How to Register for a Colorado My FAMLI+ Employer Account

Welcome to our guide on setting up a Colorado My FAMLI+ account for employers. My FAMLI+ is a program created by the state of Colorado that...

%20(1).png)

The Colorado Paid Family Leave Act (FAMLI) is a game-changing law that provides eligible workers with up to 16 weeks of paid family leave for certain family and medical reasons. This new law has the potential to greatly benefit employees in the state, while also creating some challenges for employers who must ensure they are complying with all of its regulations. In this article, we will discuss key elements of FAMLI such as eligibility criteria, types of benefits available, and what steps employers need to take to comply with the law. With this information in hand, businesses can be better prepared when it comes time to implement the new legislation.

Updated January 25th, 2023.

In November 2020, Colorado citizens made history by approving Proposition 118, making our state one of the first to introduce and fund a Family and Medical Leave Insurance Program.

The only other states (or Districts) with this type of paid leave program are:

California

Connecticut

Washington DC

Delaware

Maryland

Massachusets

New Hampshire (voluntary)

New Jersey

New York

Oregon

Rhode Island, and

Washington

FAMLI is funded by both employers* and employees in an equal share of 0.45%. Employers may choose to cover the entire amount (0.90%) as a benefit to their employees, but this is not a requirement. To ensure a smooth running system, employers are obligated to collect employee deductions and employer contributions when processing payroll. Thankfully, if you are a Gusto customer, these premiums will automatically be remitted to the state and you don't even have to register– they do everything for you.

Update: January 25, 2023

On December 16, 2022, Gusto sent this email to clients with employees in the state of Colorado.

They stated,

"Do I need to register with the agency?

Nope! We’ll register for you."

Sadly, this is not correct. Please follow the instructions in this blog post to set up your Colorado MyFAMLI+ account.

How to Register for Colorado a My FAMLI+ Employer Account

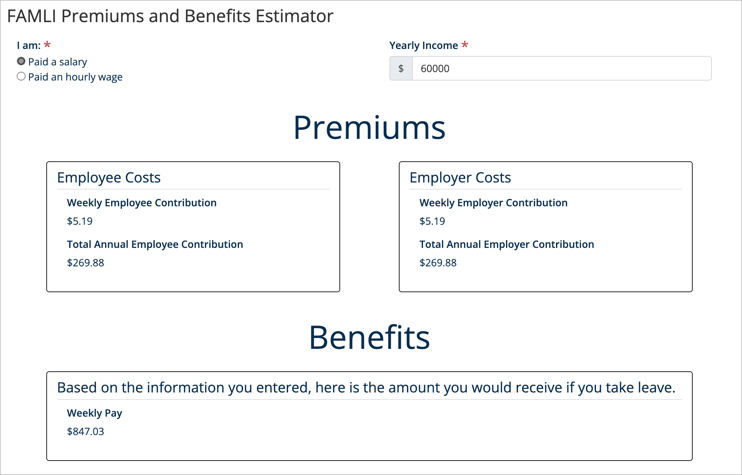

This program is not intended to create a hardship for the employer or the employee, and the state has created a handy calculator to help you understand what you will be responsible for, which can be accessed here.

In the example below, an employee earning $60,000 a year would contribute $269.88 per year, and if they needed to use this benefit, would receive $847.03 per week in benefits.

This is nearly 75% of their annual salary, which is pretty incredible. In fact, The State of Colorado notes that leave will be paid at a rate of up to 90% of the employee's weekly wage, which is based on a sliding scale and is proportional to Colorado's average weekly wage.

Directly from The State of Colorado:

As of July 2022, the State's average weekly wage is $1,350.55. Low wage earners will qualify for a higher percentage of wage replacement. Benefits are capped at $1,100 per week.

It's pretty simple. The gross amount your employees are paid– like their salary, hourly wages, or tips – is used to calculate premiums. There are a few other nuanced types of pay to include, which you can view in the Employer’s Guide to FAMLI.

If the term "gross amount" is unfamiliar, this means the amount your employees are paid before any deductions for things like taxes, health insurance, or retirement benefits.

While every employee is required to contribute to this program, the employer's liability depends on the employee headcount count and type. The chart below will help you understand if you, the employer, are required to participate in this program.

| Employer Type | Employee Premium | Employer Premium |

| 9 or Fewer Employees | Required | Not Required |

| 10 or More Employees | Required | Required |

| Self Employed | No Premium | No Premium |

| Employers with Approved Private Plans | No Premium | No Premium |

When it comes to counting remote employees, if the employer has more than ten total employees– even if they work outside of Colorado, the employer must remit both the employer and employee premiums.

If you are a nationwide employer with more than 10 employees in the US, you must remit both the employer and employee premiums.

If you use Gusto to manage your payroll, you do not need to worry about figuring out your employee headcount. Gusto will handle this for you as well.

Am I sounding like a broken record? Gusto is the absolute best payroll company on the planet. We use Gusto to manage our client payroll and it has made our lives so much better.

Want to use Gusto? Click here to use our affiliate link and get a $100 Visa gift card just for signing up.

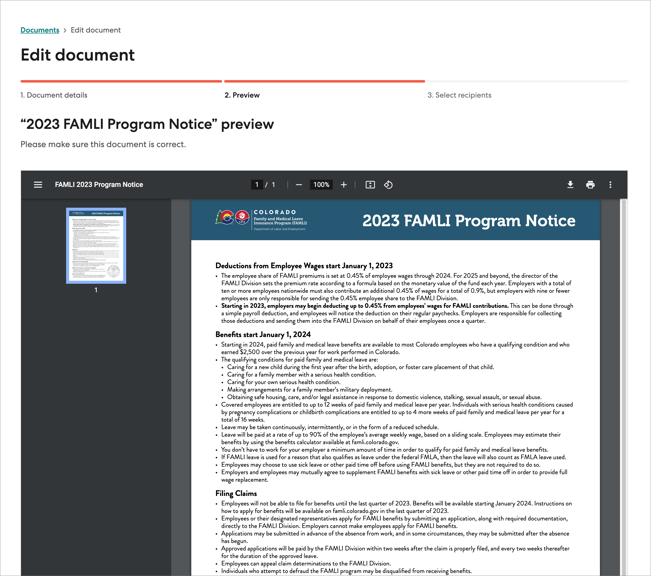

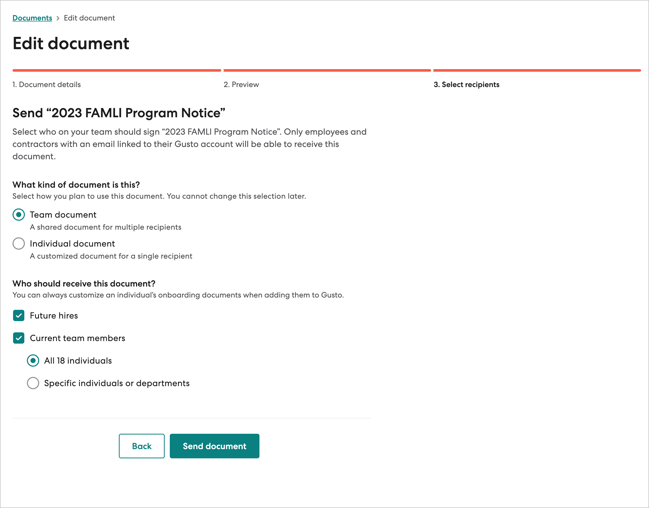

In addition to collecting and remitting the employer and employee premiums, the employer is required to post the 2023 FAMLI Program Notice in a prominent location in the workplace by January 1st, 2023. This could be a breakroom if you have a physical office or you could email this to your current (and new) employees if you're team works remotely.

If you are a super smart business owner using Gusto, we recommend adding this to your onboarding document package.

Here's how you do that...

On the left menu within Gusto, click on Company and then Documents.

Click + Add Document and then select New Document.

Here you can upload the 2023 FAMLI Program Notice PDF.

Once uploaded, you will select Team Document.

Next, under "who should receive this document" select Future Hires and Current Team Members.

You have the option to select all team members or just those affected by this change.

Then click Send Document.

First, Colorado Family and Medical Leave Insurance benefits cannot be used until January 2024. The State of Colorado is using 2023 to fill its reserves so that benefits can be paid out starting next year.

Also, once this program is ready for payouts, the employer cannot require that the employee use their accrued PTO before dipping into this program. While the employee can opt to do this, it would be voluntary (and ill-advised). An employer and employee can mutually agree to use any accrued PTO to make up any difference in wages and receive 100% of their salary. It is important (and required) to get this arrangement documented in writing before the employee takes their leave.

Starting in 2024, employees can apply for benefits for the following:

To manage their own serious health condition

To care for a family member with a serious health condition

To care for a new child (within the first year of birth, foster placement, or adoption)

To make arrangements for military deployments

To address immediate safety needs and the impact of domestic violence or sexual assault

Starting in 2024, employees can apply using Colorado's online system, similar to how folks apply for Unemployment Insurance Benefits. This online system is not currently up and running, so a link is not currently available, but will likely be here: Colorado Family and Medical Leave Insurance Program (FAMLI) - Individuals and Families.

If you are an employee applying y for benefits, you must have a qualifying life event (listed above) and have earned more than $2,500 over the previous year for work performed in Colorado. Applications must be submitted in advance unless the leave is unexpected or an emergency. Once submitted, your employer will receive a notification that gives them the opportunity to deny a claim based on fraud.

[Important Note: Unemployment Insurance fraud claims were rampant during the pandemic, and often an employee may not have applied for benefits, but a nefarious actor may have applied and received money that an employee later had to pay taxes on. So, while the employer notification may seem a bit odd, it is truly to protect everyone involved.]

Once the claim is approved, the employee will receive a notification that will include the leave start date, duration, and information regarding any denied benefits.

Covered employees are eligible to take up to 12 weeks of paid family and medical leave per year. If you have a serious health condition caused by pregnancy complications or childbirth complications, you are entitled to up to 4 more weeks of paid leave per year for a total of 16 weeks.

You don't have to take all of the leave at once and can opt to take leave intermittently or arrange a reduced work schedule with your employer.

Glad you asked! If you are a current client, feel free to reach out to us and we will be sure to set you straight. As you know, we don't bill by the hour, so a phone call will cost you absolutely nothing and will probably help you sleep better at night.

If you are not a current client and would like to be, feel free to book a call with us. We'd love to meet you!

Not ready to work with us? No worries, check out the resources below:

PDF: 2023 FAMLI Program Notice

PDF: An Employer’s Guide to FAMLI

PDF: Administrator Fact Sheet

PDF: 2023 Employee Guide to FAMLI

Webinar: Understanding FAMLI and Employer Obligations

Calculator: Premium and Benefits

Want to use Gusto? Click here to use our affiliate link and get a $100 Visa gift card just for signing up.

Welcome to our guide on setting up a Colorado My FAMLI+ account for employers. My FAMLI+ is a program created by the state of Colorado that...

As businesses continue to embrace remote work arrangements, navigating the complexities of remote employee payroll tax compliance has become a...

.png)

Hiring your first employee can be a daunting experience. After all, you’re responsible for not only finding the right person to fill an important...