Complete Guide to SaaS Accounting: Strategies for Financial Success

If you’re running a SaaS company, you already know that managing finances isn’t as straightforward as it is for traditional businesses. The...

5 min read

Enzo O'Hara Garza

:

Updated on June 14, 2024

As a business owner, it's essential to understand and calculate your burn rate. Understanding this metric is critical for gauging the fiscal health of your organization and can help you make educated choices about budgeting and cost-saving possibilities. Calculating burn rate helps identify how much cash flow you have available in relation to expenses, allowing you to adjust spending habits accordingly.

Burn rate is a term used to describe the amount of money a company spends in comparison to its revenue. It’s an important metric for any business, especially those with limited resources or that are growing quickly. Burn rate multiple (BRM) is the ratio between burn rate and total cash on hand. Realizing your burn rate in correlation to your available funds can help you manage and decide how much money should be spent every month.

Burn rate is a crucial figure for small companies to be aware of, as it can provide insight into their fiscal well-being and pinpoint potential savings. The burn rate is the amount of cash spent in a given period, usually monthly or annually. It’s calculated by subtracting any revenue generated from total expenses incurred during that time frame.

To calculate your burn rate multiple (BMR), divide your current operating costs by the projected revenue for that same period of time. This will give you an insight into the proportion of outlay to income.

For example, if your current operating costs are $10,000 and projected revenue for that month is $15,000 then your BMR would be 0.67 ($10K/$15K). A low BMR indicates healthy financials while a high BMR could mean trouble down the road if not addressed quickly enough.

Burn rate is an important metric to track for all businesses, but is especially important for those businesses who have received investor funding. Reporting on this metric at least quarterly, but more often monthly, is expected when delivering financial results to investors and board members.

Start by categorizing all expenses into fixed and variable categories; fixed costs are those which remain consistent from month-to-month such as rent or loan payments while variable costs fluctuate depending on usage like utilities or payroll taxes. From there, look for ways to reduce these expenses such as renegotiating contracts with vendors or switching suppliers if possible - every little bit helps. Additionally, review any services or subscriptions that may be unnecessary and consider canceling them if they’re not providing value for their cost. By identifying cost-saving opportunities, you can make the most of every dollar and maximize profits for long-term success.

Identifying cost-saving opportunities is a key part of managing your burn rate and improving profitability. To ensure that you are getting the most out of your budget, it’s important to analyze all areas of spending and identify any potential savings.

Start by assessing each expense individually. Take a close look at how much money is being spent on labor, materials, services, equipment rentals, etc., and determine if there are ways to reduce costs without sacrificing quality or productivity. Consider alternatives such as outsourcing tasks or renegotiating contracts with vendors for better rates. You may also want to explore options like bartering services with other businesses in exchange for goods or services that you need.

Look into automating processes wherever possible as well; this can save time and money while reducing errors associated with manual data entry or paperwork processing tasks. Make use of automation solutions available for various business operations, such as payroll and CRM software, to maximize efficiency while minimizing errors. Additionally, consider investing in energy-efficient equipment which can help lower utility bills over time.

Finally, review your existing insurance policies regularly to ensure they’re still meeting the needs of your business while providing adequate coverage at an affordable price point. You may be able to negotiate discounts based on length of service or find more competitive rates elsewhere if needed; just remember not skimp on coverage when trying to cut corners.

By identifying cost-saving opportunities, you can begin to adjust your budget accordingly and make sure that your small business is running as efficiently as possible. By revising the budget in line with identified cost-saving measures, it is possible to maximize profits and ensure that all resources are being employed effectively.

It’s essential to adjust your budget accordingly when there are changes in revenue or expenses. This will help you stay on track with your financial goals and ensure that you don’t overspend. To do this, start by analyzing the spending habits of your business. Take a look at where most of the money is going and what areas could be cut back on. Examine if a large portion of your resources are being allocated to marketing activities, and contemplate whether it would be wise to reduce these expenses and divert the funds elsewhere, like towards wages or product advancement.

Once you have identified potential cost-saving opportunities, calculate your burn rate multiple (BRM). BRM measures how much cash flow is needed for operations each month compared to total monthly costs associated with running a business like salaries, rent/mortgage payments, taxes etc Knowing this number can help inform decisions about where best to allocate resources so that all necessary expenses are covered without breaking the bank.

When adjusting your budget it's important not to forget about taxes. Make sure that any sales tax owed is accounted for and paid in full each quarter - failing to do so can result in costly penalties from the IRS or state government agencies. Additionally, it may be beneficial to set aside some funds specifically for future tax payments throughout the year rather than waiting until April 15th rolls around again.

By utilizing accounting software, like Xero, businesses can benefit from improved efficiency and organization of their financial data. Xero can facilitate the streamlining of procedures, resulting in time and cost savings. Xero accounting software can also help keep track of all financial data in one place for easy access and analysis.

For example, with accounting software you can set up automated payments to vendors or employees so that they get paid on time without having to manually enter each transaction into your system. You can also easily monitor cash flow by setting up alerts when bills become due or tracking spending habits over time. This helps ensure you don't miss any important payments or overspend on unnecessary items.

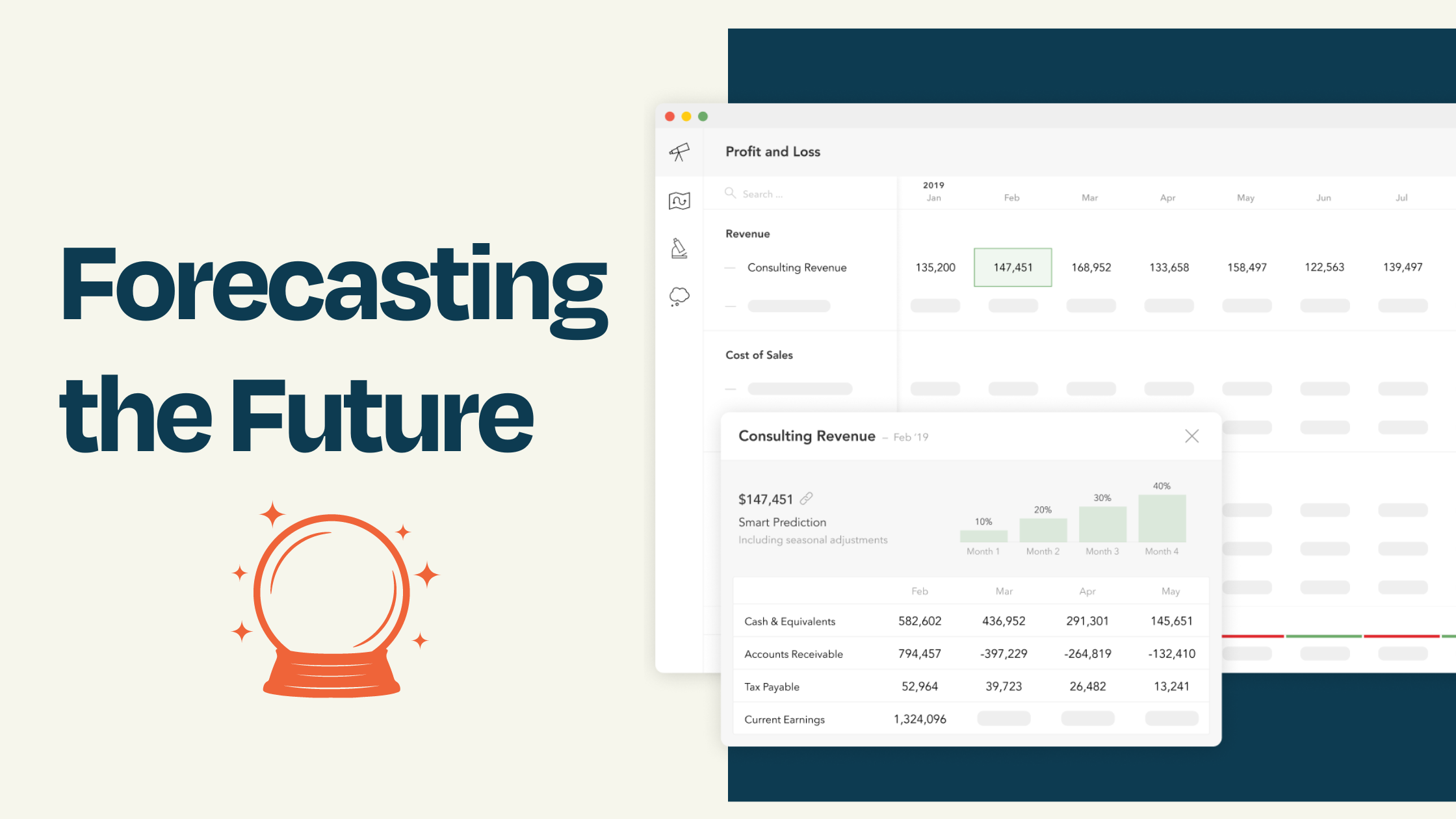

Additionally, Xero allows you to create budgets and forecasts more accurately than ever before. With the data available, it's simpler than ever to adjust your budget in line with alterations in income or outgoings throughout the year. Keeping an eye on these trends can enable you to decide more wisely where resources should be allocated in your company and anticipate potential issues ahead of time.

In conclusion, it is important to calculate your burn rate multiple in order to identify cost-saving opportunities and adjust your budget accordingly. Utilizing accounting software can aid in monitoring expenses and assessing the fiscal condition of a business. Taking proactive steps now will ensure that you are prepared for whatever lies ahead in the future as far as costs go. Calculating burn rate multiple gives businesses an insight into their spending habits which helps them make more informed decisions about how they allocate resources going forward.

Let Accountingprose LLC help you manage your business finances with our cost-effective services. Streamline your accounting, payroll and sales tax processes to maximize efficiency and save money today!

If you’re running a SaaS company, you already know that managing finances isn’t as straightforward as it is for traditional businesses. The...

Cash flow forecast is an important part of financial planning for any business. By utilizing a cash flow forecast, businesses can gain insight into...

1 min read

Running a startup can be simultaneously thrilling and terrifying. The rush of bringing novel ideas to life, the challenge of building a team from the...