April 2018 Tax Deadlines

Have you ever gotten a letter from the IRS in the mail demanding immediate payment? Not only do you owe your taxes, but now you've been slapped with...

Are you in search of guidance on mileage reimbursement and deductions within the United States? If so, this guide is for you! We have gathered everything you need to help you become an expert. From reimbursing your employees' business-related car expenses to deducting mileage as self-employed, our guide covers it all. Plus, we provide valuable insights on keeping accurate records and up-to-date IRS mileage rates.

The IRS mileage reimbursement is intended to provide taxpayers with a way to be reimbursed for business-related travel expenses. The IRS has established a set rate for miles driven for business purposes, which is designed to cover the cost of fuel and other related expenses. This reimbursement can be used to reduce a taxpayer's taxable income and make traveling for business purposes more affordable.

The two types of IRS mileage reimbursements are the standard mileage rate and the actual expense reimbursement.

Deciding whether to use the IRS Standard Mileage Rate or actual car expenses for a tax deduction can be a tricky business. Both approaches are acceptable, but ultimately taxpayers will have to choose one or the other and commit to it when filing their tax returns. The key is understanding what each approach involves.

If you opt for the standard mileage rate approach, then you must calculate your business miles traveled in a year and multiply that number by the current standard rate set by the IRS. On the other hand, those who choose actual car expenses must maintain documentation of all associated costs such as repairs, insurance, and maintenance.

There are different rules to follow depending on whether you own vs lease your vehicle, or if you are an employee vs a business owner, and much more.

Let's dig into the nuances.

If you want to use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business. Then, in later years, you can choose to use either the standard mileage rate or actual expenses.

If you want to use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business. You can, however, choose to use either the standard mileage rate or actual expenses in later years, if you own the vehicle.

If you change to the actual expenses method in a later year, but before your car is fully depreciated, you have to estimate the remaining useful life of the car and use straight-line depreciation.

If you want to use the standard mileage rate for a car you lease, you must use it for the entire lease period. For leases that began on or before December 31, 1997, the standard mileage rate must be used for the entire portion of the lease period (including renewals) that is after 1997.

If you are an employee, you can’t:

Can you imagine any tax codes that aren't riddled with exceptions or caveats? Neither can we.

According to the IRS, you can’t use the standard mileage rate if you:

Use five or more cars at the same time (such as in fleet operations)

In this case, you will need to deduct the actual expenses

Claimed a depreciation deduction for the car using any method other than straight-line depreciation

Claimed a section 179 deduction on the car

Claimed the special depreciation allowance on the car

Claimed actual car expenses after 1997 for a car you leased.

The 2023 Federal Mileage Rates are:

|

Purpose |

$/mile |

|

Business |

$0.655 |

|

Medical |

$0.22 |

|

Moving |

$0.22 |

|

Charitable |

$0.14 |

The standard mileage rate for business use is based on an annual study of the fixed and variable costs related to operating a vehicle.

The IRS takes the following into consideration when setting mileage rates:

Fuel prices

Depreciation rates

Insurance rates

The cost to maintain a vehicle

The IRS defines business mileage as mileage that is driven between two places of work, permanent or temporary.

Some common types of trips that are considered business-related include:

Traveling between two different places of work

Traveling to another location of your business.

Traveling to a temporary business location

Meeting clients and going on customer visits

Running business-related errands

Commuting to a second job only if you are going straight from your first job to work, regardless if the work location is permanent or temporary.

The following types of travel are excluded:

Driving to your main place of work - this is considered commuting and is not allowed

Commuting to a second job if you going straight from home to work.

If you have no regular place of work but ordinarily work in the metropolitan area where you live, you can deduct daily transportation costs between home and a temporary work site outside of that metro-area.

Generally, a metro-area includes the area within the city limits and the suburbs that are considered part of that metropolitan area.

Example: Denver & Glendale, Colorado

You can’t deduct daily transportation costs between your home and temporary work sites within your metropolitan area as they are considered commuting expenses.

Visits to the doctor, as well as other healthcare or dentist appointments, are generally eligible for deductions according to the medical mileage rate. However, not all of your medical trips will be refundable - primarily those that aren't covered by an employer-sponsored health insurance plan. Despite being bound by one's adjusted gross income in terms of reimbursement limits, a medical deduction can still save you substantial amounts of money over time!

The sum of medical deductions you can claim is limited and depends on your adjusted taxable income and age. Medical expenses are eligible for deduction only if they exceed 7.5% of an individual's adjusted gross income (AGI). So, in the instance where someone earns $100,000 annually, their medical deductions would qualify when they surpass the threshold amount of $7,500. To learn more about this regulation and find out what qualifies as a medical expense head to the IRS' website here.

For tax years 2018 through 2025, the deduction of certain moving expenses is no longer allowed for nonmilitary taxpayers. In order to deduct certain moving expenses, you must be an active member of the military and move due to a permanent change of duty station.

The IRS classifies a permanent change of duty station as:

A move from your home to your first post of active duty

A move from one permanent post of duty to another

A move from your last post of duty to your home or to a nearer point in the United States

The move must occur within 1 year of ending your active duty or within the period allowed under the Joint Travel Regulations.

Itching to learn more? The IRS covers all of the details regarding mileage reimbursements related to moving in Publication 521, which is available here.

Donating your time to philanthropic causes comes with its own rewards, but you could also receive a mileage tax deduction in return. This government incentive is meant to offset the costs associated with individual or group volunteering and makes doing good even better!

The IRS allows you to apply for a charity mileage deduction if your personal car is used while performing services for charitable organizations. However, keep in mind that the organization must not have already reimbursed you for such expenses. Additionally, if any other modes of transportation are utilized when providing these services away from home, be sure to abide by the following regulations:

Travel must be performed for an approved charitable organization

You can’t deduct mileage if a significant part of the trip involves recreation or vacation

More info about charitable contributions can be found here.

Check an organization's tax-exempt status here

In order to successfully claim a mileage deduction, you must be able to provide proof that the miles were used for business purposes. This includes keeping meticulous records of your trips and any other related expenses, such as tolls or parking fees. The IRS also requires that you keep track of dates, destinations, mileage, and business purpose for each trip which they may review if your taxes are audited.

If you use your car for both business and personal purposes, you must divide your expenses between business and personal use. You can divide your expense based on the miles driven for each purpose.

For example, if you drive your car 50,000 miles in the year and 25,000 are driven for personal use, and 25,000 miles are driven for business use, you would claim 50% of the cost of operating your vehicle if you are using the actual costs method. If you had $5,000 in actual costs, you would only include $2,500 as a deduction on your tax return.

Tracking your mileage can be a tedious manual process, but with the right software solution, it can be drastically simplified. Mileage-tracking apps offer a range of features designed to make logging and tracking miles easier.

When shopping for a mileage-tracking app, there are several things to consider.

Here are a few tools that you might find handy when tracking your mileage:

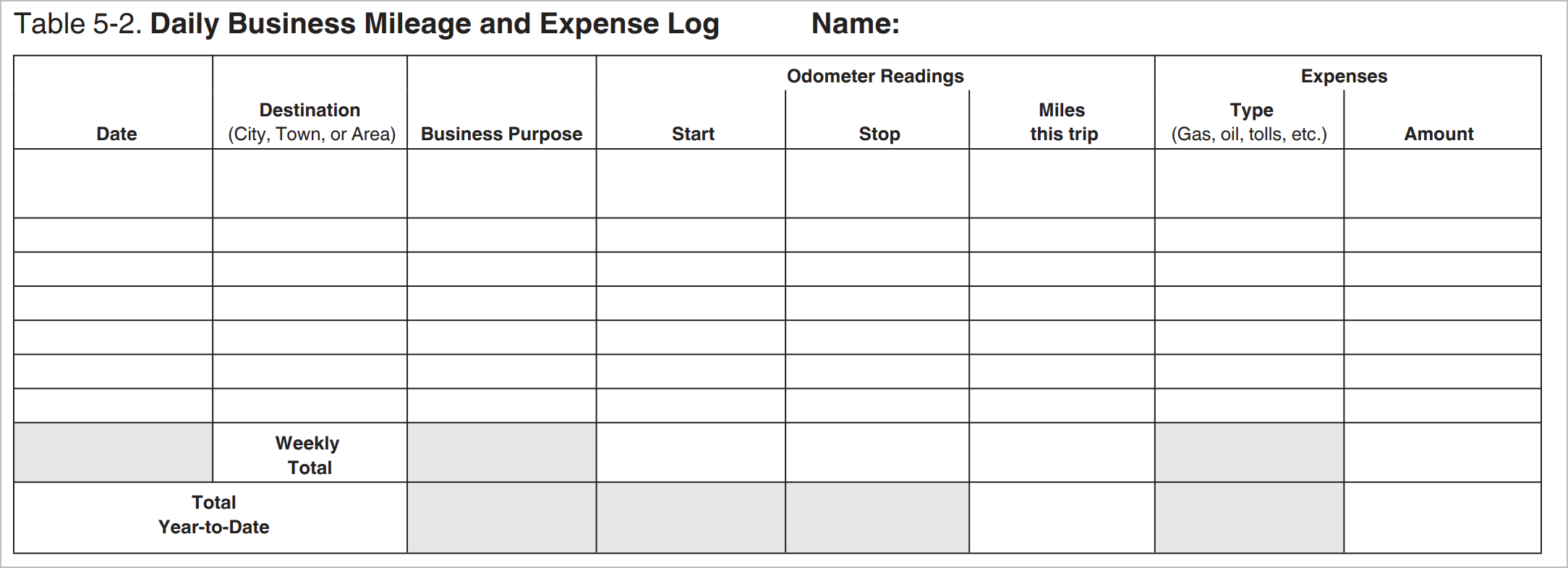

And if you are old school and want to skip the apps, an old-fashioned handwritten mileage log works just fine. This is an example provided by the IRS:

It is important to keep track of all miles driven and any other associated costs in order to successfully claim this deduction on your taxes. With the right mileage-tracking software or old-fashioned handwritten log, you can easily record and monitor your expenses so that you can maximize your tax deductions when filing. Whether it's through an app or manually keeping track, make sure that you have proof of how many miles were driven for business purposes versus personal use in order to take full advantage of this government incentive!

If you need some help tracking your actual vehicle costs and want to work with the best small business accounting team - look no further! We help our clients keep track of it all so that they are ready when it is time to file their taxes.

Ready to get started?

.png)

Have you ever gotten a letter from the IRS in the mail demanding immediate payment? Not only do you owe your taxes, but now you've been slapped with...

.png)

As a small business owner, one of the most important things you’re responsible for is taking care of your taxes every month. If you don’t, Uncle...

The tax world doesn't stand still, and neither should your approach to S-Corporation compensation. With the IRS stepping up its game and using newer...