Burn Rate Multiple: A Must-Know Metric for Business Owners

As a business owner, it's essential to understand and calculate your burn rate. Understanding this metric is critical for gauging the fiscal health...

6 min read

Enzo O'Hara Garza

:

Updated on August 29, 2025

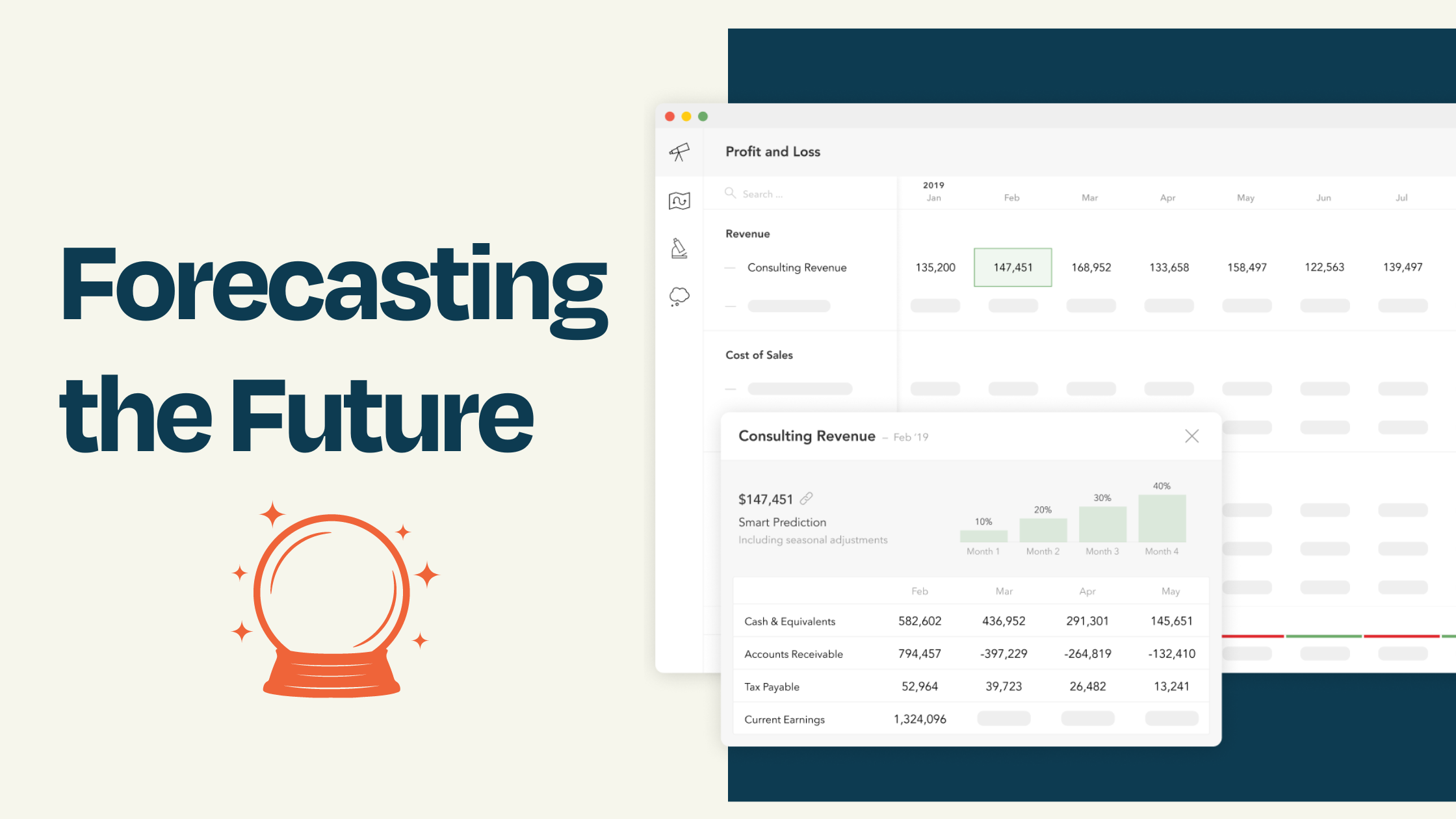

Cash flow forecast is an important part of financial planning for any business. By utilizing a cash flow forecast, businesses can gain insight into their money's movements and make informed decisions about investments, debt repayment strategies, and budgeting. With a comprehensive cash flow forecast in place, businesses can identify potential cash shortages before they occur and plan accordingly. By monitoring performance regularly with a detailed cash flow forecast, businesses are better equipped to handle unexpected expenses or changes in market conditions that could impact profitability. Learn more about why creating an accurate cash flow forecast is so important for small business success.

Cash flow is crucial for any organization, and understanding it is essential for achieving success. By knowing your cash flow, you can plan for the future and make informed decisions about managing your finances effectively.

Cash flow forecasting is an essential tool for managing your cash flows. It involves predicting when money will come in (cash inflows) and go out (cash outflows). This helps you identify potential shortfalls before they occur so that you can take corrective action or secure additional financing if necessary.

The forecasting process starts with creating a budget based on past performance, expected sales revenue, expenses, capital expenditures, and debt repayment schedules, and then using this information to project future income and bank balances. You’ll also need to factor in working capital such as accounts receivable/payable balances, and credit sales terms, as well as other investing activities such as new equipment purchases or debt reduction plans.

You should review your cash flow forecast regularly – at least once a month – so that you can adjust for changes in circumstances like customer payment delays, increases in vendor costs, or unanticipated bills arriving. Having accurate data from which to draw insights is key here; consider automating processes like invoicing where possible so that all transactions are tracked accurately within one system rather than relying on manual input into multiple bank accounts.

Understanding the cash flow of your organization is essential for ensuring its success. Identifying potential cash shortages in advance will help you plan for them and prevent costly financial issues down the road.

Cash flow forecasting is an essential tool for small business owners. It helps identify potential cash shortages before they occur, allowing you to take corrective action. By understanding your cash inflows and outflows, you can accurately predict when a shortage may arise and plan accordingly.

To begin the cash flow forecasting process, it is necessary to construct a financial statement that reveals all income sources and expenditures over an established timeframe. Analyzing the amount of cash entering and leaving your business can be done by creating an income statement (hint: Xero is great for this) that shows all revenue sources as well as expenses over a certain period. Once this information has been collected, it’s important to look at any trends or patterns that might be occurring within the data. For example, if sales are down during certain months or if there are unexpected costs that have arisen throughout the year. Identifying these issues early on can help prevent future problems from arising and provide insight into what strategies need to be implemented in order to improve overall financial performance.

Finally, businesses may want to consider making payments ahead of schedule if your vendors offer prepayment discounts, which will reduce your overall invoice and increase your bottom line. However, if prepay discounts aren't offered, aligning your clients' payment terms with your vendors' payment terms will allow you to not play bank for your clients while your vendors are waiting to get paid.

A cash flow forecast is a powerful tool to help manage debt repayment. It enables you to pinpoint precisely when payments are expected and the amount of money available for them. Cash flow forecasting helps identify any potential cash shortages, so you can plan ahead and make sure your business has enough funds on hand to pay its debts.

Alternatively, by tracking your cashflow ahead of time, you may find that you have a cash surplus that will allow you to pay back debt more quickly without jeopardizing your ability to pay your other bills. By utilizing a dependable cash flow forecasting process, businesses can stay ahead of their finances instead of playing catch up after it is too late.

Managing debt repayment is essential for small businesses to ensure that cash flow remains positive and financial obligations are met. Tracking company performance can provide a clearer picture of the fiscal well-being of your business and help you decide how to optimally utilize available funds.

Unexpected outlays can be a major hit to your business's finances, but with cash flow forecasting you can plan for them beforehand and reduce their influence on your profit. Cash flow forecasting is an essential tool for small businesses looking to stay ahead of the curve when it comes to unexpected costs. By predicting how much money will be coming in and going out each month, you can plan ahead and ensure that there are enough funds available to cover any surprise expenses that may arise.

Identifying possible sources of funds, like sales or client payments, is the initial step. Then calculate the expected cost of operating expenses like payroll or rent. This will give you an estimate of what kind of cash balance you should aim for each month. To further improve accuracy, consider factoring in seasonal fluctuations or other one-off events like holidays which could affect your incoming funds or outgoing costs.

Once you’ve identified these key elements, set up a system to track progress against expectations so that if something changes unexpectedly – such as new customers making large orders – then this information can be taken into account quickly and accurately. Having access to real-time data allows business owners to respond swiftly by either increasing production capacity or cutting back on unnecessary expenditure where appropriate; both actions help keep cash flow healthy even during times of increased demand or unexpected outlays respectively.

A smart approach is to set aside some money in your budget as a contingency, which can often prove beneficial. Having a well-structured budget also helps anticipate any additional costs associated with running a business such as taxes due at the end of the year or extra staff wages required during busy periods, being aware means that these items don’t come as unwelcome surprises later down the line.

Being ready for unanticipated costs can help you stay in control of your funds and make prudent choices. Boosting your revenue can assist in fortifying your money flow conjecture and equip you to tackle any potential monetary difficulties that may arise.

By understanding cash flows, you can identify opportunities to maximize returns on investments and make better financial decisions. Estimating future money entering and exiting from operational, investment, and financing activities over a given timeframe is the basis of cash flow forecasting.

To generate an exact plan, it is essential to be familiar with the parts of your firm's balance sheet and income statement. For example, you'll need to consider accounts receivable (credit sales), accounts payable (make payments), inventory levels, capital expenditures (investing activities) as well as interest payments and debt reduction (financing activities). Once these items are identified they should be tracked in detail over time so that changes can be monitored accurately.

The next step is to use this data along with any additional assumptions or estimates such as expected sales growth or cost increases in order to project the total amount of money coming into the business versus going out each month. This can offer insight into the capital available for utilization, aiding in decisions on budgeting and big purchases like equipment or personnel.

Forecasting allows you to understand your financial situation and identify areas where improvement can be made. Cash flow forecasts also help you prepare for unexpected expenses and monitor the performance of your business so that you can make informed decisions about how to increase profitability. By implementing effective cash flow forecasting, companies can remain competitive and ensure their long-term success in today's market.

Take control of your business's cash flow with Accountingprose. Our comprehensive cash flow forecasts can help you forecast and optimize the financial performance of your small business.

As a business owner, it's essential to understand and calculate your burn rate. Understanding this metric is critical for gauging the fiscal health...

1 min read

Running a startup can be simultaneously thrilling and terrifying. The rush of bringing novel ideas to life, the challenge of building a team from the...

Do you want to improve how well your business is doing? Using common size financials can help! Common size financial statements are a powerful tool...