Unlocking the Power of Xero Accounting Software

For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details...

16 min read

Enzo O'Hara Garza

:

Updated on August 29, 2025

Every superhero needs a sidekick. Batman has Robin. Sherlock has Watson. And for law firms looking to streamline their financial management, the unbeatable sidekick is Xero.

In the legal profession, managing finances efficiently is as crucial as winning cases. After all, even the most prestigious law firms can't run on legal victories alone. They need money - and lots of it - flowing in regularly and reliably to keep the gavel banging and justice prevailing.

But let's face it, accounting can be as complex and daunting as understanding the nuances of a landmark legal judgment. And when you're busy fighting for your clients' rights, the last thing you want to worry about is whether your firm's accounting is in order.

That's where Xero comes in. This cloud-based accounting software is not just an accounting tool - it's a game-changer. Built with businesses in mind, it's like having a world-class financial management team on your side, ready to help you keep your financials as sharp and persuasive as your legal arguments.

In this blog post, we'll delve into the world of Xero for law firms. We'll touch on the importance of efficient financial management, the benefits of Xero for legal firms, how to get started, and some success stories. We'll also tackle some frequently asked questions, ensuring you have a comprehensive understanding of how Xero can help your law firm thrive.

So, grab your gavel and join us as we adjourn to the court of financial management. The session is now in order

|

Table of Contents |

For a law firm, every decision - including which accounting software to use - has a significant impact. We're not just talking about a ripple in a pond impact, but a "Law & Order" season finale kind of impact.

Law firms and solo attorneys have unique needs. You're not just managing numbers; you're juggling client cases, tracking billable hours, managing trust accounts, and maybe even figuring out who's turn it is to bring in the office coffee. With all these balls in the air, you need an accounting software that's not just robust, but also user-friendly and efficient. You need a financial ally. And Xero might just be that ally.

Let's examine this in more detail..

You're a law firm, not an accounting practice. You shouldn't have to grapple with complex accounting software any more than an accountant should have to argue a case in court. This is where Xero shines. It's been designed with user-friendliness at its core, ensuring even those without an accounting background can navigate it with ease..

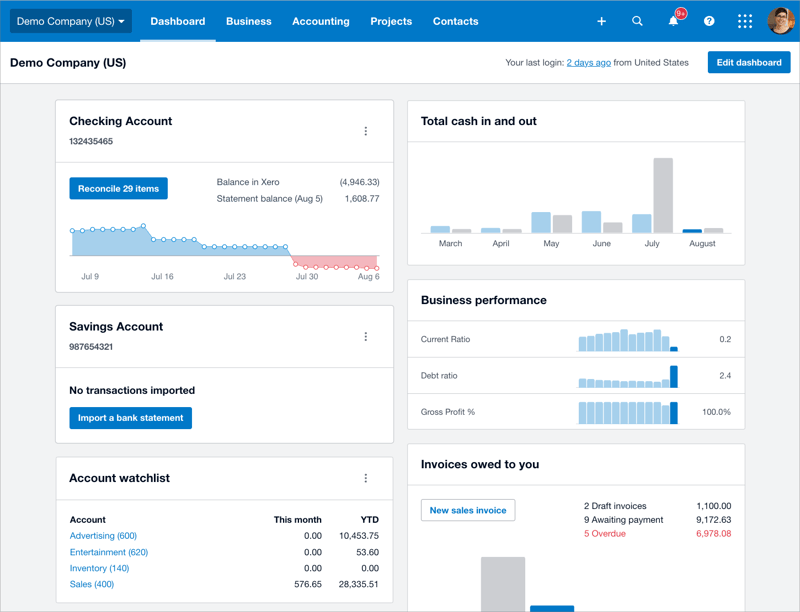

When you log into Xero, you are greeted with your dashboard. This dashboard is customizable (note the "Edit Dashboard" button on the top right of the screen) and is free of fluff and straight to the point.

Here you can see your bank, credit card and merchant accounts, financial ratios (which are also customizable), outstanding invoices, outstanding bills, and expense claims yet to be paid. You can even opt to keep an eye on any account via the "Account Watchlist". You can hide or rearrange dashboard items as you see fit, and this only affects you vs the entire team.

Unlike other accounting software which makes you reconcile your accounts twice, once throughout the month and again at the end of the month, Xero allows has a continuous reconciliation. This is made possible with integrated bank feeds.

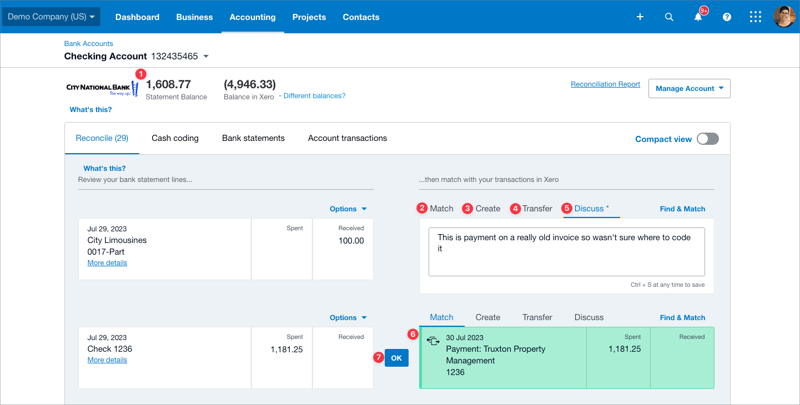

As you can see (1) the balance on the statement (which feeds in directly from the bank account) is different from the balance in Xero, which means that we have more work to do. If Xero only listed one balance, that would mean that Xero matches the bank account – huzzah! We still recommend running an end of month reconciliation report to compare balances again, but you will never have to painstakingly click each transaction, one-by-one, in order to close things out for the month.

When reconciling accounts in Xero, you have lots of options like (2) matching the transactions to a bill, invoice, credit note, expense claim, or even a transaction that has flowed in from your practice management software.

When there is no transaction match, you can (3) create a new transaction with as little or as much detail as necessary. Splitting the transaction between multiple line, adding an attachment, and adding Tracking Categories (which are called Classes in Quickbooks) all happens within a few clicks.

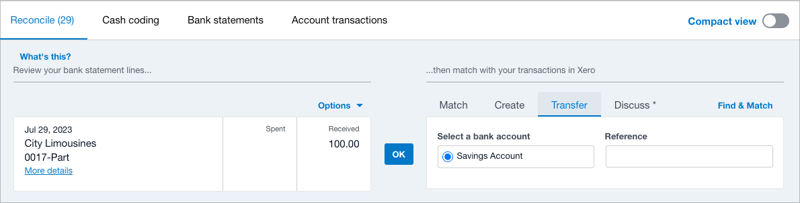

Attorneys will often transfer funds to and from a trust account, and using the (4) transfer feature. This will also save some time for you, as it will create another transactions in the account you are transferring to or from, so all you have to do is match it when reconciling the second account.

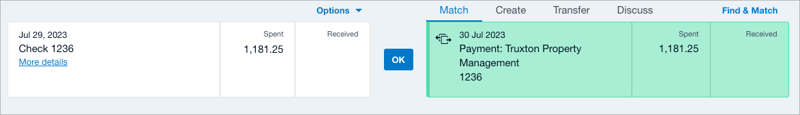

Any time there is a transaction that can be matched, you will see the transaction in Xero (6) light up green. If this is a match, all you have to is click the (7) blue OK button and you're done.

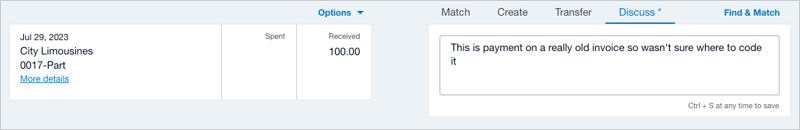

If you are feeling stuck and want to leave a note for yourself or your accountant, using the Discuss tab is a great option. We like to have our clients use this feature and we create an Uncoded Statement Line Report at the end of each week to see all notes in one easy-to-read report.

In the old days, getting a financial snapshot of your firm might involve waiting for the end of the month, quarter, or even year. But with Xero, you have access to real-time financial data. This means you can see exactly where your firm stands financially at any given moment

Xero doesn't just give you numbers; it gives you visual representations of your financial data. With charts and graphs, you can easily understand your cash flow, debts, income, and expenses. It's like having a complex case laid out in a clearly illustrated chart - suddenly, everything makes sense.

Let's look at two reports that our clients find really helpful...

Picture this: you're preparing for a big legal case, and you need a concise, comprehensive summary of all the key details. That's what the Business Snapshot report in Xero is like for your finances. It provides a condensed, yet detailed view of your business's financial health.

But how does this differ between Xero Analytics and Xero Analytics Plus? Let's find out.

In the standard Xero Analytics, the Business Snapshot is a dashboard that displays crucial financial information, such as profitability, income, expenses, and more. It's a one-stop shop for a high-level view of your organization's financial health.

The standard Business Snapshot allows you to:

Compare your business performance with the previous month, quarter, financial year, or year to date.

Discuss your organization's financial health with your accounting advisor using clear, concise data.

Ensure the dashboard is up to date by regularly reconciling bank transactions.

Access to the Business Snapshot is not limited to accountants or financial advisors; users in your organization with advisor, standard + reports, or read-only roles can view the snapshot, making it a versatile tool for team-wide financial understanding.

Xero Analytics Plus takes the Business Snapshot to the next level, offering advanced customization and detailed insights. It's like upgrading from a standard legal brief to a comprehensive case file.

With Xero Analytics Plus, you can:

Use custom date ranges that go beyond the standard last month, quarter, financial year, or year to date. This allows for a more flexible and detailed view of your financial timeline.

Choose which accounts are included in the dashboard's calculations, giving you a more tailored view of your finances.

Select which expenses to track on the expenses table, allowing you to focus on specific areas of financial outflow.

Hide or show certain metrics on the dashboard to suit your business needs, making the Snapshot truly your own.

Business Snapshot in Xero provides a clear, concise, and customizable view of your business's financial health. While both versions offer valuable insights, Xero Analytics Plus provides a more detailed, personalized view. It's like the difference between a generic courtroom sketch and a detailed, personalized portrait of your business's financial health.

The Short-Term Cashflow report in Xero is a tool that provides a detailed view of your business's recent financial activities and future projections. It functions as a roadmap, guiding you through your financial landscape.

But how does this report vary between Xero Analytics and Xero Analytics Plus? Let's explore.

In Xero Analytics, the Short-Term Cashflow report provides a snapshot of your business's cash inflows and outflows over the next 7 or 30 days. It's like a crystal ball that offers a glimpse into your near future, financially speaking.

The standard Short-Term Cashflow report allows you to:

Forecast your cash position for the next 30 days based on your existing bills and invoices.

Understand when you might need to tighten your budget or when you have a bit of financial breathing room.

Make informed decisions about upcoming expenses or investments.

This tool is a valuable ally for any business owner, providing insights into the immediate financial future of your business.

With Xero Analytics Plus, the Short-Term Cashflow report becomes an even more powerful tool for forecasting and planning. It's like going from a basic roadmap to a fully interactive GPS navigation system.

In Xero Analytics Plus, you can:

Extend your cash flow forecast beyond the standard 30-day period, providing a longer-term view of your financial future.

Include additional variables in your forecast, such as scheduled payments, expected income, or planned expenses, to get a more comprehensive picture.

Customize your cash flow prediction with different scenarios, allowing you to plan for various possibilities.

The Short-Term Cashflow report in Xero Analytics offers a clear and concise view of your business's immediate financial future. Xero Analytics Plus takes this a step further, providing more in-depth, customizable, and long-term cashflow forecasting. It's like the difference between a simple weather forecast and a detailed climate model - both are useful, but one offers a more comprehensive and adaptable view of what's to come.

Legal work involves a lot of detail, precision, and personalized service. This is reflected in every aspect of law practice, including financial management. The Custom Report Layouts feature in Xero can be a game-changer for law practices. Here's why:

Law practices often deal with complex financial transactions, from client billing to expense management. Custom report layouts in Xero allow law firms to tailor reports to their unique needs. This could mean creating a report that focuses on client retainer income, or one that breaks down expenses by case or practice area. By customizing report layouts, law firms can get a clear view of the specific data that matters most to them.

Time is a precious commodity in law practice. Custom report layouts can save law professionals time by providing the information they need in a format that's easy to understand and act upon. Instead of sifting through generic reports for relevant data, they can have a custom report that presents the necessary information front and center.

Lawyers often need to share financial information with clients, such as trust account balances. A custom report layout can help by presenting this information in an organized, understandable format. This not only makes it easier for clients to understand their bills, but also demonstrates professionalism and transparency, which can enhance client trust.

By providing a tailored view of financial data, custom report layouts can aid strategic decision-making. For example, a custom report showing income by practice area over time can help law firms identify their most profitable specialties. This information can guide decisions about resource allocation, marketing efforts, and business growth strategies.

Custom report layouts in Xero offer law practices the ability to tailor financial reports to their specific needs, saving time, improving client communication, and informing strategic decisions. They're like the legal briefs of financial reporting - concise, tailored, and highly valuable.

For law firms, the integration of Xero with practice management software can streamline operations, improve accuracy, and save valuable time.

Here's why:

Law firms manage a plethora of tasks, from client communications and case management to billing and accounting. By integrating Xero with practice management software, law firms can automate many of these tasks. For example, time logged in the practice management software can be automatically synced to Xero for accurate, hassle-free billing.

Manual data entry can lead to errors, which can be costly in a legal setting. With integration, data is automatically synced between applications, reducing the risk of errors. This ensures accurate financial records and billing, which are essential for maintaining client trust and compliance with legal regulations.

Real-time visibility into time spent on different cases

Time saved on administrative tasks can be redirected to billable work, improving profitability. Integration can automate tasks like billing, expense tracking, and financial reporting, freeing up attorneys and staff to focus on serving clients.

As for the most common integrations that law firms use with Xero, here are a few:

This legal practice management software is popular among law firms for its robust features including case management, time tracking, and billing. It integrates seamlessly with Xero, enabling firms to sync invoices, payments, and contacts.

ActionStep offers full legal practice management including matter management, document automation, and time billing. Its Xero integration ensures that financial data flows smoothly between the two systems.

Bonus! We provide this to all of our clients for free!

This tool simplifies expense management by extracting data from receipts and bills. When integrated with Xero, it can automate the recording of expenses, making it easier for law firms to track costs.

Ramp is a corporate card and spend management platform that helps businesses save money and time. Its integration with Xero enables seamless tracking of all transactions, making it easier for law firms to manage expenses and maintain accurate financial records.

Want to try Ramp out? Use our affiliate link and get $500 back when you sign up and pay your first bill.

Even with the most user-friendly software, you may still have questions or need help. Xero has you covered with a comprehensive help center, video tutorials, and even webinars. It's like having a legal mentor on call, ready to guide you through any challenges.

So, is Xero suitable for your law firm?

Well, we certainly think it can work for you! However, the true verdict will depend on your specific needs and circumstances. It may not be a one-size-fits-all solution, but for many law firms, it's a fitting choice.

Ok, you've heard us gush all about Xero, extolling all of the benefits of our favorite accounting software, but why else should you consider jumping on the Xero bandwagon?

We've worked with a lot of law firms, and we know that behind every successful law firm is a solid financial foundation. You can't have a solid financial foundation if you don't have a tracking mechanism in place and keep it up-to-date. However, once this happens, you can expect a few benefits along the way.

In the legal world, cash flow is king. From paying staff salaries and rent to covering court fees and other operational costs, a steady flow of funds is crucial. Efficient financial management helps ensure you can meet your obligations and keep your firm running smoothly.

Legal accounting isn't just about counting dollars and cents. It's also about compliance. Law firms are subject to strict accounting regulations, such as maintaining an IOLTA or trust account for client funds. Mismanagement of these accounts can result in severe penalties, including disbarment. Stay on the right side of the law!

To stay competitive and profitable, law firms need to understand their financial performance. This includes knowing your most profitable practice areas, your costs, and your revenue. Get the financial insight you need to make strategic decisions which will help you grow your firm.

Law firms typically bill by the hour against a retainer, making time tracking and invoicing critical. Inefficient processes can result in lost billable hours and slow collections, impacting your revenue.

Most of the time our clients will use practice management software like Clio and ActionStep, and even though billing might not occur within Xero, you still need this information to flow into your accounting software. This will give you a comprehensive view into your entire firm's financials, helping you to catch billing delays faster which keeps your cashflow in check.

The legal industry can be unpredictable. A long, drawn-out case can strain your resources, while a sudden influx of work can present growth opportunities. Use Xero to forecast more accurately, so you can plan for these types of scenarios before they sneak up on you.

In the courtroom of business, financial management is your star witness. It's the evidence that reveals how your firm is performing and where it could do better. It's the testimony that guides your decisions and future strategies. Efficient financial management is not just important - it's essential to your law firm's success. So, give it the attention it deserves and watch your firm flourish.

Starting with a new accounting software can feel as daunting as prepping for a high-stakes trial. But don't worry, we're here to guide you through the process. Let's get started with Xero for your law firm.

Xero makes the setup process as smooth as a well-argued closing statement.

Here are the steps to get you started:

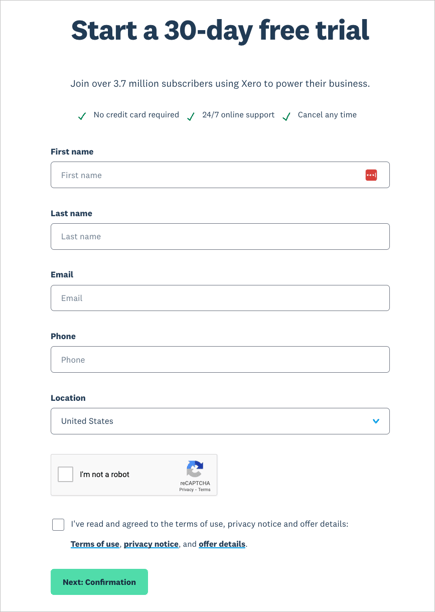

Sign up for a Xero account on their website. They offer a 30-day free trial, which is a great way to test the waters (or rather, the cloud) before you dive in.

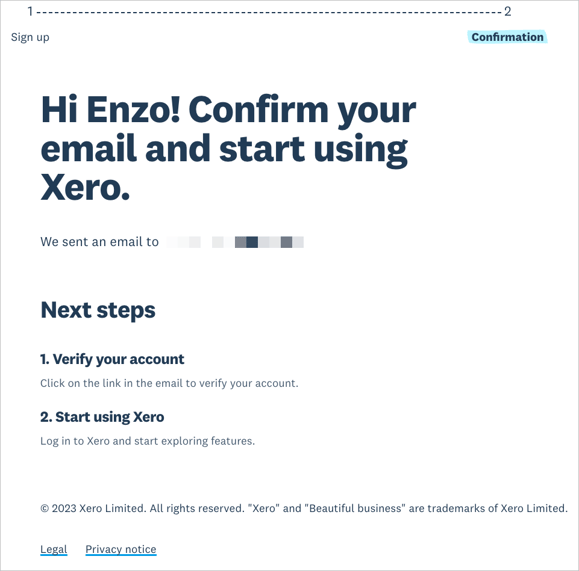

Then confirm that Xero has the correct email address.

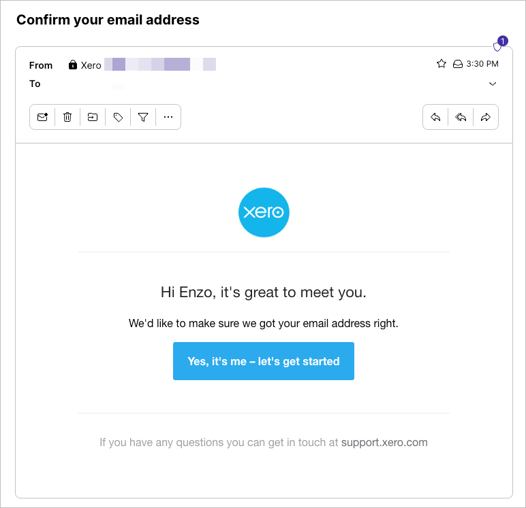

Click "Yes, it's me – let's get started"

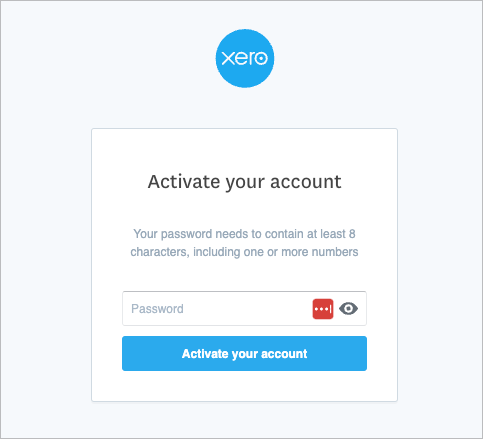

Next you will add a password to activate your account.

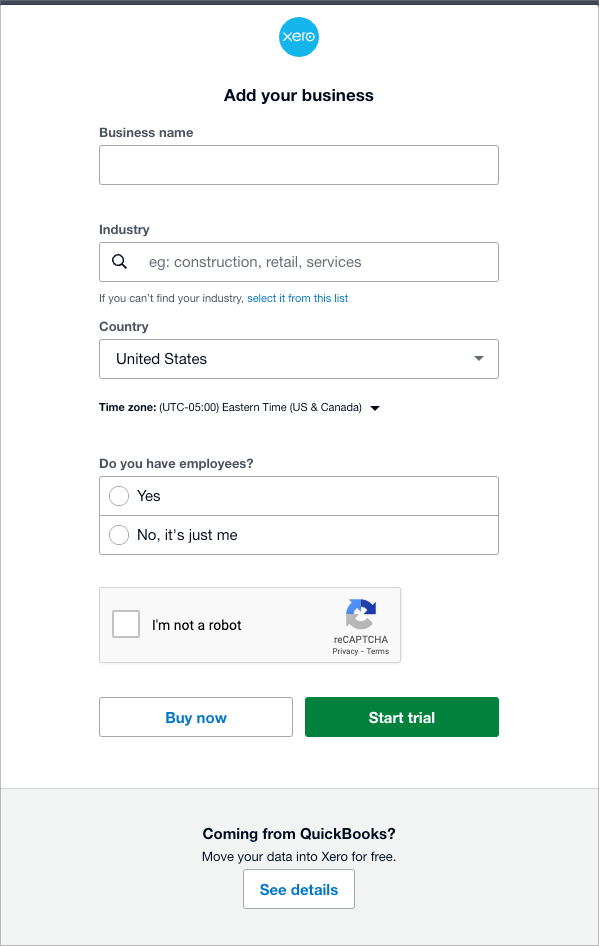

Once you've created your account, you'll need to add your law firm's details. This includes your firm's name, industry, country, time zone, whether or not you have employees, and either pay for Xero immediately, start a free trial, or convert your Quickbooks file.

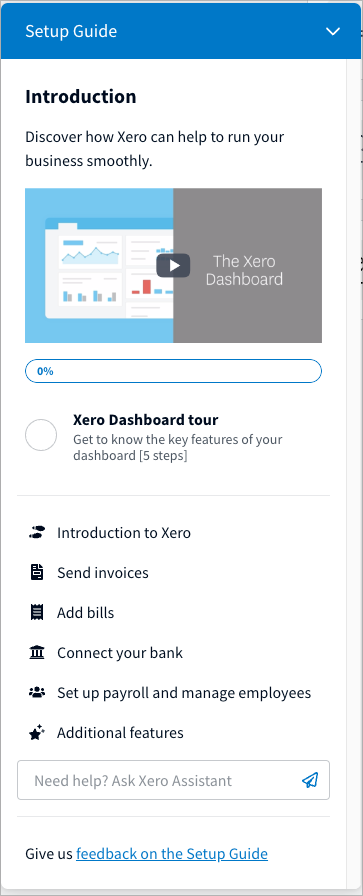

The Xero set up guide will walk you through all of the necessary steps to kick off your Xero journey properly.

With the set up guide you will walk through:

An introduction to Xero

How to send invoices

How to add bills

Connecting you bank account, so that transactions flow in automatically

Set up payroll with their preferred partner, Gusto

Learn about additional features, like adding users, using the Xero app, and connecting other apps to Xero.

Throughout the set up guide, you will have the opportunity to watch videos or use get help from the Xero Assistant.

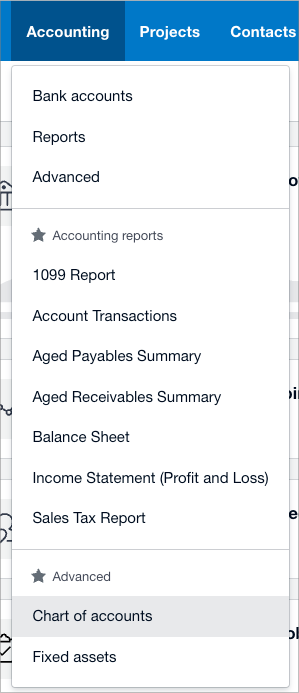

Xero provides a default chart of accounts based on your industry, and you can customize this to suit your law firm's needs. Think of your chart of accounts as the filing system for your financial transactions.

If you feeling stuck, check out this help article |

When setting up a new Xero account, importing your existing data is a crucial step. It's like moving into a new house — you want to make sure all your belongings make it safely to the new location. Here's a step-by-step guide on how to do it:

Prepare Your Data. Before you can import your data into Xero, you'll need to prepare it. This typically involves exporting your data from your old accounting system into CSV (Comma Separated Values) or Excel files. Ensure your data is clean, accurate, and formatted correctly.

Import Your Contacts. Next, import your contacts — your customers and suppliers. Go to Contacts > All Contacts, then click on "Import". Upload your CSV or Excel file, match the fields, and click "Import".

Import Your Invoices and Bills. To import your sales invoices or bills, you'll need to use a CSV format. Go to Business > Invoices to import sales invoices, or Business > Bills to import bills. Click on "Import", upload your CSV file, match the fields, and click "Import".

Import Your Bank Transactions. Finally, import any bank transactions that Xero was not able to bring over when you connected your account. Typically, Xero will only bring in the last 90 days of transactions when you connect your account. To do this, go to Accounting > Bank Accounts, then click on "Import". Upload your CSV file, match the fields, and click "Import".

If you feeling stuck, check out this help article👉 Mastering The Move: Import QuickBooks Data Into Xero With Confidence 👈 |

Remember, importing your data into a new Xero account is a critical process, so take your time and double-check everything. If you run into any issues, Xero's support team is always ready to help. It's like having a moving team ready to assist with the heavy lifting. Once the process is complete, you'll be ready to start using Xero to manage your financials with ease!

Every law firm is unique, and Xero understands this. Here's how you can customize Xero to meet your specific requirements:

While most folks will use Clio, ActionStep, or another practice management software, you may choose to invoice directly out of Xero. You can personalize your invoices to reflect your law firm's branding. You can add your logo, choose your colors, and even customize the layout. It’s like dressing your invoices in a tailored suit.

Want to automate payment reminders? |

If you handle client funds, you'll need to set up trust accounting. Xero allows you to manage your trust accounts efficiently, ensuring compliance with legal regulations.

Xero integrates with a range of legal software, such as practice management and time tracking tools. This enables you to run your law firm from one platform, saving you time and reducing administrative work.

Ready to Connect Your Apps?👉 View Clio Help Docs 👈 👉 View ActionStep Help Docs 👈 👉 Learn About Using Zapier + Xero 👈 |

You can create custom reports in Xero to monitor the financial metrics that matter to your law firm. Whether it's billable hours, expenses by case, or cash flow, you can track it all in Xero.

Setting up and customizing Xero for your law firm is a straightforward process. With a bit of setup and customization, Xero can become your trusted partner in managing your law firm's finances. It's like hiring a bookkeeper, accountant, and financial analyst all in one. Now, that’s a winning defense team for your finances!

In the spirit of full disclosure (much like in a court of law), we're going to tackle some frequently asked questions about Xero. We'll cover its potential disadvantages, who it's most suitable for, and whether it's a good fit for large businesses. Let's get started!

Just like every lawyer has their strengths and weaknesses, so too does Xero. Here are a few potential downsides to consider:

While Xero is a robust accounting tool, it does not cater specifically to legal firms. This means some legal-specific features, like advanced case management or court calendaring, are not available within Xero itself. However, this can often be mitigated by integrating Xero with other legal-specific software.

Most law firms use practice management software and simply connect it to Xero so both tools are always aligned and each tool is doing what it is was meant for.

Xero is user-friendly, but like any new software, it requires time and effort to learn. Your team may need training to use Xero effectively. It's a bit like studying for the bar exam, but thankfully, not as grueling!

Set aside time to set up Xero properly from the start, using help articles when you get stuck. If you decide that managing the accounting isn't for you, hire a professional and get back to doing what you love.

Some of Xero's advanced features, such as multi-currency support or detailed financial reporting, are only available on the higher-priced plans.

Most law firms will not need multi-currency support, so the decision really rides on whether or not you need Xero Analytics Plus. Try out Analytics before making the decision to upgrade.

Xero is ideally suited for small to medium-sized law firms, offering a flexible, feature-rich, and user-friendly accounting solution. Its cloud-based nature allows for easy access to financial data from anywhere, enabling busy law firm owners to stay on top of their finances whether they're in the office, in court, or on the go. With powerful tools tailored for legal practices, such as custom report layouts and seamless integration with practice management software, it helps streamline operations, improve billing accuracy, and provide valuable insights for strategic decision-making.

Larger law firms with more complex needs might find Xero less suitable. These firms typically have a higher volume of transactions, more specialized accounting needs, and a dedicated accounting department that may require more advanced features. While Xero is continually evolving and adding features, larger law firms may find that a more industry-specific or enterprise-level accounting software suits their needs better.

In the legal world, the devil is in the details, and the same goes for financial management. Whether you're a budding law firm making your mark or a well-established firm looking to streamline your operations, having the right accounting software by your side is crucial. Xero, with its user-friendly interface, powerful features, and seamless integrations, can indeed be your reliable partner. It's like having a trusted legal clerk, but for your accounting needs!

However, remember that every law firm is different, and what works for one may not work for another. It's important to assess your specific needs, examine your options, and choose the tool that aligns best with your firm's size, scope, and working style. As they say in law, "Due diligence is the mother of good fortune."

If you're ready to take the next step towards efficient and effective financial management, or if you need expert advice to navigate through your options, Accountingprose is here to help. Our team of accounting experts specializes in supporting law firms, and we're ready to assist you in making the right choice. Contact us today to schedule a consultation, and let's work together to keep your financial records as flawless as your legal briefs. Remember, in the courtroom of accounting, we're ready to advocate for your success!

For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details...

Xero’s recent acquisition of Syft Analytics marks a significant step forward in empowering small businesses with advanced financial insights. By...

1 min read

Welcome to the future, where technology is transforming the way we do business. One area experiencing significant change is accounting. Gone are the...