1 min read

Mastering GAAP Accounting Principles for Small Businesses

GAAP Accounting, or Generally Accepted Accounting Principles, is a crucial framework that governs corporate accounting and financial reporting in the...

6 min read

Enzo O'Hara Garza

:

Updated on August 29, 2025

Do you want to improve how well your business is doing? Using common size financials can help! Common size financial statements are a powerful tool that can help you understand and optimize your business. By utilizing common size financial statements, you can analyze trends in your company's data, calculate key ratios for decision making purposes, forecast future performance of the business and more.

Common size financial statements are an essential tool for assessing business performance. They reveal key insights into a company's financial standing, enabling managers and investors to make better decisions. These statements express every item in a statement as a percentage of total assets or sales, rather than actual dollar amounts. This eliminates the impact of size on financial figures and enables comparisons between companies of different sizes. With common size financial statements, users can draw valuable conclusions about a business's financial health, regardless of its scale.

Income Statements are one type of common size financial statement that shows how much revenue was generated from sales, what expenses were incurred, and what profits were made after deducting expenses from revenues. By expressing income statement items as percentages rather than actual dollar amounts, it is easier to compare companies across industries and identify trends in their operations over time.

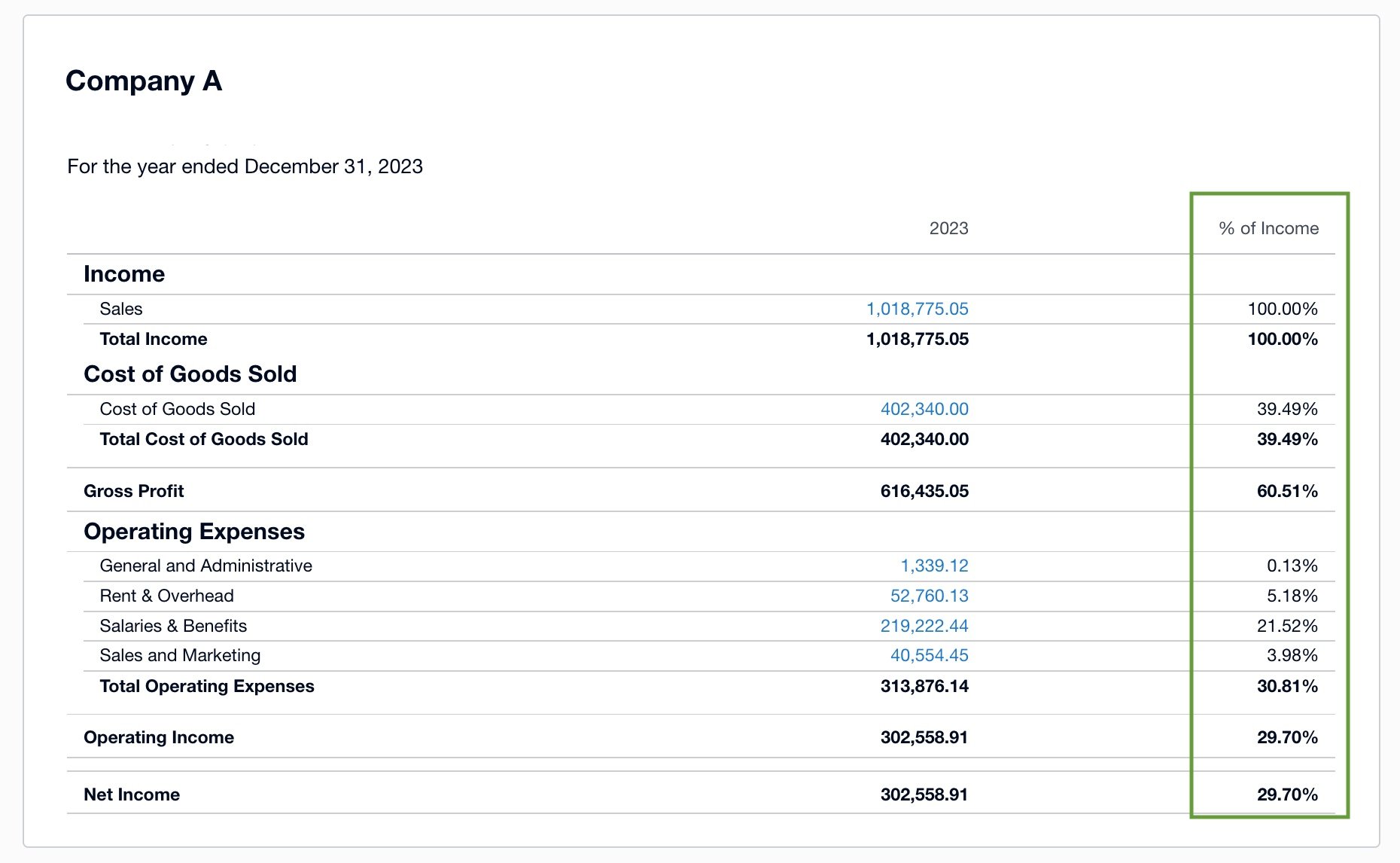

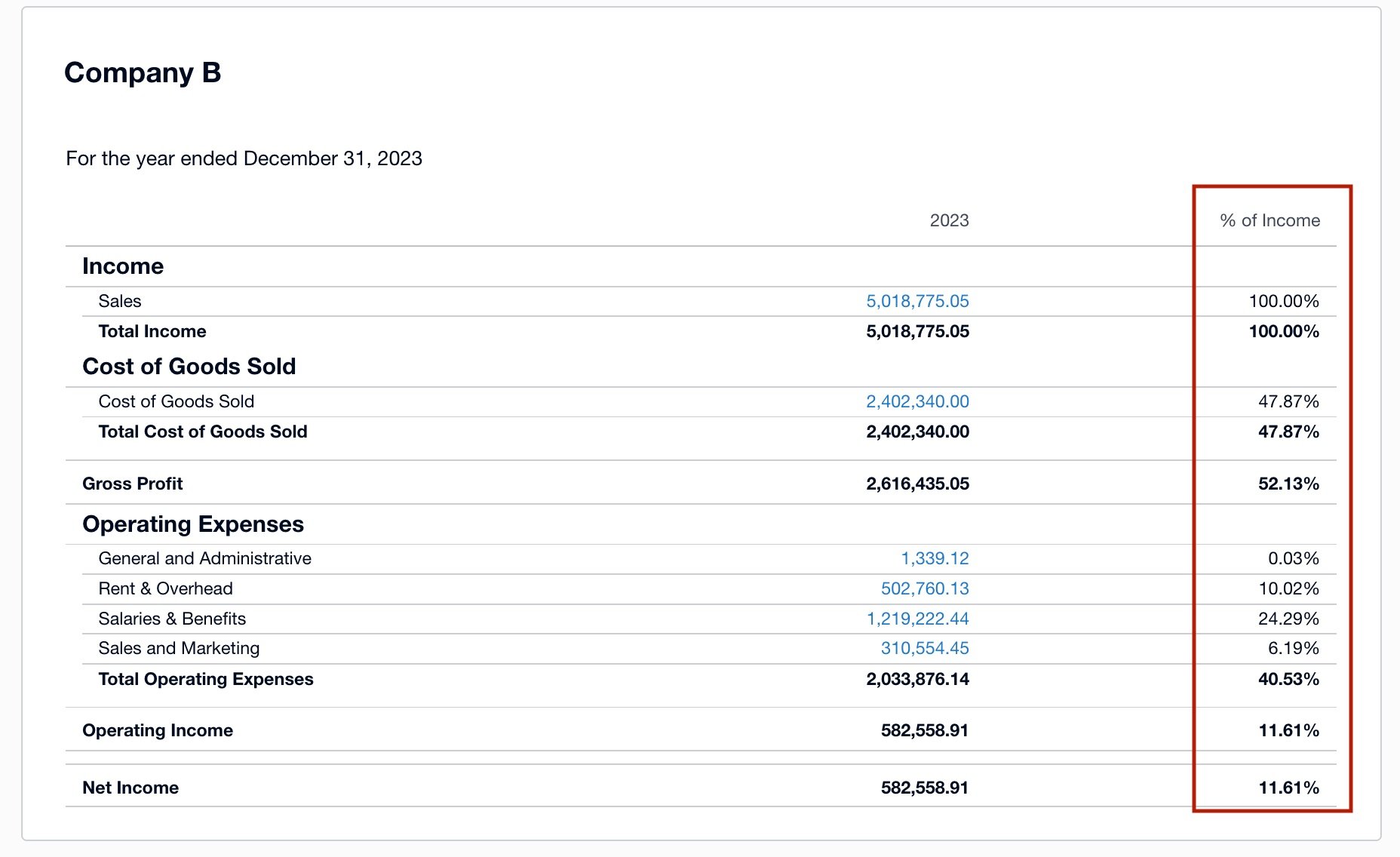

Below you can see that Company A earns less income that Company B. However, if you compare Company A's performance to Company B's, Company A has healthier financials. If Company A were able to scale to Company B's size, they would outperform Company B and have more staying power.

Investors can also use common-size financial statements to evaluate a company's optimal capital structure and its ability to meet future obligations. By examining ratios such as debt issuance costs compared to capital expenditures or operating cash flow versus debt repayment obligations, investors can gain a deeper understanding of their investments. These ratios help investors identify trends in operations over time, regardless of the industry or company size. With this knowledge, investors can make better investment decisions based on a company's financial performance and position

Cash Flow Statements show how a company's cash holdings change due to different activities, like operating (e.g., money received from customers), investing (e.g., buying/selling investments), and financing (e.g., repaying loans). When expressed as percentages rather than dollar amounts, these statements can help us analyze profitability margins for each activity over multiple periods. By doing this, we can measure the effectiveness of management teams' efforts to optimize processes and increase efficiency during those periods. In short, cash flow statements can provide valuable insights into a company's financial health and the success of its management strategies.

Common-size financial statements are an important tool for analyzing your business. These statements help you measure your company's performance compared to other businesses in your industry and identify trends over time. By looking at common-size financial statements, you can learn about profitability and efficiency ratios, which can help you make informed decisions about your business operations. This can lead to better financial outcomes for your company and help you stay competitive in your market.

Identifying Trends in Performance Over Time

Common-size financial statements provide a snapshot of how your company is performing at any given moment by breaking down each component into its relative percentage of total revenue or expenses. By utilizing common-size financial statements, it is possible to observe fluctuations in performance over the course of time and detect any prospective issues or chances for growth. For example, if sales have been steadily increasing but costs have been rising faster than sales revenues, this could indicate a need for cost cutting measures or increased efficiency initiatives.

Common size financial statements also enable comparison between different companies within the same industry or across industries. This can be useful when evaluating competitors’ pricing strategies or making strategic decisions about where to invest resources and energy going forward. By comparing various components such as net income margin and return on assets (ROA), you can quickly determine which areas are underperforming relative to the competition and adjust accordingly.

Common size financial statements also help assess profitability and efficiency ratios such as gross profit margin (GPM) and operating expense ratio (OER). GPM indicates how much money is left after subtracting direct costs from total revenue, while OER reflects how efficiently a company is using its resources by measuring operating expenses against total revenue generated during the period being analyzed. These metrics can provide important clues about whether investments are paying off or if further optimization efforts may be needed in order to maximize profits moving forward.

By using common-size financial statements, businesses can gain valuable insights into their performance over time and in comparison to other companies or industries. Despite their usefulness, common-size financial statements must be interpreted with caution due to certain limitations.

Common-size financial statements are a powerful tool for analyzing a company's financial position, but there are some important factors to keep in mind when using them to draw conclusions. In particular, the timing of fiscal year ends and differences in accounting policies can limit the usefulness of these statements for making accurate comparisons between companies.

Common-size financial statements are useful for quickly comparing companies’ performance, but can be misleading if two businesses have different fiscal year ends. For example, a company with a December 31st fiscal year end may report higher sales and profits than one with an April 30th fiscal year end due to the additional months of activity that would be included in its statement. As such, it is important to take into account differences in reporting periods when making comparisons between companies using common-size financial statements.

Companies also have some flexibility when it comes to accounting for inventory and assets on their balance sheets. Different accounting policies can result in inflated or deflated accounts, which could lead to inaccurate conclusions when using common-size financial statements as part of the analysis process. It is therefore essential that investors familiarize themselves with the various accounting principles used by each company before drawing any conclusions from the data presented on these types of reports.

Another limitation is that common-size financial statements may not be very useful for long term planning and forecasting since they only provide a snapshot view of current performance at one point in time. They don't take into account external factors such as economic conditions or competition which could significantly impact future results. Additionally, without being able to track the changes in relation between items on the statement, it is difficult to make accurate predictions about future outcomes.

Finally, there is always an element of human error when creating and interpreting these documents since calculations must be done manually and mistakes can easily go unnoticed if proper checks aren't put in place. For example, if a company fails to adjust for nonrecurring items like one-time expenses or gains then their analysis will likely lead them astray from making informed decisions about their business strategy going forward.

Despite the limitations of common-size financial statements, they can still be useful tools when used properly. By utilizing the right techniques when constructing and applying common-size financial statements, businesses can gain a more comprehensive grasp of their fiscal status and plan out their future with greater accuracy.

Small business owners can benefit greatly from software solutions that generate and analyze common-size financial statements. There are several options available, including cloud-based accounting software, spreadsheet software, customized reporting solutions, and automated data analysis tools.

For businesses seeking to access their accounts from anywhere with an internet connection, cloud-based accounting software is a convenient solution. This type of software allows users to track income and expenses in real time, generate reports quickly and easily, create invoices on the fly, manage payroll information securely online, reconcile accounts automatically every month or quarter, and more. It also integrates with other applications such as Xero or QuickBooks Online so you can sync up your bank account activity with ease.

Spreadsheet software like Microsoft Excel, Google Sheets, or Rows is another popular choice for creating common-size financial statements. With these programs you can enter data into cells manually or import it from external sources such as databases or other spreadsheets to create detailed charts and graphs that provide insight into your company’s performance over time. By utilizing formulas to calculate ratios such as gross profit margin, one can gain a more comprehensive understanding of their company's efficiency compared to other industry players.

Customized financial reporting solutions Like Fathom or Spotlight Reporting, give companies with the ability to adjust their reports according to pre-determined objectives, allowing them to get a head start on the fiscal year. These systems give users full control over various aspects of their report including layout design (elements like font size/style), data filters (selecting only certain types of transactions) , sorting criteria (by date range etc.), formatting options (colors/shading etc.) ,and more depending on what features are available in the chosen solution. This makes it much easier for companies to get exactly what they need from their reports without having invest time and energy piecing together complex documents manually.

Common size financial statements provide an effective way to analyze your business performance, identify trends in the market, calculate ratios for decision making and forecasting. By leveraging our services you can easily optimize your business operations with common size financial statements and gain a competitive edge in today's rapidly changing economy. By having our specialists at your disposal, you can make educated choices based on reliable information that will assist in propelling your small business to success.

1 min read

GAAP Accounting, or Generally Accepted Accounting Principles, is a crucial framework that governs corporate accounting and financial reporting in the...

Cash flow forecast is an important part of financial planning for any business. By utilizing a cash flow forecast, businesses can gain insight into...

As a business owner, it's essential to understand and calculate your burn rate. Understanding this metric is critical for gauging the fiscal health...