Colorado State Mandated Retirement Program Guide

Colorado's new mandatory retirement program, called the Colorado SecureSavings Program, goes into effect in January 2023. Learn more about the...

11 min read

Enzo O'Hara Garza

:

Updated on March 14, 2024

.png)

After successfully processing nearly one hundred Paycheck Protection Program applications, we have some strong feelings about the program. Overall, we like what the program is supposed to accomplish; which is getting money into the hands of small business owners. Did it accomplish that? We explore what actually happened in our in-depth review...

For those who prefer to watch, rather than read...

In our last blog, we covered the basics of the Payroll Protection Program, also known as the PPP. That blog was revised several times (and will likely continue to be revised), as the terms of the program, the application, and even the allowable payroll costs changed again and again... and again. These changes didn’t always work in our client’s favor, for example, we were expecting to include both member draws/shareholder distributions in our calculation as that is considered “similar/normal compensation” in the eyes of the IRS. We also expected to include payments to independent contractors, as this type of compensation is normal and necessary in most operations. In fact, payments to independent contractors seemed to be included in the original language of the bill, creating even more confusion for everyone. Including these two key items in the payroll, cost calculation would have resulted in higher loan amounts to pay for necessary payroll costs, at a time our clients needed it the most.

This is the email I sent to my lender which was ignored... At least I tried, right?

Dear <Lender>

Thank you for taking the time to talk to me tonight. I believe we share a mutual goal of providing critical funding that small businesses desperately to help them navigate through this unprecedented crisis. These are indeed challenging times, with ever-changing guidance provided by both the SBA and the Department of Treasury, and I know you and your team are trying to quickly adapt. I do appreciate that your team will, at minimum, calculate the loan amounts on a rolling year (04.01.19 to 03.31.20) vs a calendar year (2019) as this more accurately represents the true payroll costs of a small business. Our clients, like many other small businesses, see wage growth over time and including Q1 2019 would negatively misrepresent their costs.

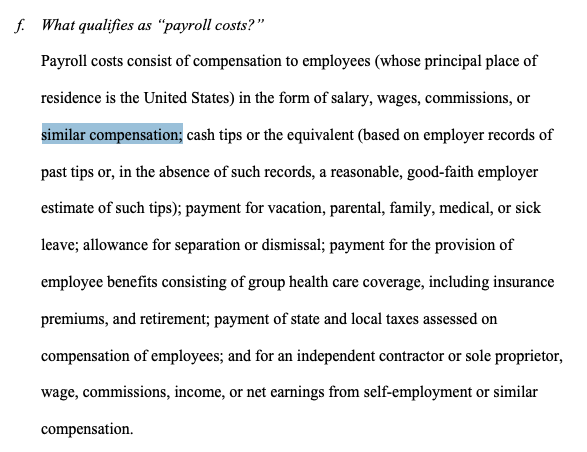

Here is the most recent guidance from the Dept of Treasury, regarding calculating payroll costs:

Dept of Treasury Interim Final Rule

Dept of Treasury FAQ 04/07/20

On page 10 of the Interim Final Rule (section f) you will see this:

Here is what "similar compensation" means in the eyes of the IRS, and I believe is in the spirit of the CARES Act:

(LLC) S Corps: Salaries/W2 Wages and Distributions/Draws

Per the IRS: IRS Source + 26 U.S. Code § 1368.Distributions

"S Corporations must pay reasonable compensation to a shareholder-employee in return for services that the employee provides to the corporation before non-wage distributions/draws may be made to the shareholder-employee."

Essentially, typical/similar compensation for an S Corp Officer would include both a salary ("reasonable compensation" included on a W2) and distributions/draws, which should not exceed 50% of the S Corp Officers compensation. This compensation split is common advice provided by many CPAs/Accountants, as to not get the business owner red-flagged by the IRS who may see that having a higher distribution/draw could be a method to avoid paying payroll tax.

We have included both W2 wages + draws/distributions up to the $100k max to calculate our client's loan amounts. In the Interim guidance, draws/distributions are not expressly excluded, and certainly fit the definition of “or similar compensation” as listed in section "f".

Partnerships: Guaranteed Payments

Per the IRS: 26 U.S. Code § 707(c)

"To the extent determined without regard to the income of the partnership, payments to a partner for services or the use of capital shall be considered as made to one who is not a member of the partnership, but only for the purposes of section 61(a) (relating to gross income) and, subject to section 263, for purposes of section 162(a) (relating to trade or business expenses)."

IRC Sec. 707(c) specifically introduces the concept of guaranteed payments into the law. It defines these payments as those made by a partnership to a partner for services or for the use of capital to the extent such payments are determined without regard to the income of the partnership. This means that no matter how profitable a business is, the partners can receive their guaranteed payment.

Essentially, a partner can take a guaranteed payment without regard to the organization's profits as part of their typical compensation. In the Interim guidance, guaranteed payments are not expressly excluded, and certainly fit the definition of “or similar compensation” as listed in section "f".

We have included guaranteed payments up to the $100k max to calculate our client's loan amounts.

Single Member LLC: Paid via Member/Owner Draws

"If a single-member LLC does not elect to be treated as a corporation (S or C Corp), the LLC is considered a "disregarded entity," and the LLC's activities should be reflected on its owner's federal tax return, typically a Schedule C. An individual owner of a single-member LLC that operates a trade or business is subject to the tax on net earnings from self employment in the same manner as a sole proprietorship."

The LLC provides legal protection, but the LLC owner's wages act the same. They cannot pay themselves on a W2 (this is not allowed) and according to The Dept of Treasury Borrower Information Sheet should be allowed to participate in the PPP starting on 04/03/20.

Additionally, according to the Interim Final Ruling (bottom of page 6), an LLC (taxed as a sole prop) must also submit such documentation as is necessary to establish eligibility such as payroll processor records, payroll tax filings, or Form 1099- MISC, or income and expenses from a sole proprietorship. For borrowers that do not have any such documentation, the borrower must provide other supporting documentation, such as bank records, sufficient to demonstrate the qualifying payroll amount.

In addition to financial statements, we would like to provide business bank statements as proof of their payroll costs, as our clients run all of their draws through company bank accounts.

Regarding providing 1099s... While our clients are operating legitimate businesses and may require a 1099 for their services, it is up to their clients to provide 1099s to them by Jan 31. While the rules around intentionally disregarding a 1099 filing is clear and the fines are steep, many business owners fail to remit these forms. Thus, bank records are likely the best way to show what LLC members are paying typically themselves to determine payroll costs.

We have included draws/distributions up to the $100k max to calculate our client's loan amounts.

I hope that this provides clarity and allows you to rethink how your lending team calculates payroll costs. I understand that this is a brand new program, and we are essentially in the Wild West of lending. I do not want to overstep the boundaries of this program, but rather provide adequate funding that my clients desperately need. I am doing my very best to advocate for them, and I hope you see me as your ally.

To add insult to injury, every bank we worked with had a different underwriting process, requested different information and different documentation, and even calculated the loan amount based on a different time frame. It was as if every lender was building the plane as it fell off the cliff, some more successful than others.

When applying for loans, we noticed that:

And the icing on the cake... our primary lender who is funding approximately $8 Million for our small business clients:

In the end, most of the clients we applied for, and who were eligible for this program, were ultimately funded. Yes, we are salty about the changes in the program, but thankfully we pushed nearly everyone through in time. My entire team worked extremely long hours for a week straight and were all collectively burned out after it was said and done. It seems like our clients were incredibly lucky and, despite our complaints about our primary lender, had a reasonably competent lending team who put in the effort to reserve funding and move as quickly as possible. In fact, we had clients that decided to use their own lenders and despite applying early, didn't hear a peep back. Major banks like Chase and Bank of America, were the worst the work with, despite flexing their lobbying power to adjust the terms in their favor. Some banks like Silicon Valley Bank and Citi didn't even begin lending until late into the game. Wells Fargo only briefly offered lending but were cut off because of their past indiscretions, which penalized their customers who stuck with them despite their bad behavior. Full disclosure, we have our own business bank accounts at Wells Fargo and will be switching to a local bank after the dust settles. Some stand-out local (Colorado) banks that processed Payroll Protection Program loans include Midfirst, Bank of the West, Collegiate Peaks, and Alpine Banks.

We were also disappointed to see that this program was abused by businesses that were anything but small. The biggest culprits include:

Those businesses are not small, and would normally not pass the SBA's size and revenue requirements. However, they were able to participate in the program because of the way the CARES Act was written. Those examples are just a few of the many businesses that should have not been able to participate, and we may see that doing so will cause them to fail anyway. It isn't good publicity to take money away from small businesses and consumers will be voting with their dollars soon enough.

According to a survey done by James Beard, the state of the restaurant industry is dire. It seems that boring, repetitive chain restaurants were the only ones to truly benefit from the Paycheck Protection Program. A loss of unique, homegrown restaurants could mean the death of local culture. Takeout can only carry a business so far, and many expect to not make it longer than the next few weeks. Do you really want to have to choose between Ruth's Chris, Potbelly, or Taco Cabana for the rest of your life? I certainly don't want to imagine that future.

Does this mean that shelter-in-place restrictions need to be lifted? No. It would be incredibly short-sighted to "reopen the economy" as the only result would be a sharp increase in loss of life, and ultimately no economy. Dead people can't buy tacos. What really needs to happen is lending, especially loans that offer forgiveness, needs to be provided to actual small businesses. The changes to the Paycheck Protection Program were already difficult enough to navigate, and if you add slow rollouts by lenders and inconsistent guidelines, it made the whole process seem impossible. Unless you are well connected or have a (well connected) accounting team that is willing to work 15 hours a day and have incredible luck, you were SOL with the PPP. There is still an opportunity to fix this - our administration is currently talking about a second wave of PPP funding. Fingers crossed that the money gets into the hands of those who really need it.

So, now that the doors of the first round of PPP lending are closed, the question of the hour is... Will these loans actually be forgiven?

After seeing the Department of Treasury guidance change again and again, all while bankers were unable to keep up with those changes, we are concerned with how the second piece of the program, loan forgiveness, will work. In fact, after asking a lender last week (April 14th, 2020) about loan forgiveness reductions based on employee salary reduction, we found that they had not even heard of this part of the program. WTF. This lack of basic program knowledge coupled with the ever-changing loan application experience/process, which varied widely bank-to-bank, gives us serious doubts that the second half of this program, and arguably the most important piece of this program, loan forgiveness, will be executed correctly, timely, and in the favor of borrowers.

Let’s reflect on some guidance provided by the Department of Treasury that should shed some light on what was expected during the underwriting process.

Question 1: Paragraph 3.b.iii of the PPP Interim Final Rule states that lenders must “[c]onfirm the dollar amount of average monthly payroll costs for the preceding calendar year by reviewing the payroll documentation submitted with the borrower’s application.” Does that require the lender to replicate every borrower’s calculations?

Answer: No. Providing an accurate calculation of payroll costs is the responsibility of the borrower, and the borrower attests to the accuracy of those calculations on the Borrower Application Form. Lenders are expected to perform a good faith review, in a reasonable time, of the borrower’s calculations and supporting documents concerning average monthly payroll cost. For example, a minimal review of calculations based on a payroll report by a recognized third-party payroll processor would be reasonable. In addition, as the PPP Interim Final Rule indicates, lenders may rely on borrower representations, including with respect to amounts required to be excluded from payroll costs. If the lender identifies errors in the borrower’s calculation or material lack of substantiation in the borrower’s supporting documents, the lender should work with the borrower to remedy the issue.

In our experience, lenders were not willing to take third-party payroll processor reports without a lot of pushing on our part. While advocating for our clients, lenders attempted to shut us down time and time again, with underwriters trying to pass off low loan amounts by using lazy math. It was frustrating to see our hard work tossed aside as lenders bypassed our applications and supporting documentation to just guesstimate loan amounts and offer less than what our clients need. Thankfully we acted as the middleman between our clients and the lenders. If we had not done this, they would have been fooled into taking less than what they deserved. I (Tina, writer of this blog and owner of Accountingprose) was told to stop emailing/calling underwriters to correct loan amounts or all of our client’s loan applications would be canceled- retribution that is both unprofessional and petty. The legislation is clear, but most lenders were woefully unprepared for the onslaught of applications, which is likely the root cause of the brunt of our frustration and the frustration of the underwriters. Let’s be clear, this reaction by the lender was likely not founded in malice or incompetence, there was just no prior framework built, and the rollout was rushed by our current administration. We sympathize with the lenders who were expected to carry out a nearly impossible task with no time to prepare but expected more from a company that we considered a partner.

With that in mind, let’s look at some guidance from the Department of Treasury regarding forgiveness.

How can I request loan forgiveness?

You can submit a request to the lender that is servicing the loan. The request will include documents that verify the number of full-time equivalent employees and pay rates, as well as the payments on an eligible mortgage, lease, and utility obligations. You must certify that the documents are true and that you used the forgiveness amount to keep employees and make eligible mortgage interest, rent, and utility payments. The lender must make a decision on the forgiveness within 60 days.

In essence, the same lenders who challenged us on loan approvals are the same lenders that will now make decisions about forgiveness. Those lenders who used lazy math had limited time to even open our emails (much less fully review our documentation), and those who stand to gain in this process are now going to the arbiters of our client's fate. I’m sure when the bill was written, the entire program sounded like a win- the SBA is guaranteeing the loans 100% making it risk-free for lenders, there is no requirement for collateral from the borrower, the lenders are given total autonomy in the approval process, all while taking the pressure off of the SBA (who currently can’t even meet the demands of the tapped out EIDL program).

With this in mind, we are hoping for the best, but are preparing for the worst (or at least a hell of a fight). I expect to see class action lawsuits made against lenders if they are not prepared to provide loan forgiveness to struggling small businesses, to the fullest extent of the law. If you are working with an accountant, please have them document the heck of your approved expenses, so that you receive the highest loan forgiveness possible. If you are doing this on your own, be mindful and ask questions if you need to, you have one shot to get the right.

Colorado's new mandatory retirement program, called the Colorado SecureSavings Program, goes into effect in January 2023. Learn more about the...

1 min read

Today (June 25th, 2020) ‘automated’ accounting service ScaleFactor announced that it would be permanently shutting down, closing its doors on August...

Have you considered in house payroll vs outsourcing? You're staring at a $15,000 payroll tax penalty notice. The deadline was last Friday. You...