Revolutionizing Accounting: Future with RPA & AI

AI, RPA, and other automated tech are transforming accounting, bringing increased precision, efficiency, safety, cost-savings and visibility. In...

As a small business owner, you wear many hats, but when it comes to managing your finances, it's crucial to understand the difference between bookkeeping and accounting. While both play a vital role in the financial health of your business, they serve distinct purposes.

Think of bookkeeping as the foundation of your financial story, recording daily transactions, while accounting is the analysis that helps you make sense of it all. In this article, we'll explore the unique roles of bookkeeping and accounting, how they work together, and why your small business needs both to thrive.

Join us as we clarify the essential roles of these financial tools and discover how they can help you make informed decisions, stay compliant, and drive your business forward.

Essential Takeaways

|

Bookkeeping and accounting are essential to any business's financial management, but they have distinct roles that contribute uniquely to the business's financial ecosystem.

Bookkeeping is the day-to-day process of recording transactions, categorizing them, and reconciling bank statements. This foundational work ensures that all financial data is systematically organized so that every dollar is accounted for.

At the heart of bookkeeping is managing the general ledger—a detailed record of all financial transactions, which is critical for accurate financial oversight and the preparation of financial statements. Tasks typically include managing the general ledger, processing payroll, and keeping track of all incoming and outgoing payments.

Learn more about when and why to hire a bookkeeper for your business.

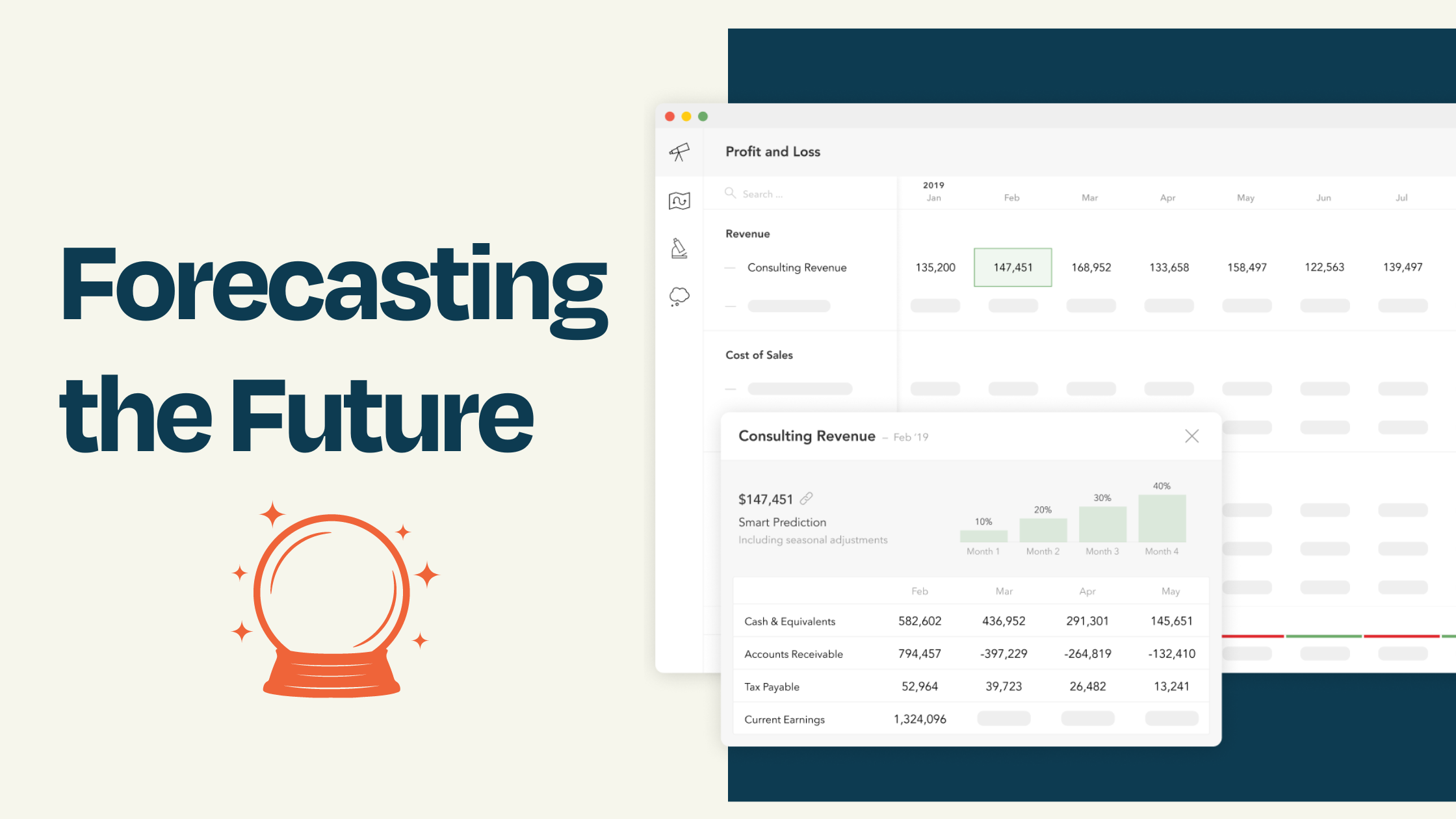

Accounting goes a step further by analyzing, interpreting, summarizing, and reporting the financial data collected by bookkeeping. Accounting turns data into valuable insights, providing forecasts for future business growth, identifying market trends, and supporting strategic planning.

Accountants prepare financial statements, assist with compliance, and help business owners understand the financial implications of their decisions. Explore basic accounting methods in our Beginner’s Guide.

Together, bookkeeping and accounting provide a comprehensive view of a business's financial health, enabling stakeholders to make informed decisions based on solid financial data.

Understanding how bookkeepers and accountants contribute to your business is important for effective financial management. Whether operating a nimble startup or a sprawling enterprise, these roles adapt to meet your company's needs.

Here, we examine how the responsibilities of bookkeepers and accountants can vary significantly depending on the size of the business.

In small businesses, bookkeepers might handle tasks such as recording daily sales and expenses, while the accountant may come in on a monthly basis to review financial statements, offer insights on cash flow management, and prepare for tax obligations

In contrast, a large corporation might employ a team of bookkeepers who focus solely on recording transactions across different departments. Meanwhile, their accountants analyze these entries to provide strategic advice to management, help in budgeting and financial forecasting, and ensure regulatory compliance on a larger scale.

The dynamic roles of bookkeepers and accountants are essential to the financial fabric of any company. By recognizing the specific needs of your business, you can better position these professionals to support your financial strategy and operational goals.

Small businesses often operate with limited resources, making it tempting to cut corners when it comes to financial management. However, investing in both bookkeeping and accounting services is crucial for the success and growth of any small business.

Bookkeeping ensures that a small business has accurate and up-to-date financial records, which are essential for compliance with tax laws and regulations. It also helps business owners monitor cash flow, manage expenses, and make informed decisions about day-to-day operations.

Accounting provides small business owners with a deeper understanding of their financial performance and position. By analyzing financial statements, accountants can identify areas for improvement, such as reducing costs or increasing revenue.

They can also provide valuable advice on financial planning, budgeting, and forecasting, helping small businesses set and achieve long-term goals.

When deciding whether to focus more on bookkeeping or accounting, small business owners should consider their stage of growth, financial needs, and strategic goals. For example, a startup may prioritize bookkeeping to ensure accurate record-keeping and compliance, while a growing business may benefit from more advanced accounting services to support strategic decision-making.

Factors to consider when choosing between bookkeeping and accounting services include:

The complexity of your financial transactions.

The size of your business and the volume of financial data.

Your industry and specific financial reporting requirements.

Your business goals and growth plans.

Your budget and resources.

When choosing the appropriate bookkeeping and accounting services, it's essential to align your selection with your business's specific needs and capabilities. By carefully evaluating these factors, you can ensure that your financial services are not only a perfect fit but also a robust foundation for your business's future growth and stability.

To assess your requirements and make an informed decision, consider the following steps:

Evaluate Your Current Financial Situation: Review your financial records, processes, and pain points to identify areas where you need the most support.

Define Your Business Goals: Determine your short-term and long-term objectives, and consider how financial management can help you achieve them.

Consult with Professionals: Reach out to financial service providers like Accounting Prose to discuss your needs and explore tailored solutions that align with your goals and budget.

Consider Scalability: Choose services that can grow and adapt with your business, ensuring that you have the right level of support at each stage of your journey.

Ultimately, the right mix of bookkeeping and accounting services will depend on your unique business needs. By taking the time to assess your requirements and consult with professionals, you can make an informed decision that supports your business's success.

Small businesses often face various challenges when it comes to managing their finances effectively. Some of these common challenges include:

Lack of Time and Resources: Small business owners often struggle to find the time and resources to keep accurate financial records while focusing on growing their business.

Difficulty Staying Organized: Keeping track of financial documents, receipts, and invoices can be overwhelming, leading to disorganization and potential errors.

Limited Financial Expertise: Many small business owners lack the financial knowledge and skills needed to make informed decisions and plan for the future.

Compliance Concerns: Navigating complex tax laws and regulations can be daunting, and small businesses may worry about staying compliant with various financial reporting requirements.

Cash Flow Management: Managing cash flow effectively is crucial for small businesses, but it can be challenging to balance income and expenses, especially during growth periods.

With Accounting Prose, small businesses can alleviate these challenges through a partnership that not only manages their daily financial tasks but also provides strategic insights to foster growth. This allows business owners to focus on what they do best: driving their business forward.

Accounting Prose understands these challenges and offers tailored solutions to help small businesses overcome them. By providing expert bookkeeping and accounting services, they can:

Save you time and resources by handling your financial management tasks efficiently and accurately.

Implement organized systems and processes to keep your financial records up-to-date and easily accessible.

Provide financial guidance and insights to help you make informed decisions and plan for the future.

Ensure compliance with tax laws and regulations, giving you peace of mind and reducing the risk of penalties.

Help you manage your cash flow effectively by providing regular financial reports and advice on optimizing your income and expenses.

With Accounting Prose's support, small businesses can focus on their core operations and growth objectives while ensuring their financial management is in capable hands.

Understanding and utilizing both bookkeeping and accounting services can help businesses optimize their financial operations, make informed decisions, and achieve long-term success. By partnering with professionals like Accounting Prose, small business owners can access the expertise and resources they need to navigate complex financial challenges and opportunities.

Accounting Prose offers a range of bookkeeping and accounting services designed to meet the unique needs of small businesses. From daily transaction management to strategic financial planning, their team of experienced professionals can help you streamline your financial processes, improve compliance, and make data-driven decisions that drive growth.

Don't let financial management challenges hold your business back. Take control of your financial future by understanding the importance of bookkeeping and accounting and partnering with a trusted professional services provider like Accounting Prose.

Contact us today to learn more about how we can help you optimize your financial operations and achieve your business goals.

AI, RPA, and other automated tech are transforming accounting, bringing increased precision, efficiency, safety, cost-savings and visibility. In...

Cash flow forecast is an important part of financial planning for any business. By utilizing a cash flow forecast, businesses can gain insight into...

A journal entry is a means of manually recording transactions and adjustments to your Xero accounting file. Some main reasons for posting a journal...