1 min read

Top Accounting Automation Tools: Streamline Finances

Welcome to the future, where technology is transforming the way we do business. One area experiencing significant change is accounting. Gone are the...

37 min read

Enzo O'Hara Garza

:

August 08, 2023

In our tech-filled world, businesses are quickly adopting automated solutions. These tools streamline operations, boost efficiency, and provide an edge over competitors. Accounting, a key part of any business, has greatly changed due to automation.

Today, we're starting an exciting journey into accounting automation. If you've ever been overwhelmed by complex financial spreadsheets or a mountain of invoices, this blog post is your roadmap. It will guide you into the world of accounting process automation.

We'll start by explaining what accounting process automation is and how it works. As we go deeper, we'll compare the challenges of traditional, manual accounting with the many benefits of automated solutions.

But, as with anything, there are two sides to the story. We'll also look at the potential downsides of accounting automation, and the problems you might face when implementing it. Next, we'll give you practical tips on which accounting tasks your business can automate, and what to keep in mind when choosing an accounting software.

Finally, we'll answer some common questions about accounting automation. Are you ready to take this journey? Let's dive in!

|

Table of Contents |

Accounting process automation, in a nutshell, uses software tools and applications to carry out everyday accounting tasks without requiring human intervention. It's all about harnessing the power of technology to automate repetitive and time-consuming tasks, increasing efficiency, and reducing the chances of human error.

Let's break it down into simpler terms with concrete examples:

The first step in any accounting process is capturing and entering data. This generally involves manually inputting data from various sources into an accounting system. But, thanks to automation, this task is much easier.

Here's how Xero can assist in automating this crucial step:

In the era of digital accounting, manually inputting each transaction from your bank account into your accounting software is a thing of the past. With Xero's automation capabilities, you can streamline this process through the use of automatic bank feeds and bank statement imports. These features not only save you time but also ensures your financial data in Xero is always up-to-date and accurate.

Connect your bank account directly with Xero to get daily automatic bank feeds. This allows for real-time updates and eliminates the need to manually input each transaction. To see if a bank feed is available for your bank account, add a new bank account within your Xero chart of accounts and search for the name of your bank. If your bank appears in the search results, the bank feed is available for that bank.

"If your bank isn't directly integrated with Xero, you can download your bank statement in a compatible format and then import it into Xero. Xero currently supports the following file types: OFX, QBO, QFX, QIF, and CSV. We suggest using OFX files since they require no work on your end to import into Xero. For example, if you use a CSV, you must map the import correctly. However, this could be a time-consuming extra step. Skip the busy work and, if your bank will export data as an OFX file, go that route.

Managing invoices effectively is a crucial part of any business's financial operations. It not only ensures steady cash flow but also contributes to the overall efficiency of your accounting process. Xero offers two powerful invoicing features—Recurring Invoices and Online Invoicing—that can streamline this process. Let's delve into the details.

Set up recurring invoices for regular customers. Xero will automatically generate and send them based on the frequency you set.

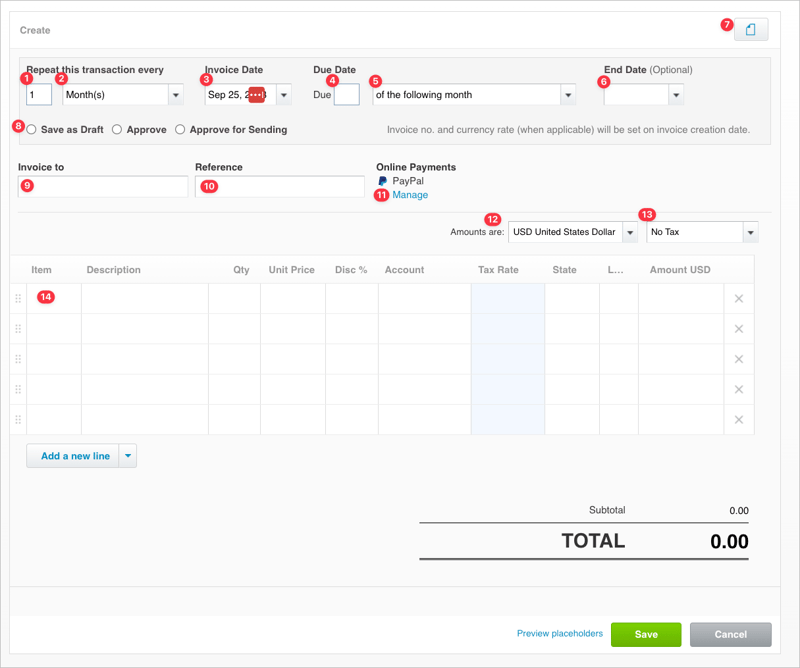

As you can see from above, you have a ton of options when creating a repeating invoice in Xero. Let's go through each area:

1. Here you can choose the invoice interval. This means we want to send it ever 1...

2. Here is where you would choose the corresponding period. In this example we used month and 1 and 2 together are saying, "Create this invoice every month".

You can choose whatever interval you like, but are limited to month or year as the period. That's not limiting though as you can just adjust the interval to create an invoice every 3 months if you want to create an invoice quarterly.

3. This is the date of the first invoice.

4. This is used in combination with #5, which gives you the following options:

of the following month

day(s) after the invoice date

day(s) after the end of the invoice month

of the current month

If you want this invoice to have Net 30 terms, a very common choice, you would enter 30 in #4 and select "day(s) after the invoice date" in #5.

6. Allows you to choose an end date, which is great if you have a contract that lasts for a limited time, like a year, for example.

7. Allows you to upload an attachment, which can be helpful to include for proof of why an invoice is being sent. You may want to include a signed contract, for example.

8. You have three choices here, which you would choose based on how you plan to interact with repeating invoices:

Save as Draft - This is helpful if you want to create an invoice that needs to be edited before sending or reviewed by someone else on the team before sending. The invoice will have to be saved in order to record this invoice as revenue on your Income Statement and as Accounts Receivable on your Balance Sheet.

Approve - This means that when this recurs, your income and receivable will be posted to your Xero file, but the invoice has not been sent to your client.

Approve for Sending - This option is great for those invoices that require no changes and can immediately be sent to your client. If you have a fixed fee that never (or very rarely) changes, this option will ensure that your client will get their invoice even if you are on a beach sipping cocktails.

9. You enter your client's information here.

10. A reference can be added here. Xero allows you to utilize placeholders here, which means that you can add [Week], [Month], [Year], [Week Year], and [Month Year] and Xero will autofill that information when the invoice is generated. For example, if you are a web designer and are auto sending your September invoices and used "[Month Year] Design Services" in the placeholder, the reference would read "September 2023 Design Services". How neat is that?

11. If you have payment services connected to your invoice branding template, the name of the service would show up here.

12. You can select which currency to use when creating this invoice. This is super helpful if you work with clients who do not use USD as their currency, and need to pay in their own currency. Don't worry about the currency conversion, Xero handles this behind the scenes.

13. Select if this invoice is tax inclusive or tax exclusive.

14. If you've set up items, when you choose an items from your products and services list in Xero, the description, unit price, and account will all pre-fill. All you have to do is enter the quantity and make sure the correct tax rate is applied to your client.

This may sound like a lot of work, but after you've set up a few repeating invoices and get the hang of it, setting up future repeating invoices should take under 3 minutes at most.

When clients pay invoices using online payment services connected with Xero, the payments get automatically matched with the right invoice, reducing manual data entry.

With Xero, you aren't limited to its proprietary merchant services either.. You can easily add Stripe, GoCardless, Paypal, Chase Integrated Payments, Windcave, eWay, or add your own custom payment URL. If you have high ticket sales, you may want to opt for Stripe ACH vs Stripe credit card payments as your fees will be capped at $5 per transaction. This is much better than 2.9% + $0.30 per transaction which isS Stripe's standard merchant processing fee.

Keeping track of business expenses can be quite a daunting task, especially if you're often on the move or dealing with a high volume of transactions. With Xero Expenses, this process becomes a lot simpler and more efficient. This feature allows you to capture receipts and bills on the go, eliminating the need for manual data entry and ensuring that your expense records are always up-to-date and accurate.

The process is straightforward and user-friendly, designed to minimize the time and effort you spend on expense management. Using the Xero Expenses mobile app, you can take photos of your receipts whenever and wherever you make a transaction. The app uses advanced optical character recognition (OCR) technology to automatically extract key details from the receipt, such as the date, vendor name, and amount.

Once the details are extracted, they are automatically prepared for reconciliation in your Xero account. The receipt image is stored alongside the transaction record, providing a digital paper trail that is easy to follow for audits. You can also add additional details manually if needed, such as the expense category or any notes you want to remember about the transaction.

One of the strengths of Xero lies in its ability to adapt and meet the unique needs of different businesses. Thanks to its vast ecosystem of third-party apps available in the Xero Marketplace, users can customize their Xero experience with tools that automate and simplify various accounting and financial management tasks. Let's delve deeper into how apps like Hubdoc, Receipt Bank (now part of Dext), and Ramp integrate with Xero to bring efficiency and precision to your financial operations.

Hubdoc is an application designed to automate financial document collection and management. It integrates seamlessly with Xero, allowing you to capture bills and receipts in one centralized location. Once you upload your documents to Hubdoc, it extracts the essential data and creates transactions in Xero with the key information and source documents attached. This means less manual data entry and a more organized and efficient way to manage your financial documents.

Receipt Bank, which has now merged with Dext, provides an efficient way to handle your receipts and invoices. By simply taking a photo of a receipt with the Receipt Bank app, the software extracts the data and pushes it into Xero. This eliminates the need to keep track of a pile of paper receipts and ensures all your expenses are recorded accurately in Xero. Moreover, Receipt Bank can also fetch and process bills from popular suppliers automatically, reducing the administrative burden even further.

Ramp is a leading corporate card and expense management solution that has been designed to help businesses gain better control over their spending. When integrated with Xero, it provides an enhanced suite of tools for managing and tracking expenses, making it a valuable addition to the Xero ecosystem.

Ramp goes beyond traditional corporate cards by not only providing a method of payment but also offering comprehensive spend management features. It provides businesses with real-time visibility into their spending, with detailed analytics that help identify trends and potential areas for savings.

Ramp's card controls allow businesses to set spending limits and restrictions, ensuring that expenses stay within budget. Moreover, Ramp's automated receipt matching feature simplifies the expense reporting process. When a purchase is made with a Ramp card, the transaction is automatically matched with the corresponding receipt, eliminating manual expense reports.

When Ramp is integrated with Xero, all transactions made with the Ramp card are automatically synced with Xero. This means that every time a cardholder makes a purchase, the transaction details—along with the attached receipt—are automatically pushed to Xero. This eliminates the need for manual data entry, reduces the risk of errors, and ensures real-time updating of financial records.

Once in Xero, these transactions can be easily reconciled with bank statement lines, streamlining the accounting process. Moreover, the integration allows the finance team to track expenses in real-time, making it easier to manage budgets and cash flow.

We love Ramp and wish that more software worked as elegantly and as budget-friendly as it does. Should you decide to give it a whirl. Ramp is currently offering their software for free + you get a $500 bonus if you sign up and spend $1000 on Ramp cards within 30 days of getting started. Plus, they offer 1.5% cash back on ALL Ramp cards spends. To learn more, visit our Ramp partner page.

These two features are primarily aimed at accountants and the gains your accountant will see will give them more time and mental space in their day to do higher value work. Mega win!

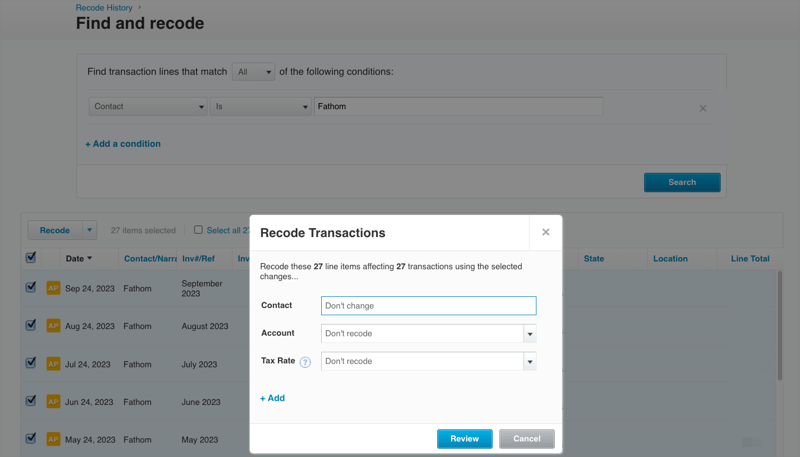

Xero's "Find and Recode" feature is an invaluable tool for accountants and bookkeepers, helping to streamline the task of finding and correcting transactions in bulk.

Xero's "Find and Recode" features give the user the ability to search and filter for specific transactions using various parameters such as account, contact, and the user who last modified the transaction, facilitating the process of finding transactions that need to be recoded. Once identified, these transactions can be recoded in bulk, allowing for changes to multiple transaction details at once, including the account, tax rate, and tracking category.

To ensure transparency and accountability, Xero maintains an audit trail of all changes made using the Find and Recode feature. Details of the recoding, including the individual who made the changes, and the time of the change, are stored in the history and notes section of each recoded transaction.

Find and Recode serves as a valuable tool for correcting errors, enabling users to amend a multitude of incorrectly coded transactions simultaneously rather than rectifying each one individually. If there's a need to restructure the chart of accounts, Find and Recode facilitates the movement of transactions between accounts. Additionally, in situations where a tax rate undergoes change, this feature streamlines the process of updating the tax rate on all relevant transactions.

Just a friendly reminder: while the Find and Recode feature is super handy and powerful, it's best to tread carefully. Because it lets you make changes to a bunch of transactions all at once, it's also pretty easy to make big mistakes if you're not careful. So, always give your changes a good once-over before you hit that apply button. Better safe than sorry!

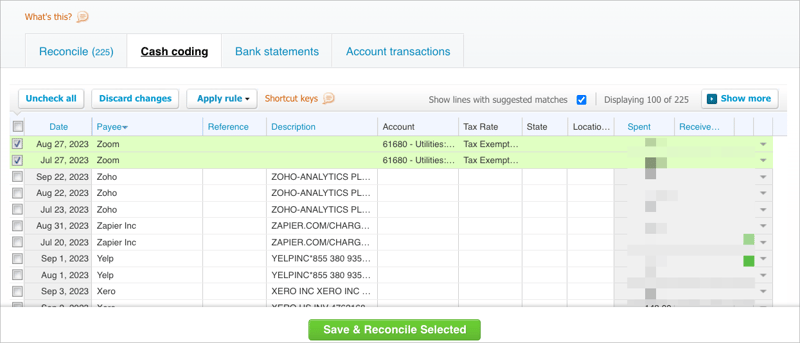

Cash coding allows the user to view and reconcile multiple lines of transactions at once, which can significantly speed up the reconciliation process. It can be particularly useful for reconciling simple transactions, such as interest or bank fees, which can be easily identified and do not usually require a detailed review.

Cash coding stands out for its ability to code and reconcile multiple transactions simultaneously, a capability that significantly cuts down the time it would take to process each transaction individually. To further expedite this process, Xero provides automatic suggestions based on your past reconciliations. This feature is designed to increase the speed of coding your transactions. It's also possible to use Xero's Find and Recode feature in conjunction with Cash Coding to correct bulk errors swiftly. Once you've coded the transactions, the system allows you to approve and reconcile all of them in one go, adding to this feature's efficiency. And to ensure accountability and compliance, Xero maintains a detailed audit trail of all changes made using Cash Coding.

While cash coding can be a powerful tool for speeding up the reconciliation process, it's important to use it responsibly. Because it allows for bulk changes, there's a risk of making mistakes on a large number of transactions if not used correctly. Always double-check your codings before approving and reconciling them.

After the data is entered into Xero (or your accounting system of choice), it's crucial to ensure that transactions are matched and categorized correctly. Accounting software, through the use of preset rules, can automatically assign transactions to the appropriate accounts. For example, a payment made to a specific vendor would be linked to the existing expense account for that vendor. This process is further enhanced by creating broad bank rules and matching existing transactions.

Creating broad bank rules is a way to automate transaction categorization more effectively. These rules are set up to recognize the nature of a transaction based on certain details such as the vendor's name, transaction amount, or reference details. Once set, the accounting software can automatically categorize incoming transactions based on these rules.

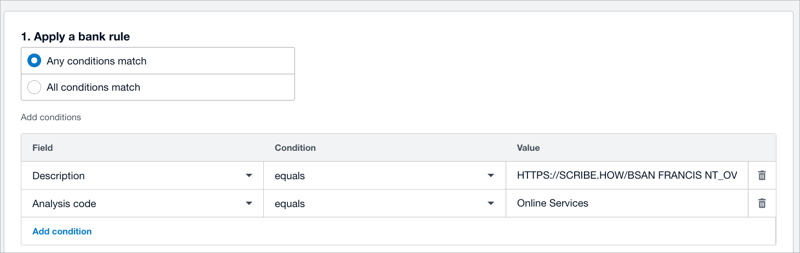

Here's an example of a Xero: bank rule that would not yield the desired result:

This bank rule would required the following to run:

Not every bank will transmit data to Xero's bank feed in the exact same way. Some banks will add more information that may not even be accurate.

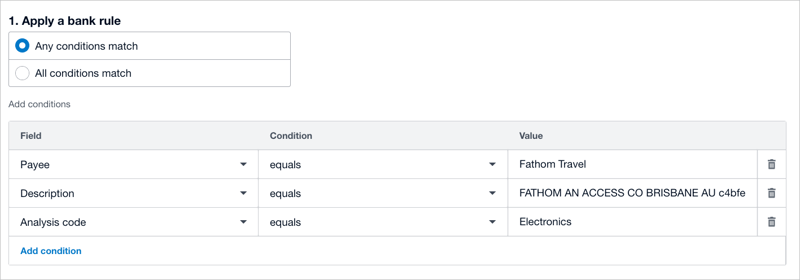

The example above shows an incorrect payee - this should be Fathom.HQ which is our Xero preferred reporting add-on.

It also shows an analysis code of "Electronics", which is also incorrect as this is a SaaS tool.

Regardless, in order for this bank rule to work as it currently stands,

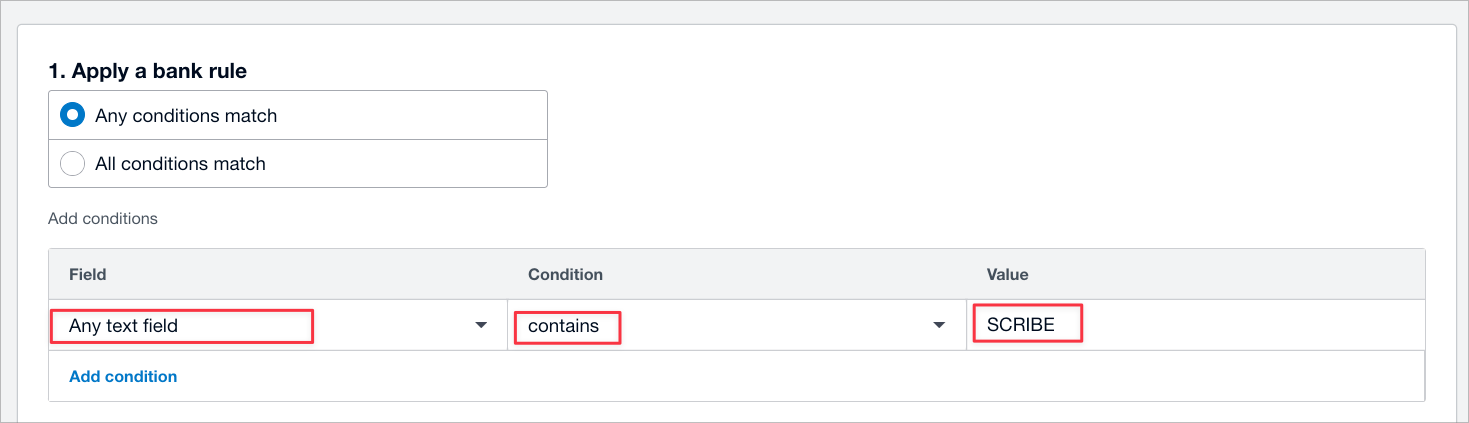

Rather than blindly accepting what Xero suggests, you can create rule that has more utility by removing non-essential information.

Going back to the initial example, you would do create a bank rule that looks like this:

This bank rule is now saying, "if any transaction contains the word Scribe", run this bank rule. If you know that no other vendor has Scribe in their name, then I can be reasonably certain this bank rule will work 99.99% of the time.

If you find there is an exception to this rule in the future, I can just update the bank rule or choose not to use the rule when reconciling the transaction in Xero. Spending the time upfront to better manager will not only save you time, but also increases the accuracy and consistency of transaction categorization.

In many cases, transactions such as bills or invoices may have already been entered into the system through a process known as line item extraction.

For example, an app like Dext Prepare (formerly ReceiptBank) can automatically extract line-by-line details from a bill or invoice and sync this data with your accounting software.

Once these details are in your accounting system, the software can match the incoming transaction from the bank feed with the pre-existing bill or invoice. This ensures that the transaction is not entered twice and that it's reconciled correctly with the right document.

If you're looking to ease the reconciliation process in Xero, you might want to consider integrating with Ramp. This powerful financial tool offers a seamless connection with Xero, ensuring that all transactions made using the Ramp card are automatically synced to your Xero account. What does this mean for you? It means less time spent on manual data entry and more time for other important business tasks.

Whenever a purchase is made with the Ramp card, the transaction details are automatically captured and sent directly to Xero. But it's not just the basic transaction info. Ramp also sends over the attached receipt, providing a complete picture of each transaction. This not only circumvents the need for manual data entry, but it also reduces the risk of human errors that can occur during manual input.

One of the major advantages of this integration is that it leads to real-time updating of your financial records. No longer do you have to wait for end-of-the-month reconciliations or go through the tedious process of matching transactions with bank statements. With Ramp and Xero, every transaction is instantly accounted for, keeping your financial records up-to-date at all times.

And the best part? Ramp transactions arrive in Xero already reconciled. That's right, there's no extra reconciliation work to be done in Xero. The integration handles all of that for you. This means you can spend less time on bookkeeping and more time on what really matters—growing your business.

Despite its longstanding use and familiarity, manual accounting brings a host of challenges. Let's dive into these hurdles to better grasp the potential drawbacks of this conventional method.

Human error is an ever-present risk in any field, including accounting. Manual tasks are no exception, and they can leave room for mistakes that may lead to significant discrepancies in financial reporting.

Even the most meticulous and experienced individuals are not immune to errors. After all, we're only human. Complex financial data, repetitive tasks, and a high volume of transactions all contribute to the potential for mistakes.

Consider a simple misplacement of a decimal point. An accountant entering an expense of $500.00 as $50.00 (or vice versa) could throw off a company's financials by $450.00. While this may seem insignificant in isolation, imagine the impact of such errors happening frequently or with larger amounts. The cumulative effect could greatly distort a company's financial picture, resulting in incorrect assessments of profitability and financial health.

Transposition errors are another common occurrence in manual accounting. Here, two digits within a number are accidentally swapped. For example, recording a $573 purchase as $537 may seem like a simple mistake, but it can cause a $36 discrepancy. Multiply such errors across all transactions in a fiscal year, and the result could be a substantial financial discrepancy.

Incorrect categorization is also problematic. Accountants may assign transactions to the wrong categories, such as recording an expense that should be under "Office Supplies" as a "Travel expense." These errors can lead to misleading reports, affecting budget allocation, tax calculations, and financial decisions.

Duplicate entries are yet another common human error. Imagine if an accountant accidentally enters the same invoice into the system twice. This duplication would overinflate expenses and create a distorted view of the company's financial position.

As you can see, even seemingly minor errors in manual accounting can have a multiplying effect over time, causing significant discrepancies. In some cases, they can even result in legal issues if they lead to incorrect tax filings or raise suspicions of fraudulent activities.

Accounting accuracy is crucial, and the potential risks associated with manual tasks underscore the importance of finding solutions to mitigate human error.

Manual accounting can be a real time sink that demands an unwavering eye for detail. With traditional methods, each financial transaction is painstakingly logged, sorted, and compared—a major drain on time, especially for businesses dealing with high volumes of transactions.

First comes recording transactions, also known as journalizing. Every financial event, from sales and purchases to income and expenses, must be meticulously noted by hand or entered into a computer system. This can be a tedious process, especially for businesses handling loads of daily transactions.

Next up is categorizing those transactions into the right accounts, like revenues, expenses, assets, liabilities, and equity. Proper categorization is key to accurate financial reporting and analysis, but it often means sifting through mountains of receipts and invoices—a painstaking journey indeed.

Then there's the reconciling of transactions. This is where internal financial records are pitted against external documents like bank statements to ensure everything matches up. Identifying and resolving discrepancies can eat up a substantial amount of time, especially if the error isn't immediately obvious.

After all that, it's time to compile everything into financial reports like income statements, balance sheets, and cash flow statements. These reports demand careful number crunching and consolidation of all the recorded and categorized transactions. Creating them manually can feel like hours upon hours of work, or even days, depending on the complexity and volume of the data.

And let's not forget the continuous monitoring and updating of financial records. Tracking receivables, payables, inventory, and petty cash—all of these ongoing tasks can further weigh down the already time-intensive process of manual accounting.

These demanding processes can create bottlenecks and sap productivity, taking valuable resources away from vital business activities like strategic planning and customer relations.

Outdated or manual accounting systems come with a serious downside: they lack real-time financial information. This means that the numbers you see may not accurately reflect your business's current financial situation. And the consequences of this delay? They can obstruct your ability to make prompt and informed decisions.

Let's talk about the delay in updating financial records. In manual accounting, this isn't an instant process. Each transaction must be entered, categorized, and reconciled manually. And during busy periods or times with a high transaction volume, this can mean a significant delay between when a transaction occurs and when it shows up in your books. Days turn into weeks.

Now, here's the kicker: the impact it has on visibility into your financial status. Because of these delays, the financial data you're looking at may very well be outdated. Imagine relying on a financial report that is missing a major expenditure made earlier in the day. You might think you have more funds available than you actually do, leading to financial commitments your business can't afford.

But wait, there's more! We're talking about the effect on decision-making. Real-time financial information is crucial for making timely and informed business decisions. Without it, you might be basing your choices on outdated or incomplete data. Imagine a situation where a customer places a big order, but your financial records haven't caught up to reflect a recent price increase from your supplier. You might underestimate the cost of fulfilling the order and overestimate your potential profit.

And here's another kicker: the inability to react quickly. Without real-time information, you're unable to promptly respond to financial changes. For example, let's say a major client delays payment. It could take days before you become aware of the situation and can take action, potentially affecting your cash flow and financial planning.

This ongoing lag in updating and accessing financial information is one of the significant drawbacks of manual accounting. It's time to take your financial management to the next level.

Manual accounting systems pose a serious risk when it comes to fraudulent activities. Dishonest employees can easily manipulate traditional books without leaving a trace, making it difficult to detect their actions. These systems lack comprehensive audit trails, making it challenging to pinpoint the timing and methods of fraudulent activities. Additionally, discrepancies are harder to spot without the automated checks and balances found in modern accounting software. Furthermore, manual systems often lack efficient internal controls, making it easier for fraud to go undetected.

Thankfully, there's a better solution. By using accounting software like Xero, you can strengthen internal controls, establish a clear audit trail, and benefit from built-in mechanisms that detect and prevent fraud. With Xero, you can have peace of mind knowing that your financial records are accurate and secure. It's a win/win/win situation.

Manual accounting systems can quickly become a hindrance as your business expands and financial complexity grows. The limitations of these systems to handle increasing transaction volume and intricate operations pose a significant challenge to scalability.

Think about it - as your business grows, the number of financial transactions, such as sales, purchases, and payroll, can skyrocket. Each of these transactions must be painstakingly recorded, categorized, and reconciled in a manual accounting system. But let's be real here, this manual process can easily get overwhelmed by the sheer volume of transactions, leading to delays, errors, and inefficiencies.

Growth often brings added financial complexity. Your business might diversify its product lines, venture into new markets, or expand its workforce. Each of these changes adds layers of complexity to financial operations, from tracking multiple revenue streams to navigating international transactions and grappling with different tax regulations. Unfortunately, manual accounting systems struggle to keep up with this increasing complexity.

Not only does manual accounting demand more time and resources as your business grows, but it also restricts access to financial data. In a manual system, access to financial data is often limited to those maintaining the books. However, as your business expands, more stakeholders like managers, investors, and auditors may require access to this data. Granting controlled and secure access can be quite a challenge with a manual accounting system, hampering your ability to make timely, data-driven decisions.

All of these limitations make it clear that scalability becomes a formidable challenge with manual or outdated accounting systems. If you have plans to scale your business, it's crucial to invest in systems that can grow with you. Don't let outdated practices hold you back from reaching your business goals.

Manual accounting systems can be a real headache when it comes to keeping up with the ever-changing landscape of tax laws and accounting standards. The constant need for monitoring and updates to ensure that every financial transaction and report is compliant can feel like a daunting task.

One of the biggest challenges is staying on top of changes in regulations. Tax laws and accounting standards are always evolving, and it takes a lot of effort to stay current. In a manual system, this can mean endless hours of research and interpretation to make sure you're doing things right.

Implementing changes in the accounting system can be equally frustrating. Updating methods and processes to record and report financial transactions is time-consuming and prone to error. And when regulatory deadlines are looming, it can be even more stressful.

Ensuring compliance in financial reporting is another headache that manual systems can't seem to shake. It's not just about documenting transactions correctly; it's also about presenting the information in a way that meets all the regulatory requirements. This can be a complex process that's prone to mistakes when done manually.

And let's not forget about the risk of penalties and fines. Non-compliance with tax laws and accounting standards can have serious consequences. Manual systems, with their higher risk of error and lack of built-in compliance checks, only add to that risk.

So, if you're tired of dealing with the headaches and risks of manual accounting systems, it may be time to consider a more efficient and reliable solution.

Maintaining a comprehensive and well-structured audit trail in manual accounting systems can be quite a challenge. Without a detailed record of each transaction, it becomes arduous to trace and validate transactions when needed. This poses a significant hurdle for ensuring financial transparency and accountability.

Recording transactions by hand is not only time-consuming but also prone to errors. It becomes increasingly difficult to keep track of who made each transaction, when it occurred, and what it was for. As the number of transactions grows, this task becomes even more daunting.

The lack of a comprehensive audit trail makes it challenging to trace transactions. Questions about authorized transactions or their purposes can be hard to answer without the necessary information in a manual system. This lack of traceability hampers financial management and decision-making, making it difficult to resolve discrepancies or disputes.

Another challenge is verifying transactions in the absence of a detailed audit trail. Gathering the necessary documentation and evidence to verify transactions can be a time-consuming process in a manual system. Auditors and regulatory bodies may encounter obstacles in their efforts to ensure accuracy and compliance.

An audit trail is crucial for financial transparency and accountability. It allows businesses to demonstrate responsible financial management and compliance with regulations. The absence of a comprehensive audit trail makes it harder to provide this assurance, potentially affecting relationships with stakeholders such as investors, lenders, and regulators.

Manual accounting systems present significant challenges when it comes to sharing and collaborating on financial data. Instead of seamless digital processes, these systems rely on physical transfers of documents or files, which are not only inefficient but also prone to data misplacement or loss.

Imagine having to exchange paper documents or files for every financial transaction. This outdated method can slow down decision-making and hinder effective teamwork, especially for larger businesses or remote teams. It's a time-consuming process that can impede collaboration, making it difficult to meet deadlines and create accurate financial reports.

Additionally, the risk of data loss or misplacement skyrockets with manual accounting systems. Documents can vanish, become damaged, or even end up in the wrong hands. This can lead to the loss of critical financial data and introduce errors into the accounting records. The inefficiencies of manual processes intensify during periods when several individuals need simultaneous access to the same financial data, further delaying progress and hindering productivity.

Furthermore, manual accounting systems often lack sophisticated access control mechanisms. Consequently, maintaining strict control over who can access specific information and tracking document modifications becomes an uphill battle. This lack of control opens the door to unauthorized access and modifications, increasing the risk of errors or even fraudulent activities.

It's clear that relying on manual accounting systems comes with a host of challenges that impede efficiency, accuracy, and collaboration. Embracing digital solutions that offer seamless sharing, enhanced security, and real-time collaboration is crucial in today's dynamic business environment.

Handling financial reports manually and deriving valuable insights from them can be a real challenge in traditional accounting systems. It's a tedious and time-consuming process that heavily relies on manual analysis and interpretation, which can hinder effective financial decision-making.

One major struggle in non-digital accounting systems is the laborious process of report generation. You have to gather data manually, organize it into the required format, and calculate financial metrics by hand. This can be extremely time-consuming, especially when dealing with complex reports or regular reporting needs like monthly or quarterly updates.

Another limitation of manual accounting systems is the difficulty in analyzing financial data. Unlike automated systems that can quickly perform complex calculations and generate visual representations of data, manual systems require manual calculations and interpretations. This makes it harder to identify trends, compare performance against benchmarks, and make informed projections.

Accessing historical data for comparative analysis or trend identification can also be a challenge in a manual system. Past financial records may be stored in physical files or scattered across different locations, making it time-consuming and cumbersome to retrieve and effectively utilize the data.

The inefficiencies in reporting and analysis within manual systems can result in delayed financial decision-making. By the time a report is generated and analyzed, the information it contains may no longer be timely or relevant. This can lead to missed opportunities or decisions being based on outdated information.

Relying solely on manual processes for financial reporting and analysis can be a struggle. The limitations and inefficiencies involved can hinder efficiency and responsiveness in financial decision-making. It's crucial to consider more efficient and automated approaches to ensure accurate and timely insights for effective financial management.

Manual accounting systems can be quite burdensome and expensive, requiring significant resources to maintain. They entail the need to hire, train, and manage staff solely for the purpose of handling financial transactions. This additional workforce comes with its own costs, adding to the financial strain.

Moreover, paper documents necessitate secure physical storage, resulting in expenses for filing cabinets, storage rooms, or even off-site facilities.

The time investment required to manually enter, check, and organize data further detracts from core business activities, undermining productivity and profitability.

Additionally, the possibility of human error looms large in manual accounting systems, which can lead to financial discrepancies and subsequent costs to correct them. In some cases, such errors could even trigger regulatory fines or damage the company's reputation.

The rapid advancement of technology has transformed many aspects of business, and accounting is no exception. Automating accounting processes can bring a wealth of benefits to an organization, from enhanced accuracy to improved efficiency. Let's explore these benefits in more detail.

Remember those sleepless nights, double-checking every entry and calculation to ensure no errors slipped through? With automated accounting, those days are gone. One of the most significant benefits of automation is the level of accuracy it brings to your accounting processes. By eliminating manual data entry and calculations, you reduce the risk of those sneaky human errors that can lead to financial discrepancies. An automated system ensures precision in every transaction, from simple calculations to the generation of complex financial reports. It’s like having a safety net for your finances, ensuring your numbers are always spot-on.

Time is money, particularly in small businesses where every hour counts. Traditional accounting tasks can be time-consuming, leaving you less time to focus on growing your business. Automation can significantly cut down the time spent on repetitive tasks like invoice processing, payroll, and tax calculations. This efficiency allows you and your team to focus on more strategic aspects of your business, like financial analysis, planning, and of course, customer engagement. Imagine what you could achieve with those extra hours!

In the dynamic world of business, having access to real-time information is crucial. Automation provides instant access to your financial data, with any changes or transactions instantly updated. This means you can have an accurate, up-to-the-minute view of your organization's financial status at any given moment. This immediate access to information is invaluable for decision-making and strategic planning. It's like having a financial crystal ball, giving you the power to make informed decisions quickly.

Automation is like a spring clean for your accounting department. It eliminates the need for paperwork and physical document storage, reducing clutter, and making it easier to find and access necessary information. It also seamlessly integrates various aspects of accounting, creating a streamlined workflow, and reducing the chance of data duplication. This efficiency means less time spent on mundane tasks and more time spent on propelling your business forward.

Keeping up with the ever-changing regulatory landscape can be a headache. But, automation can help ensure compliance with these standards. Automated systems can be updated to align with changing regulations, and they can generate the necessary reports for auditing purposes. This reduces the risk of non-compliance, and the associated penalties, keeping your business on the right side of the law.

Investing in an automation system may seem like a significant upfront cost, but the long-term cost savings can be substantial. Automation reduces the need for manual labor, and the improved accuracy prevents costly mistakes. Additionally, the increased efficiency can lead to reductions in operational costs. Over time, these savings can add up, making it a wise investment for your bottom line.

As your business grows, so too does the volume of financial transactions. An automated accounting system can easily adapt to this growth, handling an increased volume of transactions without the need to hire additional staff or invest in more resources. This scalability makes automation a practical, cost-effective solution for growing businesses.

In today's digital age, protecting sensitive financial data is crucial. Automated systems often have robust security measures in place to safeguard this information. They can control who has access to certain information and track any changes made, reducing the risk of unauthorized access or fraud. It's like having a digital lockbox for your financial data, giving you peace of mind.

With real-time access to accurate financial data, you, as a business leader, can make more informed, strategic decisions. You can identify trends, monitor performance, and forecast future financial scenarios. This data-driven decision-making can lead to better business outcomes and help steer your business towards success.

Nobody likes the word "audit", but automation can make this process less daunting. Automated systems can generate detailed reports of all transactions, making it easier to trace and verify financial data. This not only streamlines the auditing process but also adds an extra layer of accountability to your business.

Automating accounting processes can bring numerous benefits to your small business, from enhanced accuracy and efficiency to improved decision-making and compliance. It's an investment that can yield significant returns and transform the way you manage your finances, giving you more time to do what you do best – run your business.

Firstly, there's the cost factor. Setting up an automated accounting system doesn't come cheap. It's not just the price tag of the software; there can also be additional costs for upgrading hardware or training your team to use the new system. It's an investment, for sure, but one that needs careful consideration.

Then there's the learning curve. Accounting automation isn't something you can master overnight. Your staff might need to learn new skills or change the way they work, which could slow things down for a while. Like learning to ride a bike, it might be a bit wobbly at first, but with practice, it gets easier.

Just like anything tech-related, automated accounting systems can have their off days. Glitches, bugs, or system failures can happen, disrupting your business operations. And when they do, you'll need someone with the technical know-how to fix them.

And speaking of technology, the more you rely on it, the more vulnerable you are if it goes down. If your system crashes or the power goes out, your accounting operations could grind to a halt. It's like having a car but no gas; you're not going anywhere until it's resolved.

Flexibility can also be an issue. While automation software is great at crunching numbers and handling everyday tasks, it might struggle with out-of-the-ordinary scenarios or complex financial situations. In these cases, you might still need a human touch.

Integrating the new software with your existing systems and data can be a tough nut to crack. If it's not done right, you could end up with data errors or systems that just don't play nice together. It's a bit like trying to fit a square peg in a round hole; it needs a careful approach.

Security is another concern. While most accounting automation software has good security measures, no system is totally bulletproof. Cyberattacks or data breaches can happen, potentially exposing sensitive financial information. It's a bit like leaving your house unlocked; you're opening yourself up to risks.

Automating your accounting processes could also change the dynamics of your team, reducing the level of personal interaction. This could impact the team spirit or collaborative environment. It's a bit like working in silence; it gets the job done, but it might not be as enjoyable.

With automation taking over many manual tasks, some jobs might become redundant, which can make employees feel insecure. It's a bit like seeing a robot do your job; it can be unsettling.

Lastly, while automation is efficient, it can't replicate human judgment. For complex decision-making, you still can't beat the intuition and expertise of a human accountant. It's like using a GPS; it'll get you there, but the local driver might know a better route.

Rather than offering a basis "here's what you can automate in your business", let's look at real-world examples that you (or your accountant) can put into practice today. There are hundreds of articles that just skim the surface, but if you've made it this far, you deserve the cheat code.

Forget about manually approving bills and handwriting checks. Xero + Ramp is the best thing since sliced bread! You can automate your accounts payable process using a combination of Xero, an online accounting software, and Ramp, a corporate card and spend management platform.

Here's a step-by-step guide on how this can be done:

Set Up Integration. First, the business needs to set up an integration between Xero and Ramp. This is usually a straightforward process that involves logging into Ramp, going to the settings, and selecting Xero as the accounting software to connect. Once the integration is set up, data can flow seamlessly between the two platforms.

Issue Ramp Cards. Next, the business can issue Ramp corporate cards to their employees. These cards can be used for business expenses, eliminating the need for employees to use their personal cards and then seek reimbursement.

Implement Spend Controls. With Ramp, the business can set spend controls on each corporate card. This means specifying limits on how much each cardholder can spend per day, week, or month. It also allows the business to specify the types of purchases that can be made with the card, reducing the risk of unauthorized or fraudulent transactions.

Make Purchases. When employees make purchases using their Ramp cards, the transaction details are automatically captured by Ramp. This includes the vendor name, amount, and date of the transaction, as well as the receipt if the purchase was made online.

Review and Categorize Expenses. Ramp's platform allows the business to review and categorize these expenses. The business can set up rules to automatically categorize certain types of purchases, such as office supplies or travel expenses. This not only saves time but also ensures that expenses are categorized consistently for accounting and tax purposes.

Sync with Xero. Ramp’s transactions can be synced with Xero on a daily, weekly, or monthly basis, depending on the business's preference. Once synced, these transactions will appear in Xero's accounts payable, ready to be reconciled.

Reconciliation. With the necessary data already in Xero, reconciliation becomes a breeze. The software matches the expenses on the Ramp card with the corresponding transactions in the bank feed. If everything checks out, the transactions are automatically reconciled.

By using Xero and Ramp together, a small business can automate their accounts payable process, freeing up time to focus on more strategic tasks. This not only reduces manual work but also helps to prevent errors, improve financial control, and provide real-time visibility into expenses.

Are you as SaaS company struggling with getting invoices out on time and then recording accrued or deferred revenue properly? We use Chargebee in our business and think that you can also reap the benefits of using Xero + Chargebee together.

Accounts receivable (AR) management is critical for a SaaS company's cash flow. Automated AR processes can improve efficiency, accuracy, and reduce the time-to-payment. By integrating tools like Xero, an accounting software, with Chargebee, a subscription billing and revenue management platform, a SaaS company can achieve this automation. Here's a step-by-step guide:

Set Up Chargebee for Subscription Management

Subscription Plans: Create different subscription tiers or plans in Chargebee.

Trial Management: Automate trial sign-ups, conversions, and follow-ups.

Dunning Management: Implement automated dunning processes to handle failed payments and communicate with customers about these failures.

Integrate Chargebee with Xero. Chargebee offers a direct integration with Xero. Once integrated, all invoices, credit notes, payments, and customer information in Chargebee can be automatically synced with Xero.

Automated Invoice Creation. When a customer subscribes or renews a subscription via Chargebee, an invoice is automatically generated in Chargebee and then synced to Xero.

Automate Revenue Recognition. SaaS often deals with advanced payments and varied subscription terms. Use Chargebee's revenue recognition feature to recognize revenue in accordance with accounting standards and sync these details to Xero for accurate financial reporting.

Automate Sales Tax & VAT Calculation. Chargebee can calculate sales tax or VAT based on the customer's location. This tax information can be synced to Xero, ensuring accurate tax reporting.

Customer Communication

Payment Reminders: Set up automatic payment reminders in Chargebee to notify customers of upcoming payments or renewals.

Invoice Notifications: After the generation of an invoice in Chargebee, automatically send the invoice to the customer via email.

Automate Payment Collection. Integrate Chargebee with payment gateways like Authorize, Stripe, PayPal, etc. Once a customer invoice is generated, Chargebee can automatically charge the customer's payment method on file, and the payment status gets updated in Xero.

Reconciliation. Use Xero's bank feeds and reconciliation features. When payments are processed through Chargebee and synced to Xero, you can match them against bank transactions, ensuring accurate accounting.

Handling Refunds & Chargebacks. Manage refunds and chargebacks directly in Chargebee. Once processed, these transactions will also reflect in Xero, keeping the accounting records up-to-date.

Reporting. Leverage both Chargebee and Xero's reporting features to gain insights into AR aging, customer churn, MRR (Monthly Recurring Revenue), etc.

Accounts Receivable Follow-up. In case of overdue invoices, utilize Chargebee's dunning system to automatically follow up with customers. If certain invoices remain unpaid after several reminders, you can review them in Xero and make decisions regarding further actions, like involving a collections agency or writing off the invoice.

Regularly Review & Optimize. As your SaaS business grows and evolves, continuously review and refine your AR processes. Stay updated with any new features or integrations offered by Chargebee and Xero that can further streamline and automate AR.

By combining the subscription management capabilities of Chargebee with the accounting prowess of Xero, a SaaS company can create an efficient, automated accounts receivable process, ensuring timely and accurate billing and collection.

Automating and upgrading financial reporting is essential for small businesses to gain better insights into their financial health, make informed decisions, and potentially satisfy stakeholder demands. Xero combined with FathomHQ, a financial analysis and reporting tool, offers a powerful suite to achieve advanced financial reporting. Here's a guide on how to do it:

Integration of Xero with FathomHQ. Start by connecting your Xero account to FathomHQ. The integration will allow FathomHQ to access financial data from Xero, providing the basis for advanced reporting.

Data Synchronization. Once integrated, FathomHQ will automatically sync with Xero to update the financial data. This ensures that your reports are always based on the latest figures.

Set Up Key Performance Indicators (KPIs): FathomHQ provides tools to track and analyze a range of financial and non-financial KPIs. Define the KPIs that matter most to your business – from profitability metrics to customer acquisition costs.

Customized Financial Statements. Use FathomHQ's reporting tools to create customized financial statements. These can be tailored to show the information most relevant to your business, stakeholders, or investors.

Advanced Analysis Tools:

Trend Analysis: Compare financial performance over multiple periods to identify growth patterns or areas of concern.

Benchmarking: Compare your business's performance against industry averages or against specific competitors if the data is available.

Cash Flow Analysis: Understand the ins and outs of your cash movements and forecast future cash positions.

Automate Monthly Reporting:. Set up FathomHQ to generate monthly or quarterly financial reports automatically. These can be sent directly to stakeholders or used internally for management meetings.

Visual Dashboards:. FathomHQ excels in creating visual reports and dashboards. Utilize this feature to make complex financial data more understandable for non-finance team members.

Scenario & Forecasting Tools. Use FathomHQ's tools to run different financial scenarios (e.g., how a 10% increase in sales or a 5% decrease in costs would impact profitability). This helps in planning and making informed decisions.

Consolidated Reporting (if applicable). If your small business has multiple entities or branches, FathomHQ can consolidate data from different Xero accounts, providing a holistic view of the entire business's financial health.

Automate Alerts. Set up automated alerts in FathomHQ for specific scenarios, such as when cash flow drops below a certain level or if there's a significant deviation in a particular KPI. This keeps you proactive in managing potential issues.

By leveraging the combination of Xero's robust accounting features and FathomHQ's advanced reporting capabilities, small businesses can automate and upgrade their financial reporting, resulting in richer insights and more strategic decision-making.

Upgrading and automating payroll processing can help small businesses ensure accuracy, save time, and remain compliant with relevant laws and regulations. Xero's accounting software integrates smoothly with Gusto, a cloud-based payroll platform. Here's how to use these tools together to streamline payroll:

Integration of Xero with Gusto. Start by integrating your Xero account with Gusto. This will allow for seamless data sharing between the platforms, making sure that your accounting and payroll data remain consistent.

Employee Onboarding. With Gusto, employees can self-onboard. They can input their personal details, tax information, and banking details for direct deposit, reducing manual data entry for employers.

Automate Salary Calculations. Input employee salaries or hourly rates in Gusto. The system can automatically calculate pay based on the hours worked, taking into account any overtime, bonuses, or commissions.

Benefit Management. If you offer benefits such as health insurance, retirement plans, or HSAs, Gusto can manage and track these. Deductions related to benefits will be automatically calculated and reflected in employee paychecks.

Tax Calculation and Filing. Gusto can automatically calculate federal, state, and local taxes for each employee. Moreover, Gusto can handle tax filings and payments on your behalf, ensuring that you remain compliant.

Time-off Tracking. Track employee vacations, sick days, or other types of leave within Gusto. The system will adjust payroll automatically based on approved time off.

Reimbursements and Deductions. If employees need reimbursements for business expenses or if there are other deductions (e.g., equipment purchases), these can be managed within Gusto and reflected in the payroll.

Seamless Syncing with Xero. After processing payroll in Gusto, the data can be automatically synced with Xero. This includes wage expenses, tax liabilities, and any other payroll-related transactions. It ensures that your financial records in Xero always reflect the latest payroll data.

Reporting:

Both Xero and Gusto offer robust reporting features. Use these to generate payroll summaries, tax reports, year-end summaries, and more. This can be helpful for both internal review and external compliance (e.g., tax audits).Compliance Updates. Gusto regularly updates its software based on changes to labor laws, tax rates, and other relevant regulations. This means your payroll process will be compliant without you having to keep track of every change.

By effectively integrating Xero and Gusto, small businesses can automate a significant portion of their payroll processes, ensure accuracy, stay compliant with regulations, and free up time and resources for other business activities.

While automated accounting can bring numerous benefits such as efficiency, speed, and reduced errors, it's not without its challenges. Here are a few key issues that businesses may encounter when implementing and using automated accounting systems:

High Upfront Costs. The initial costs of implementing an automated accounting system can be high. This includes not only the cost of the software itself but also any hardware requirements, system customization, data migration, and training for staff. For small businesses, these costs can be prohibitive, although they may be offset by the long-term benefits of automation. Finding an accounting team that is well versed in accounting automation is your best bet - they already know all the accounting hacks and can hit the ground running.

Integration with Existing Systems. Automated accounting systems may not seamlessly integrate with a company’s existing software systems. This can lead to data silos, where information is stuck within one system and cannot be easily transferred or accessed by another. This can be a significant challenge if the business relies on several different software solutions for various aspects of its operations. If your existing systems do not natively integrate, using tools like Zapier or Make can help solve this problem.

Data Security and Privacy. Automated systems often involve storing sensitive financial data in the cloud, which can raise concerns about data security and privacy. Businesses must ensure they use software from reputable vendors that offer robust security measures, including data encryption, secure user authentication, and regular system backups.

Dependence on Internet Connectivity. Since many automated accounting systems are cloud-based, they require a reliable internet connection to function. If the internet connection is unstable or unavailable, it may disrupt access to the system and hinder business operations. Thankfully, this is a problem that isn't usually persistent and resolves itself quickly.

Loss of Human Oversight. While automation can reduce human error, it also means losing some degree of human oversight. Automated systems can still make mistakes, such as duplicate entries or incorrect data input, and these may not be caught without human review. Similarly, an over-reliance on automation may mean missing out on nuanced insights that come from human analysis. This can be solved by adding a system if checks and balances into your processes.

Need for Training and Change Management. Implementing a new system requires training employees to use it effectively. Some employees may resist the change, particularly if they are not comfortable with technology or if they perceive the new system as a threat to their job security. Effective change management is crucial to address these concerns and ensure a smooth transition. While this one is harder to manage, the best accountants will be eager to use automation to their advantage and won't stick their head in the sand.

Software Limitations. No accounting software can cater to all the unique needs of every business. There might be specific industry requirements or unique business processes that the software cannot handle well. Customizing the software to meet these unique needs can be costly and time-consuming.

Despite these challenges, the benefits of automated accounting outweigh the potential drawbacks for many businesses. You should carefully consider these challenges and how they might be addressed before deciding to implement an automated accounting system.

When searching for an accounting software, there are several key attributes to look for to ensure that it meets the needs of your business.

Here are some important aspects to consider:

User-Friendly Interface. The software should be intuitive and easy to use, even for individuals who are not tech-savvy. A user-friendly interface can greatly increase efficiency and reduce the time spent on training.

Customization. Look for software that allows customization to match your business's unique needs. This can include customizable reports, invoice templates, user roles, and more.

Scalability. The software should be capable of growing with your business. It should be able to handle an increased volume of transactions and more complex tasks as your business expands.

Integration. Your accounting software should be able to integrate seamlessly with other systems that you use, like your CRM or inventory management system. This can help to streamline your processes and avoid the need for manual data entry.

Cloud-Based. Cloud-based software can be accessed from anywhere with an internet connection, providing flexibility and enabling remote work. It also means that the vendor is responsible for software updates, data storage, and security.

Comprehensive Features. The software should provide a comprehensive range of features to handle all your accounting needs. This can include invoicing, expense tracking, payroll management, inventory management, tax preparation, and more.

Security. Given that accounting software deals with sensitive financial data, robust security measures are essential. Look for features like data encryption, two-factor authentication, and regular backups.

Customer Support. Good customer support can be invaluable when you encounter problems or have questions about the software. Look for vendors that offer multiple channels of support, such as email, phone, and live chat.

Cost-Effectiveness. The cost of the software should provide good value for money considering its features and capabilities. Be sure to consider ongoing costs, such as monthly or annual subscription fees, as well as any upfront costs.

Positive Reviews and Reputable Vendor. Lastly, look for software that has positive reviews and comes from a reputable vendor. This can give you confidence in the reliability of the software and the vendor's commitment to customer service.

Remember, the best accounting software for your business will depend on your specific needs and circumstances. It can be helpful to take advantage of free trials to test out different options before making a decision.

As you venture into the world of accounting automation, it's natural to have questions. Whether you're curious about the basic concept of accounting process automation, the challenges of manual accounting, or the benefits and drawbacks of automation, we've got you covered.

Accounting process automation is the use of technology to automate manual, repetitive accounting tasks. This can include anything from invoice processing and expense tracking to financial reporting and tax preparation.

Manual accounting can be prone to human error, time-consuming, and lack real-time information. It also carries an increased risk of fraud, has limited scalability, and can present compliance and regulatory challenges. In addition, there may be a lack of a clear audit trail, difficulty in collaboration, inefficient reporting and analysis, and high costs.

Accounting process automation can enhance accuracy, save time, provide real-time information, and improve efficiency. It can also enhance compliance, reduce costs, provide scalability, improve data security, aid in better decision-making, and improve auditability.

Yes, drawbacks can include high implementation costs, a learning curve for users, potential technical issues, dependency on technology, limited flexibility, data integration challenges, security concerns, reduced personal interaction, potential job redundancies, and loss of human judgment.

Tasks that can be automated include accounts payable, accounts receivable, invoice generation, expense tracking, financial reporting, payroll processing, tax preparation, and financial analysis.

Challenges can include high upfront costs, difficulty integrating with existing systems, concerns over data security and privacy, dependence on internet connectivity, loss of human oversight, the need for training and change management, and potential software limitations.

Look for a user-friendly interface, customization options, scalability, integration capabilities, cloud-based operation, comprehensive features, robust security, good customer support, cost-effectiveness, positive reviews, and a reputable vendor.

Automation has redefined the accounting landscape, offering businesses a viable solution to manual, error-prone processes. By leveraging automated tools like Xero, companies can simplify data capture and entry, streamline invoicing, and ensure accurate financial reporting. While certain challenges are associated with adopting automated accounting, the benefits it brings in terms of efficiency, accuracy, and cost savings cannot be overstated.

Remember, transitioning to automated accounting is not just about eliminating tedious tasks; it's about empowering your business to grow and succeed in a digitized world. Embrace the change, and witness firsthand how automated accounting can revolutionize your financial processes.

Are you ready to take the leap into accounting automation? Start by exploring Xero's robust features and see how they can transform your business's financial operations. If you need guidance or have any questions about how to automate your accounting tasks, don't hesitate to reach out to us. At Accounting Prose, we're here to help you navigate the world of accounting automation and unlock the full potential of your business.

Take control of your business finances today. Contact us to schedule a consultation, or dive deeper into our resources to learn more about the benefits of accounting automation. Your journey towards streamlined financial processes begins here.

1 min read

Welcome to the future, where technology is transforming the way we do business. One area experiencing significant change is accounting. Gone are the...

AI, RPA, and other automated tech are transforming accounting, bringing increased precision, efficiency, safety, cost-savings and visibility. In...

.png)

Cash flow management is the lifeblood of any thriving business. A crucial component of that mechanism is the Accounts Payable (AP) process. It's like...