1 min read

ScaleFactor Closure: Clients Seek Rapid Alternatives

Today (June 25th, 2020) ‘automated’ accounting service ScaleFactor announced that it would be permanently shutting down, closing its doors on August...

9 min read

Enzo O'Hara Garza

:

Updated on August 29, 2025

Are you looking for an alternative to Silicon Valley Bank? Many entrepreneurs are now scrambling to find an alternative after learning about Silicon Valley Bank's massive capitalization issues, which has lead the FDIC to take control on this bank and close SVB down amid this crisis. This is an enormous issue, especially within the tech community, especially as SVB has been touted as the best bank for startups for years. In this blog, we will dive into who SVB is, what protections depositors have, and what alternatives to SVB exist.

Silicon Valley Bank (SVB) was a global financial institution specializing in venture debt and other innovative services for startups, technology companies, and life sciences organizations. Founded in 1983, SVB previously provided capital to entrepreneurs looking to expand their businesses by offering venture debt loans, cash management solutions, private banking services, and more. SVB has offices around the world including locations in North America, Europe, Asia Pacific and Latin America, making them popular for companies with an international presence.

SVB had become the go-to bank for Silicon Valley's tech industry by providing cash flow solutions for high growth companies. They previously earned money primarily through interest payments on loans it makes to its customers, for certain services such as international wire transfers or foreign currency exchange, and from investment management activities including private equity investments in start-ups and venture funds. They also earned money by charging fees for services such as account maintenance, loan origination and servicing, overdraft protection and other banking products.

The collapse of Silicon Valley Bank may cause severe ramifications which may not only affect depositors, but their employees and community at large. SVB was the 16th largest bank, and provided financial services for many industries including technology, venture capital, life sciences, and private equity. Many tech companies have been pushed towards Silicon Valley Bank as they have partnerships with companies like Stripe, who will not only set up your new C-Corporation, but will automatically set up a Silicon Valley Bank bank account through their Stripe Atlas program.

As of Friday, March 10th the Federal Deposit Insurance Corporation, aka the FDIC, has stepped in to take control of Silicon Valley Bank. The FDIC offers a type of insurance that protects depositors against the loss of their deposits if a bank or savings institution fails. FDIC insurance provides coverage up to $250,000 per depositor, per insured bank, for each account ownership category.

The FDIC recognizes these ownership categories when protecting deposits:

Single

Joint

Certain retirement accounts (such as an IRA)

Revocable and irrevocable trust account

Employee benefit plan account

Corporation, partnership or unincorporated association account

Government account

Individual accounts are accounts that are solely owned by one person without any designated beneficiaries. For instance, an individual may hold a checking or savings account in their name only. In contrast, joint accounts are owned by two or more individuals but without any named beneficiaries. A joint checking or savings account may be held by a married couple or a parent and child. Retirement accounts and trust accounts are eligible to have one or more beneficiaries designated.

FDIC insurance extends to all deposit accounts at insured banks. This includes:

Checking accounts

Savings accounts

Money market accounts

Certificates of deposit

Negotiable order of withdrawal (NOW) accounts

Official items issued by the bank (such as cashier’s checks or money orders)

When a bank fails, the FDIC takes over the failed bank's assets and liabilities, including its deposits. The FDIC uses its insurance fund to pay depositors for their losses, up to the insured amount. This means that depositors don't lose their insured deposits, even if their bank fails.

![]()

If you have more than $250,000 at Silicon Valley Bank, call the FDIC at 866-799-0959 as soon as you can.

You will be made whole on Monday, March 13th for up to $250,000 and you can expect to receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors. As of December 31st, SVB had $209 billion in assets, and $175.4 billion in deposits, though more details about what they have available to pay back depositors will come to light in the next few days.

The FDIC has released a statement regarding a change to depositor protections. More info here.

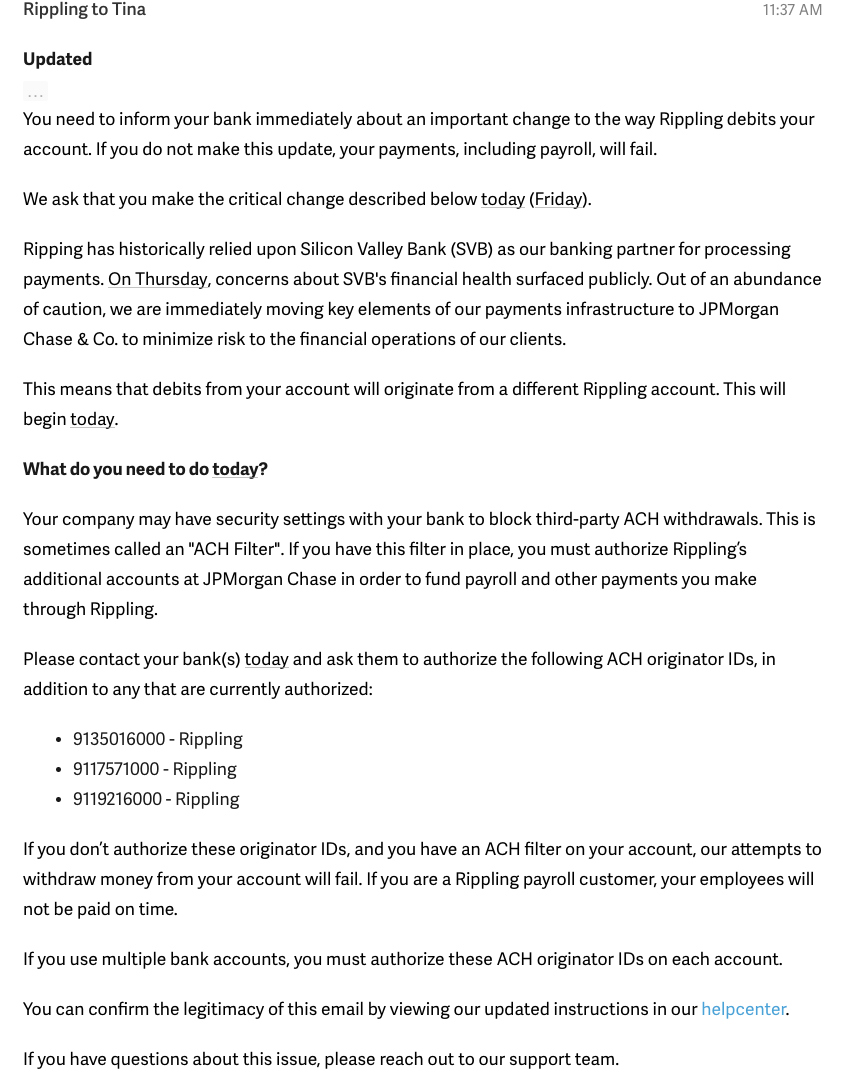

please follow these instructions in order to not miss a payroll.

If you have deposits in excess of $250k, you are not alone in this crisis. Here is what Max Reyes, reported for Bloomberg said.

Some investors are calling for a government bail out, in order to support those depositors affected, though there have been no plans to do so at this point.

Deposits up to 250k are insured by the government through the Federal Deposit Insurance Corporation (FDIC) in the United States, which seems like an absurdly low amount in 2023. If you have more than 250k to deposit, there are several ways to protect your funds, and none of the ways include burying your cash in coffee cans in your yard or hiding it under your mattress.

On March 12th, 2023, the FDIC released their, "Joint Statement by the Department of the Treasury, Federal Reserve, and FDIC" which states:

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

One day after closing Silicon Valley Bank, the FDIC announced the closure of Signature Bank. This press release notes that the same protections will be provided to depositor who held accounts at Signature Bank.

You can split your deposits into different accounts or at different banks to keep each account under the $250,000 limit. This does take more time and energy, but would give you immediate peace of mind, keep in mind that opening accounts at different branches of the same bank won’t increase your insurance.

You can use different ownership categories such as individual accounts, joint accounts, revocable trusts, and retirement accounts to increase your coverage limit.

According to the FDIC

The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category.

Deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at the same bank. For example, a revocable trust account (including living trusts and informal revocable trusts commonly referred to as payable on death (POD) accounts) with one owner naming three unique beneficiaries can be insured up to $750,000. See “Revocable and Irrevocable Trust Accounts” for more information about how deposit insurance is calculated for these types of accounts

Private deposit insurance is an alternative to the government-backed deposit insurance offered by the FDIC in the United States. It is typically provided by private companies or organizations and offers protection to depositors in case of bank failure or insolvency. Private deposit insurance is not as common as FDIC insurance and is not regulated by the federal government.

Private deposit insurance works in a similar way to FDIC insurance, where depositors pay a premium to the insurance company or organization in exchange for coverage on their deposits. However, the coverage limits and terms may differ from FDIC insurance, and the financial strength and stability of the insurance provider should be carefully evaluated before depositing funds.

It's important to note that private deposit insurance is not recognized by all financial institutions, and deposits covered by private insurance may not be as widely accepted or as secure as those covered by FDIC insurance. Before choosing private deposit insurance, it is important to do thorough research and consult with a financial advisor.

You can check with your financial institution to see if they accept private deposit insurance and if so, which companies they work with. It is important to carefully evaluate the financial strength and stability of the insurance provider before purchasing private deposit insurance. You can review the insurance company's financial ratings from rating agencies such as A.M. Best, Moody's, or Standard & Poor's, and consider any consumer reviews or complaints.

Consulting with a financial advisor can also be helpful in evaluating your options and making informed decisions regarding private deposit insurance.

IntraFi Network Deposit (formerly known as CDARS) is a service that allows depositors to access FDIC insurance on large deposits beyond the standard $250,000 insurance limit. It works by spreading a large deposit across multiple FDIC-insured banks within the IntraFi Network, while keeping the depositor's funds with their preferred bank.

With IntraFi Network Deposit, a depositor's funds are divided into smaller amounts and placed into demand deposit accounts or certificates of deposit (CDs) at participating banks. This allows the depositor to receive FDIC insurance coverage on the entire amount, even though it exceeds the standard $250,000 limit, without having to manage accounts at multiple banks.

The depositor's preferred bank serves as the custodian of the deposit and handles all transactions, providing a single point of contact for the depositor. The depositor receives one consolidated statement and one year-end tax form, simplifying record-keeping.

IntraFi Network Deposit is offered through participating banks and is available to individuals, businesses, and other organizations. It is important to note that the participating banks in the IntraFi Network are responsible for providing the FDIC insurance coverage on the deposits, and their financial strength and stability should be carefully evaluated before using the service.

Other options exist when looking for alternative providers able to offer similar products, features and benefits found at Silicon Valley Bank. Some popular examples include Chase, Wells Fargo, Citibank, U.S. Bancorp, SunTrust, PNC Bank, TD Bank, Regions Fidelity Investments Vanguard Charles Schwab American Express – just to name a few.

However we have had many clients switch over to Relay with a ton of success.

Relay is a financial technology (fintech) company, partnered with Thread Bank that provides a suite of financial tools and services designed to help small and medium-sized businesses manage their finances.

The platform enables the automatic import of bills from QuickBooks Online or Xero, allowing for easy review, approval, and payment of all bills from a single dashboard.

It also allows for automation of payment approval rules for bills, whether for a single payment or a multi-step payment process.

It allows for payment of multiple bills to the same vendor in a single batch, and payment of multiple bills to different vendors in a single workflow.

Paid bills are automatically synced back to the general ledger as "paid," and the platform offers 50 same-day ACH transfers per month, which can help businesses avoid late fees.

Relay's virtual cards (you can have up to 50 virtual cards) allow businesses to make secure purchases online, track expenses, and set spending limits for employees.

The platform's expense management tool provides a simple and efficient way to track expenses and reimbursements, while the payment solution enables businesses to make and receive payments electronically.

The platform's dashboard provides an overview of cash flow, outstanding invoices, and expenses, helping businesses make informed financial decisions.

Relay's services are designed to help businesses save time and money, reduce the risk of fraud and errors, and streamline their financial operations. The platform is user-friendly, with an intuitive interface that can be accessed through a desktop or mobile device.

Here's a video from CEO and Co-Founder, Yoseph West which talks about where Relay is headed.

Since Relay's partners Thread Bank, funds are FDIC insured, which as you have found might not be a perfect way to protect your deposits. So, using Relay along with employing the methods above, will give you the peace of mind you are looking for when switching to a new bank.

Additionally, on March 13th, Relay posted this FAQ, which talks about increasing FDIC coverage to up to $2,000,000 in deposits per business.

Keeping your money secure is our top priority at Relay, and we’re excited to provide added protection to our customers.

Relay and our primary partner bank, Thread Bank, are offering an insured cash sweep program, increasing FDIC insurance to cover up to $2,000,000 in deposits per business

Also, Relay has generously made this offer to anyone on the fence about starting with Relay,

Any of those clients who open an account by Friday. March 17 and deposits $25,000 in the next thirty days will automatically get a $250 bonus as well as access to free same day ACH, domestic and international wires for 12 months.

Nice. :)

The application process takes about ten minutes, as long as you have access to all documents that must be provided. This needs comes straight from Relay's help docs so is up-to-date and accurate.

Photo of Government-issued ID*

Social Security Number (SSN) [U.S. citizens] or Passport Number [Non-U.S. citizens]

Personal Address of Beneficial Owner

Position / Title of Beneficial Owner

Personal and Business Phone Numbers

Email Address

Beneficial owners include:

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation); and**

An individual with significant responsibility for managing the legal entity customer (e.g., a Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Managing Member, General Partner, President, Vice President, or Treasurer).**

*For international owners, Relay requires a photo of a passport for the Government-issued ID field. Here is a list of unsupported countries.

** All Beneficial Owners must be over the age of 18 at the time of registration. We are unable to offer our services to businesses that are owned, wholly or partially, by minors.

Employer Identification Number (EIN)*

U.S. Business Address and Phone Number**

Legal entity name

Industry

Description of business operations

State of Incorporation

*Employer Identification Number (EIN) Verification Letter may be requested for verification purposes.

** Additional documentation such as Articles of Organization, Company Bylaws, Certificates of Formation etc. may be requested for additional verification.

DBA (Doing Business As) [if applicable]

Social Security Number (SSN)

U.S. Business Address and Phone Number

Industry

Description of business operations

It can be a U.S. driver’s license, a state ID, a Military ID, Tribal Identification Card, or a passport (U.S. and non-U.S. citizens). Passports are required for non-U.S. citizens. Expired IDs cannot be accepted.

The image must be of the original document. Scanned copies are not permitted. The image file must be PNG,JPG, or JPEG. It must be a color image with no blur or flash, with the ID aligned horizontally. The four edges and corners of the ID must be clearly visible. Please follow the example below to guarantee its acceptance.

If more than one person has 25% or greater ownership of the company, they must be invited to Relay during initial registration. Please have all owner emails on hand when signing up. Once all owners have registered, the account will be ready to use!

As Silicon Valley Bank has failed, many small business owners and founders are now looking for alternatives. While Accountingprose isn't a financial institution, we spend the time to partner up with those companies that we believe in, and Relay is one of those companies.

If you are a current client and need an invite into Relay please let us know and we can get that process started today. If you are not a client and want to be, please book a call so we can get you some help as quickly as possible.

1 min read

Today (June 25th, 2020) ‘automated’ accounting service ScaleFactor announced that it would be permanently shutting down, closing its doors on August...

It's 2018, which means two things: miswriting checks and the urge to establish new (or abolish old) habits. Whether setting goals for personal or...