Colorado 2025 Sales Tax Guide

Navigating sales tax can be daunting for any small business owner, especially in a state like Colorado with its unique rules and local jurisdictions....

Colorado's new mandatory retirement program, called the Colorado SecureSavings Program, goes into effect in January 2023. Learn more about the specifics of this program, including who it will affect, what kind of savings can be expected, and how employers and employees should prepare for the upcoming changes.

Did you know that approximately 40% of Colorado's private-sector workforce, nearly 940,000 workers, do not have access to a retirement saving program a work? Social Security alone won't be enough to retire, so Colorado has taken steps to ensure its citizens have a secure retirement by enacting the Colorado SecureSavings Program (HB17-1290).

This program, which goes into effect in January 2023, requires employers to provide their employees with an opportunity to save for retirement. It is designed to help Colorado residents prepare for the future and ensure they have financial security when they reach their golden years, without creating a financial burden on the employer and its employees.

In this blog, we will cover the most common questions that we have received from our clients.

Let's get started...

Not every business must register and enroll employees into this state-mandated retirement program, In fact, businesses must meet these criteria in order to participate in this program:

Your business is registered to conduct business in the state of Colorado

You have at least five W-2 employees who have worked for you for at least 180 days

You have been in business for two or more years; and

You don’t currently offer a qualified retirement savings program to your employees

This is probably the biggest question we have had from our clients, especially as many businesses have struggled to make it through the pandemic and beyond. Thankfully, the State of Colorado has made it easy to participate in this program, without breaking the bank.

This program is designed to help employees establish a financially secure future with easy, automatic payroll contributions to a Roth IRA. Colorado SecureSavings is an added benefit to offer and comes at no cost to employers.

Yes. If you have a qualified employer-sponsored retirement plan, you can apply for an exemption.

What is a qualified, employer-sponsored retirement plan?

Traditional pensions, a 401(k) plan, a 403(b) plan, a SEP Plan, and SIMPLE IRA plan are all examples of qualified employer-sponsored retirement plans. The full list of plans is located here.

As the plan sponsor, you have no fiduciary responsibility. That means there is absolutely zero risk to you in regard to any investment decisions or outcomes of employees that take part in this program.

You are not authorized to make matching contributions as a part of this program. Such contributions are explicitly forbidden, and your only role is to facilitate this program for your employees.

This clearly laid out in the Program Rules.

Employee participation is voluntary. Your employees have 30 days to opt out once you, the employer, add them to this program. If they do not opt-out they will automatically contribute 5% of their gross wages, which can be adjusted at any time. If an employee opts out and changes their mind, they can rejoin the program at any time.

Colorado SecureSavings has an annual asset-based fee of approximately 0.32%, which means your employees will pay roughly $0.32 for every $100 in their accounts.

There is also a $22 annual account fee which is charged quarterly at $5.50 each quarter.

These fees pay for the administration of the program and the operating expenses charged by the underlying investment funds in which the program’s portfolios are invested.

Colorado SecureSavings will be fully available across the state in early 2023. When it’s time, the State of Colorado will send you an invite and reminder via email or mail. You will simply enter your EIN and the Access Code that Colorado SecureSavings sends you and voila– you're in!

If you haven't seen anything from the state yet, don't worry.

The expected deadlines to register are:

Employers with 50 or more employees: March 15, 2023

Employers with 15 to 49 employees: May 15, 2023

Employers with 5 to 14 employees: June 30, 2023

You can call 1-844-692-1073 to check in about when you will receive your notification.

Essentially you will need to follow this process:

|

When |

What you need to do |

|

No later than 30 days after you get your notice |

Set up your online account |

|

When you set up your online account |

Complete the Employer Onboarding flow, including: 1. Adding your payroll information 2. Connecting your company bank account 3. Adding your latest employee roster and accompanying personal information (employee name, contact info, date of birth, SSN, etc.) 4. Finishing any other required steps |

|

30 days after you complete the onboarding steps |

1. Update employees’ deferral savings rates in your payroll system 2. Submit your employee contribution amounts with your next payroll. |

|

Ongoing for each pay period |

Continue submitting contributions, maintaining employee deferral changes, and keep your employee roster up to date |

If you use Gusto to process your payroll, it is super easy to find all of the information you need.

First, log into your Gusto account.

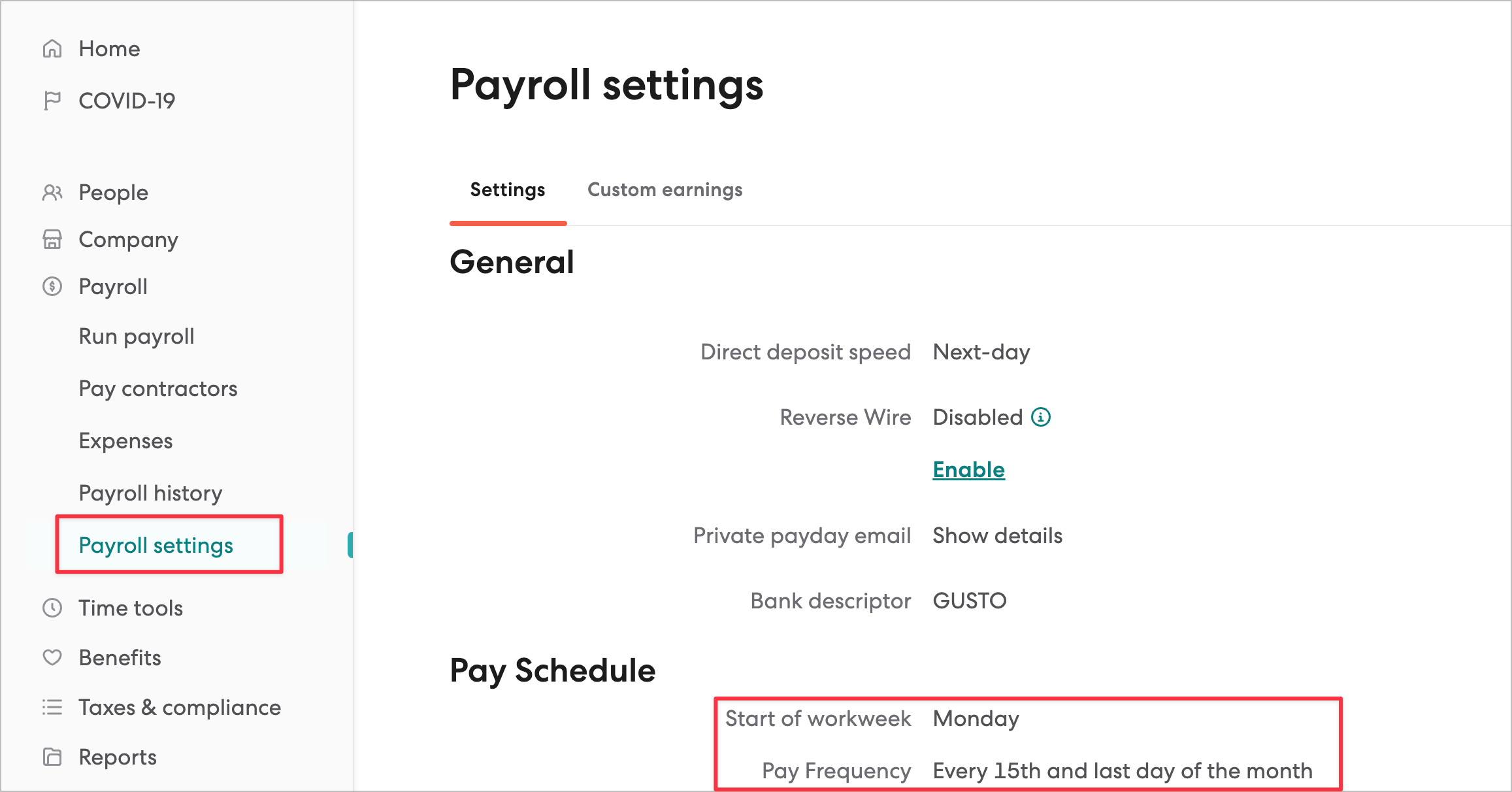

Next, go to the left sidebar and select Payroll Settings.

Under Pay Schedule, you will find your Pay Frequency.

In this example, the pay dates are the 15th and last day of each month, which means the frequency is semi-monthly.

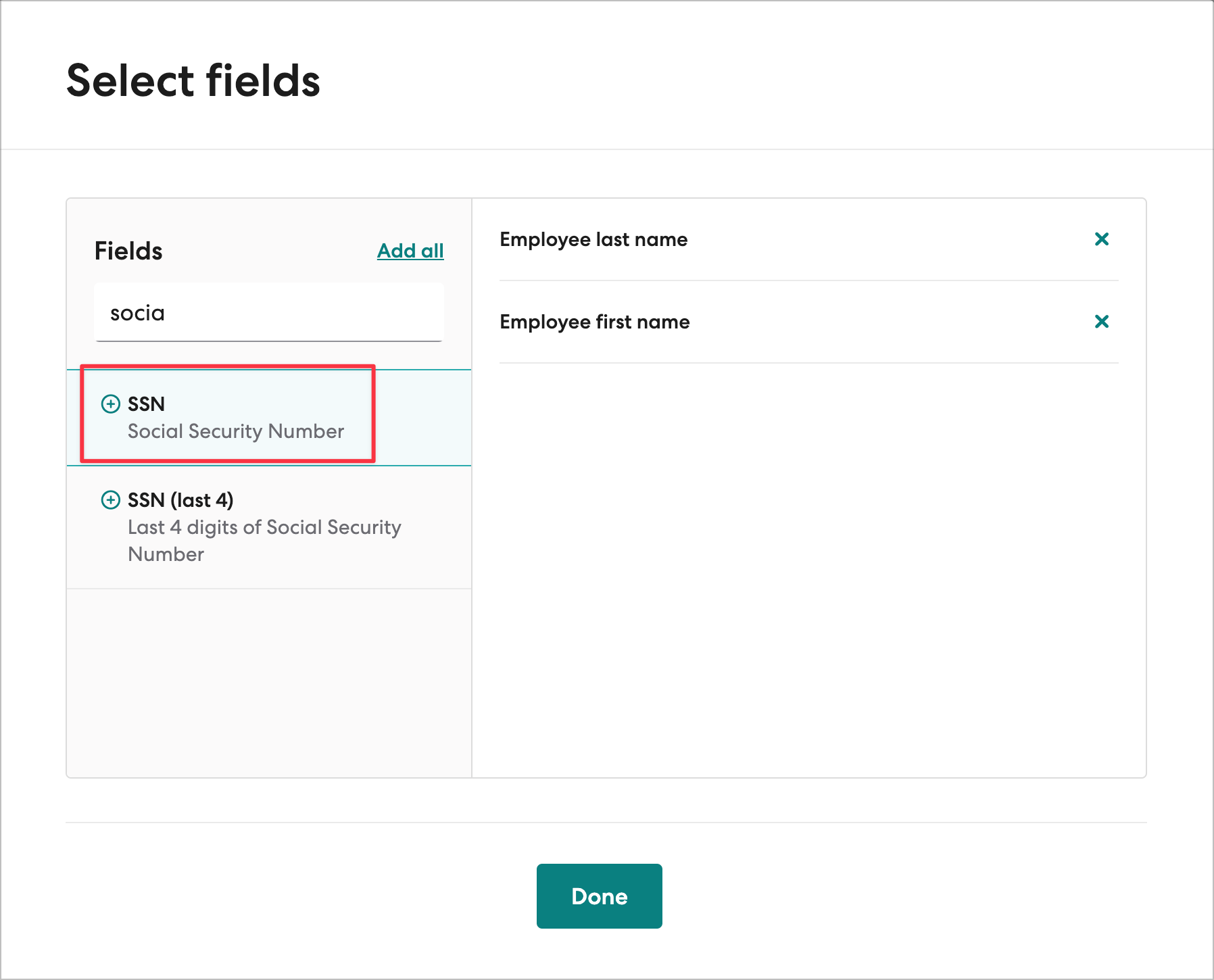

You will also need your employee's information, including their employee name, contact info, date of birth, and social security number,

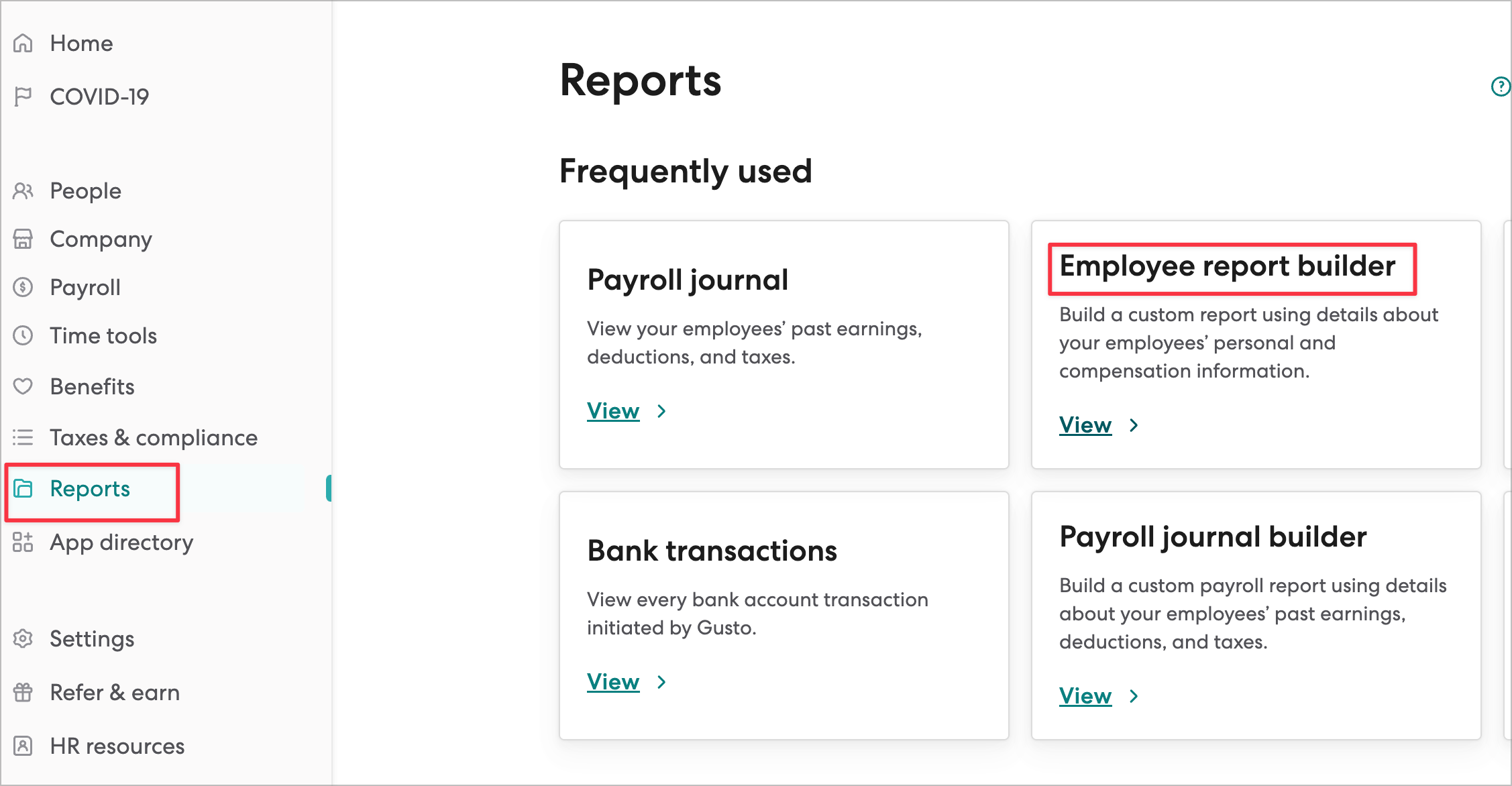

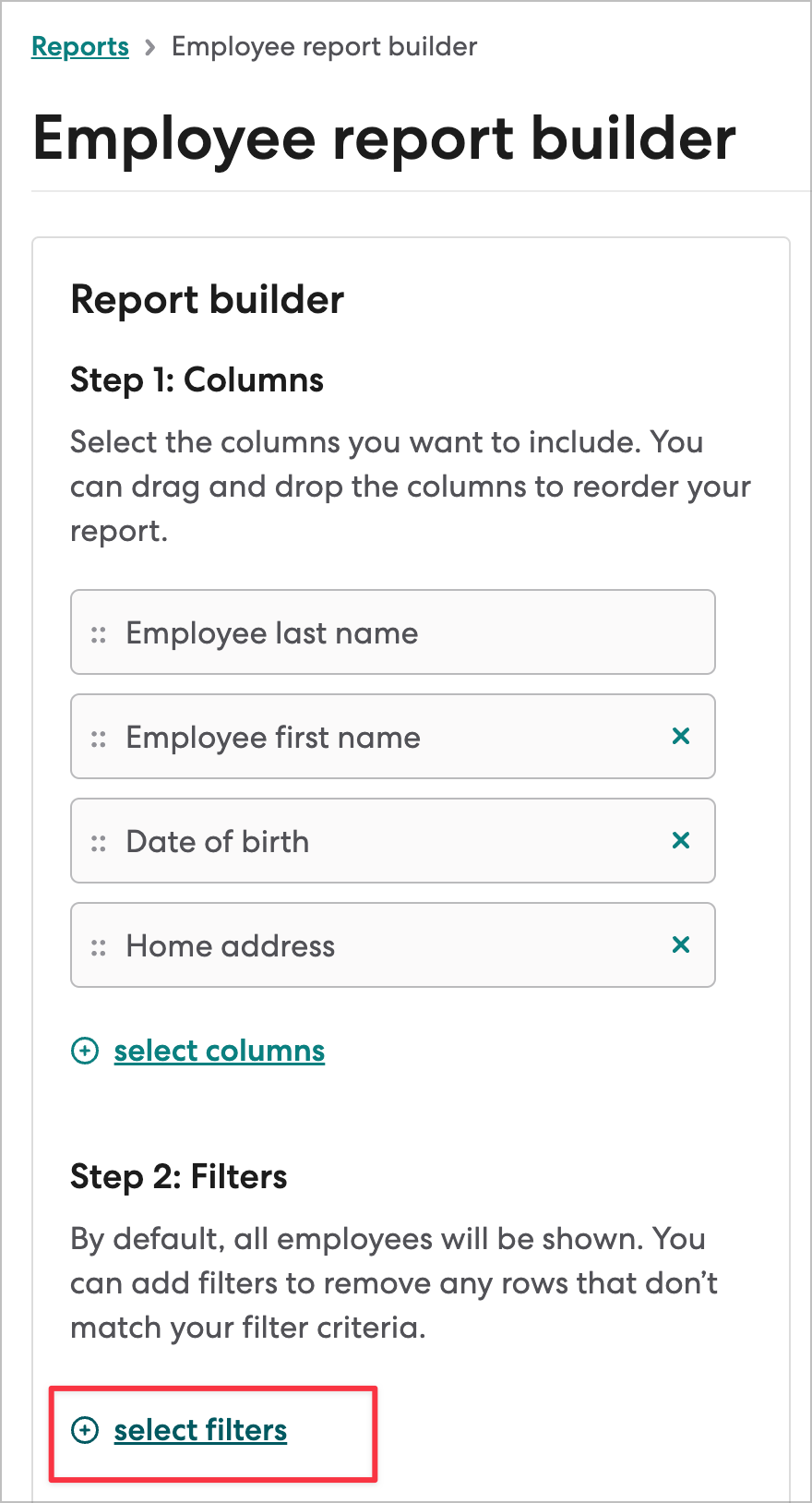

Go to the left sidebar and select Reports

Then select Employee Report Builder.

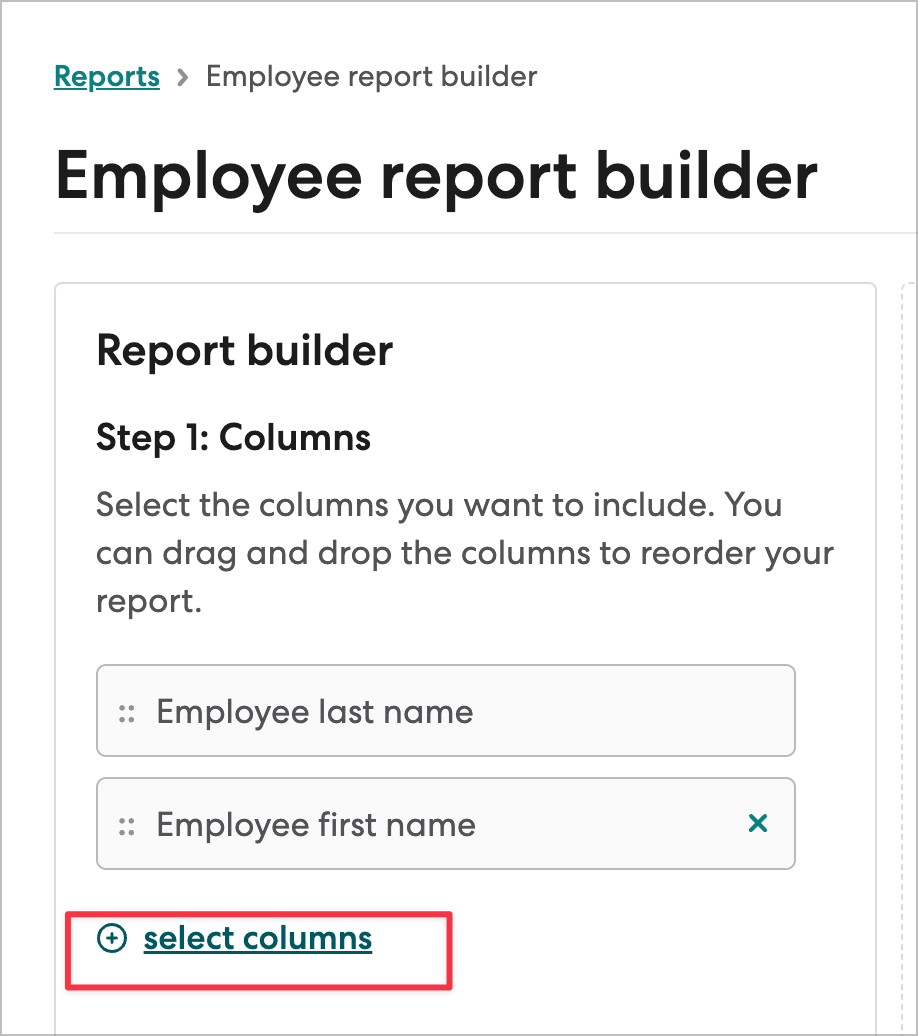

Within the Employee Report Builder, click on +Select Columns.

Here you can easily search for all of the details that the state will need.

When you've got all that you need, click Done.

Rather than pulling a report for every employee you've ever had, you should add a filter to only run a report that will display your active employees.

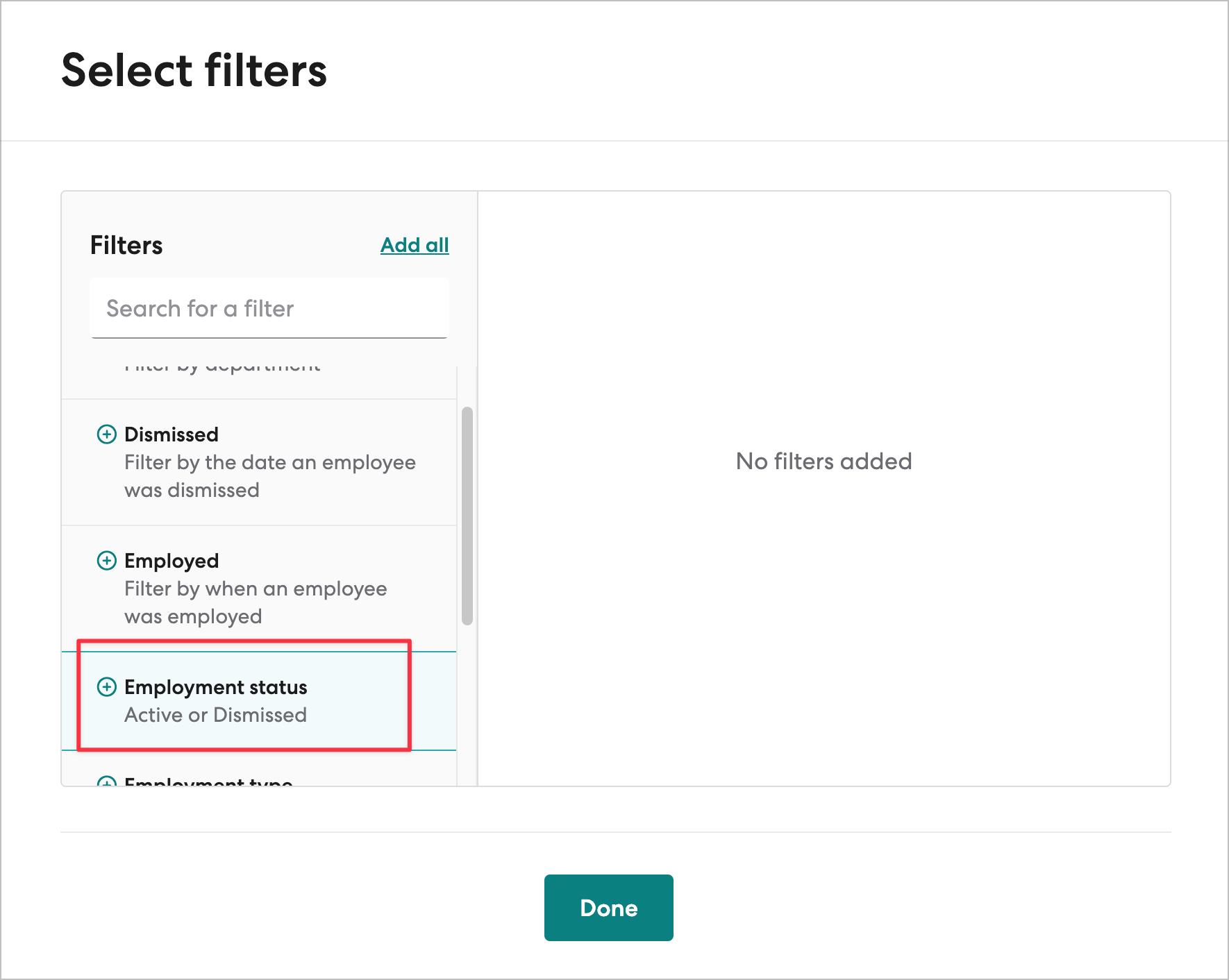

Click +Select Filters.

Next, choose Employment Status and then click Done.

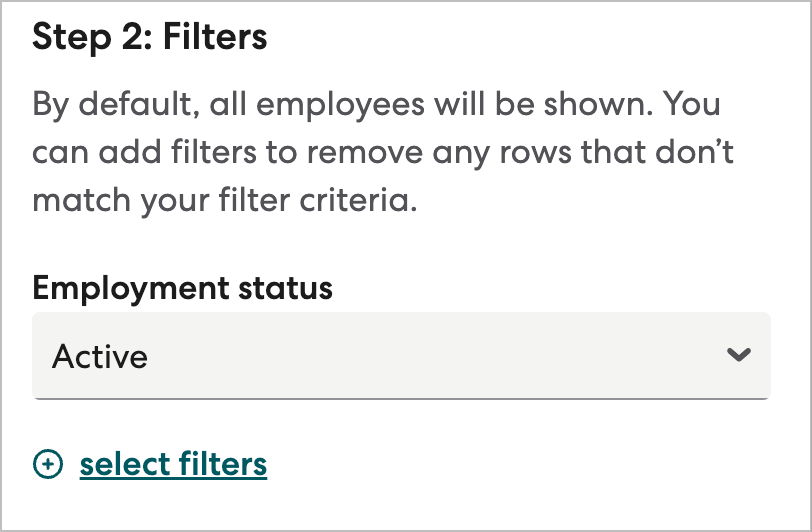

Be sure the dropdown is set to Active.

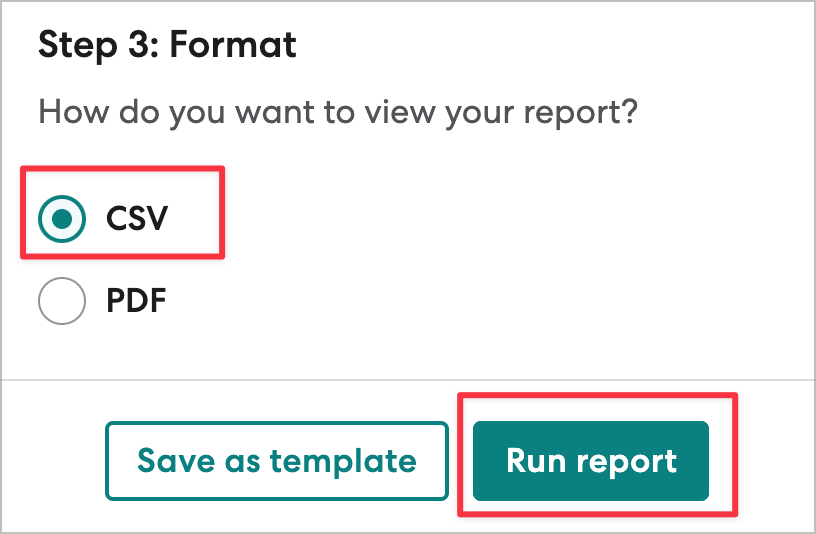

Finally, you should choose to download this information in CSV format to make it easier to upload the info to the state's site.

Unfortunately, since this is still a new program, even we haven't seen what this process looks like, but you should be able to upload a formatted CSV vs typing in data line-by-line. (fingers crossed)

Step 3 of the registration process is to update your employees’ deferral savings rates (the % they will have deducted from each check, each pay period) in your payroll system and submit your employee contribution amounts with your next payroll, but this is not automatic for many payroll systems yet.

Currently, the only integrated payroll partners are, Quickbooks Online, Heartland, Paylocity, and Payroll Specialties. Gusto is not listed as an integrated payroll company, and after speaking to our partner representative, this is not currently on their roadmap, so no one or two-way sync is available. Until Gusto notifies us that they plan to integrate, we must manually handle this manually for our current payroll clients.

This means we must:

Register new employees

Remove terminated employees

Update Gusto whenever an employee increased or decreases their payroll deferrals

Woof.

We hope that the state offers some sort of notification of changes so that no updates are missed, but again, this program is very new and we have not seen under the hood.

If you're anything like us, you want to have every resource available in order to manage benefit programs for your small business– especially those programs mandated by state law. These resources should help you sort out any lingering questions you might have.

If you are a current client, feel free to reach out to us and we are happy to hop on a Zoom call to discuss this program with you. Don't worry about racking up a big bill– we don't charge you by the hour, minute, or even second!

If you are not a current client and would like to be, feel free to book a call with us. We'd love to meet you!

Want to use Gusto to manage your payroll? Click here to use our affiliate link and get a $100 Visa gift card just for signing up.

Navigating sales tax can be daunting for any small business owner, especially in a state like Colorado with its unique rules and local jurisdictions....

%20(1).png)

The Colorado Paid Family Leave Act (FAMLI) is a game-changing law that provides eligible workers with up to 16 weeks of paid family leave for certain...

Welcome to our guide on setting up a Colorado My FAMLI+ account for employers. My FAMLI+ is a program created by the state of Colorado that...