless and flexible mobile experience makes it the better choice for staying connected and in control of your finances, regardless of where your business takes you.

Pros |

Cons |

|

|

Pros |

Cons |

|

|

Winner: Xero

When it comes to accounting software, security is paramount. Two of the go-to accounting software solutions for small enterprises, Quickbooks Online and Xero, have distinct security approaches.

Xero outshines Quickbooks Online in terms of security protocols, with all its plans providing bank feeds and direct access to financial data without manual entry - a feature that gives it an edge over its competitor. Furthermore, Xero's authentication measures such as two-factor authentication (2FA) for users logging into the platform bolster the system's defenses against malicious actors trying to gain unauthorized access to confidential information. You can have confidence that your business is safeguarded when using Xero, thanks to its additional layer of security.

Xero offers an edge over Quickbooks Online with its authentication measures, such as two-factor authentication (2FA) for users logging into the platform. This extra layer of protection provides peace of mind that confidential information is secure when using Xero. Additionally, Xero's automatic backups every five minutes and encryption on all data stored within the system further bolster security - a feature not available with any version of QuickBooks Online's plans. Furthermore, user permissions can be customized to ensure each user has only the access they need to sensitive business data or transactions - something you won't find in the app store for either platform. You can be confident that your business will remain secure when you use Xero, thanks to its features.

Pros |

Cons |

|

|

Pros |

Cons |

|

|

The Idea: Xero provides superior security protocols to Quickbooks Online, such as two-factor authentication and encrypted data storage, making it a safer choice for small businesses. With its customizable user permissions and automatic backups every five minutes, Xero has the edge when it comes to keeping your confidential information secure.

Choosing between QuickBooks and Xero really depends on the specific needs, budget, and preferences of your organization.

Here's a brief guideline that might help you make the decision:

You're looking for a solution with a broader and more mature ecosystem. QuickBooks has been around longer than Xero, and it has a more extensive network of third-party integrations and certified advisors.

Your business heavily relies on job costing. QuickBooks provides comprehensive job costing features that allow for detailed tracking and reporting of job profitability.

You prefer a desktop application. While QuickBooks Online is available, you can opt for a locally installed version of QuickBooks if you prefer to keep your data on your own servers.

You prefer a stronger emphasis on design and user experience. Xero is often praised for its clean, intuitive interface which makes navigating the platform a breeze, even for non-accountants.

Your business operations are spread across different locations or you have a remote team. Xero's cloud-first approach enables easy access to real-time financial data from anywhere, making it a great choice for distributed teams.

You want unlimited users without extra cost. Xero doesn't charge extra for adding additional users, which can be a cost advantage for businesses with multiple individuals needing access to the accounting system.

Remember, the best way to choose is to identify your organization's needs and try out both platforms before making a decision. If you still feel stuck, talk to an Xero Advisor or Quickbooks Specialist to help you sort out the right fit for you.

Selecting the suitable accounting software for a small enterprise can be an intimidating job. When comparing Xero vs Quickbooks Online, it's important to consider factors such as ease of use, integrations, reporting capabilities, customer support options and mobile accessibility. Ultimately you want an accounting solution that is secure and reliable while providing value-added features tailored to meet your specific needs. With these considerations in mind we believe Xero stands out above Quickbooks when it comes to Xero vs quickbooks comparison making it the ideal choice for any growing small business looking for a comprehensive yet cost effective online accounting solution.

Let Accountingprose help your business succeed.

We provide the best small business accounting, payroll and sales tax services at an affordable cost.

Xero and QuickBooks Online (QBO) are both popular accounting software solutions for businesses. They offer similar features like invoicing, expense tracking, and payroll management. However, there are a few key differences that can influence which platform is the best fit for your business.

Pricing. Xero offers three pricing plans, with the basic plan starting at $11 per month. QuickBooks Online also offers three pricing plans, but their basic plan starts at a higher price point, around $25 per month. Keep in mind that both services frequently run promotional pricing, so these prices may vary.

User Experience. Xero is known for its user-friendly interface and easy-to-use features, making it a popular choice for small businesses and those new to accounting software. QBO has a more detailed (and sometimes confusing) interface.

Customer Support. Xero offers 24/7 email support and has a comprehensive knowledge base for self-service support. QBO, on the other hand, offers phone and chat support but only during specific hours.

Mobile Access. Both Xero and QBO offer mobile apps, but users have reported that Xero's app is more intuitive and easier to use.

Security. Xero provides two-factor authentication, automatic backups every five minutes, and encryption for all data stored within the system. While QBO also provides secure data storage, it lacks the two-factor authentication and automatic backup features offered by Xero.

Third-Party Integrations. Both platforms integrate with hundreds of third-party apps. However, Xero integrates with more apps than QBO, providing users with more flexibility to customize the software to their specific business needs.

Reporting. QBO offers more built-in reports compared to Xero, but Xero gives the option to customize reports to meet your exact need.

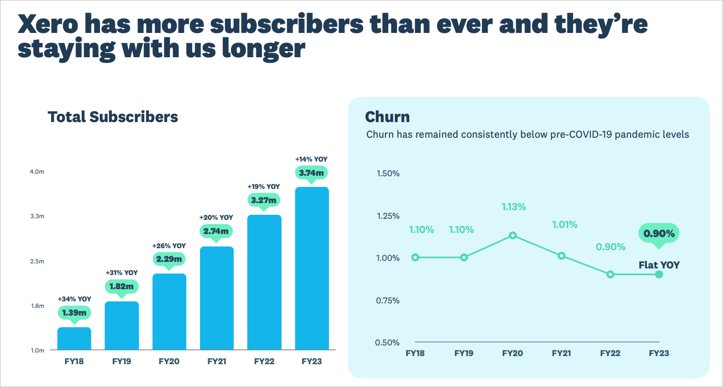

As of 2023, Xero has 3.7 million subscribers worldwide, which is an increase of 470k since 2022. Their churn remains very low, at 0.9%, which means that people who choose Xero, tend to stay with Xero.

Xero is an excellent choice for small businesses due to its user-friendly, cloud-based platform that simplifies accounting tasks. Its intuitive interface is designed with the busy entrepreneur in mind, making it easy for anyone to understand and manage their finances. Plus, because it's cloud-based, Xero offers the convenience of accessing your financial data anywhere, anytime. This flexibility can be a game-changer for small businesses, as it allows for real-time decision making based on current financial data. Furthermore, Xero's robust features, such as invoicing, payroll, inventory tracking, and integration with a multitude of other business apps, make it a versatile tool that can grow with your business. Lastly, Xero's dedication to providing valuable customer support ensures you're never left in the dark when navigating your financial landscape.

Investing in Xero is absolutely worth considering, especially for small to medium-sized businesses seeking to streamline their financial management. The platform's user-friendly interface, coupled with its comprehensive suite of features, makes it an invaluable tool for handling everything from invoicing and payroll to inventory tracking and financial reporting. Its cloud-based nature offers the flexibility to access real-time financial data from anywhere, enabling quick, informed business decisions. Furthermore, Xero's capability to integrate seamlessly with numerous other business applications enhances its usefulness, allowing for a unified, efficient business management system. Finally, with its commitment to customer support, users can rely on getting the help they need when they need it. So, while the decision ultimately depends on your unique business needs and circumstances, Xero offers a compelling package that delivers value far beyond its cost.

For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details...

1 min read

Have you ever looked under the hood of your car and marveled at how all those parts work together to get you from Point A to Point B? Your business's...

Hey there, fellow small business owners! We know that managing your accounts is like juggling a bag of squirrels—tricky, unpredictable, and downright...