Calculating Payroll Costs for Your Employees

Navigating the waters of payroll costs is more than just a routine task for businesses; it's a pivotal element in the grand scheme of financial...

.png)

Gusto Payroll is a cloud-based payroll solution designed to simplify and streamline the payroll process for businesses. With a focus on automation, compliance, and user-friendly interfaces, it is a go-to choice for numerous companies looking to alleviate the challenges of managing payroll. This article delves into the top features, benefits, and step-by-step instructions on how to use Gusto Payroll.

|

Table of Contents |

Whether you're a seasoned entrepreneur or just starting your journey in the realm of small business, payroll is one aspect you cannot overlook. It's like the heart of your business operations, pumping life into your team's productivity. Gusto Payroll understands this and has designed a range of features to simplify, optimize, and streamline your payroll process.

From impressive integrations that reduce manual data entry to flexible payment options catering to diverse employee needs, and automatic tax calculations and filings that ensure compliance, Gusto is equipped with features that make it a robust, comprehensive payroll solution. So, let's dive in and explore these top features of Gusto Payroll a bit more. Buckle up, because this is going to be an enlightening ride!

Gusto boasts impressive integrations with several business software applications, such as accounting tools, time tracking systems, and HR platforms. This allows for seamless data synchronization, reducing manual data entry and the chances of errors.

Gusto shines in automating the intricacies of payroll processing. With its intuitive platform, time-consuming tasks such as calculating salaries, overtime, bonuses, and more become significantly simplified.

Offering flexibility, Gusto presents various payment options, including direct deposit, paper checks, and pay cards. This caters to diverse employee preferences and needs.

Gusto is a game-changer when it comes to payroll taxes. Not only does it calculate them, but it also automatically files federal, state, and local taxes, ensuring compliance at all times.

And there you have it, the top features of Gusto Payroll, each designed to simplify your payroll process and help your business run like a well-oiled machine. With its impressive integrations, flexible payment options, and automatic tax calculations and filings, Gusto Payroll is like an efficient, dedicated team member that never takes a day off. It's more than just a payroll service—it's a comprehensive solution that caters to the diverse needs of your business and employees. So whether you're juggling juggernauts or managing minnows, Gusto Payroll has got your back. Now, isn't it time you let Gusto take the payroll reins and focus on what you do best—growing your business?

Gusto Payroll is an online people platform that offers a range of services to help small businesses manage their payroll and employee benefits. As with any software, there are pros and cons to consider when deciding whether to use Gusto Payroll in 2023. In this section, we will explore the advantages and disadvantages of using Gusto Payroll based on the information available.

Gusto Payroll offers several advantages for small businesses, including its full-service payroll capabilities, user-friendly interface, and transparent pricing. However, it is important to consider the potential drawbacks, such as the cost compared to other payroll products and the limited feature options on lower tiered plans. Ultimately, the decision to use Gusto Payroll in 2023 will depend on the specific needs and priorities of each business.

Gusto offers different product offerings tailored to different business sizes and needs. They have plans for small businesses, midsize businesses, and larger enterprises. Each plan offers different features and pricing options to suit the specific requirements of businesses.

Price: $40 per month, plus $6 per person per month.

Suitable for: Smaller businesses (10 or fewer employees) with simple salaries, wages, and pay schedules.

Includes full-service payroll, including W-2s, 1099s, direct deposit or printable checks with unlimited payroll runs.

Employees get lifetime access to their Gusto account to view pay stubs and tax forms.

Integrations for accounting, time tracking, and more are available.

Can sync medical, dental, and vision insurance with payroll.

Price: $80 per month, with a slight increase in price per person to $12 per month.

Suitable for: Businesses with 20 or more employees.

Offers everything in the Simple plan, plus additional benefits.

Includes next-day direct deposit, time tracking, and PTO management.

Provides hiring and onboarding tools, project tracking, workforce cost reports, and team management tools.

Note: Broker integration is not available with this plan.

Price: Custom quote

Suitable for: Businesses with more sophisticated HR, policy, and compliance needs.

In addition to Gusto's monthly plan, they also offer a handful of paid add-ons:

International Contractor Payments

State Tax Registration

R&D Tax Credits

Health Insurance

Health Insurance Broker Integration

Workers Comp

Life & Disability Insurance

401K Programs

Health Savings Accounts (HSA)

Flexible Spending Accounts (FSA)

Dependent Care FSA

Commuter Benefits

To decide which plan is right for your business, you should consider the following factors:

Number of employees: The more employees you have, the more expensive your payroll service will be.

Features: What features are important to you? Do you need a payroll service that offers time tracking, benefits administration, and HR tools?

Budget: How much are you willing to spend on payroll services?

If you are a small business with a few employees and you only need basic payroll features, then the Simple plan may be a good option for you. If you have more employees or you need additional features, such as time tracking or benefits administration, then the Plus plan may be a better option. If you are a large business with complex payroll needs, then the Premium plan may be the best option for you.

Here are some additional tips for choosing the right Gusto Payroll plan for your business:

Start with the Simple plan: If you are unsure which plan is right for your business, you can start with the Simple plan. You can always upgrade to a higher-priced plan later if you need more features.

Consider your future needs: If you plan to grow your business in the future, you may want to choose a plan that offers more features and customization options. This will save you from having to switch to a different payroll service later on.

Get a quote from Gusto: If you are still unsure which plan is right for your business, you can contact Gusto to get a quote. Gusto's team of experts can help you to choose the plan that is best for your specific needs.

Though we suggest Gusto as our exclusive payroll provider for all our clients, we know there are other options out there. They all vary in pricing, features, options, and usability. The primary differences will come down to price, usability, and features. We have gathered the other popular payroll providers to compare them with so you can make an informed decision.

Winner: Gusto

Dive into the bustling world of small business HR, and two names are sure to echo loudly: Gusto and ADP. Both giants in their own right, they serve as comprehensive toolkits for your payroll and HR needs, be it time-tracking, benefits, or a suite of HR resources. Yet, like two master chefs using different recipes, they do have their nuances.

First, let's talk dollars and cents. If you're a sprouting business with a tight budget and just a handful of star employees, Gusto might be your wallet's best friend. They've got diverse plans tailored for the David-sized businesses. ADP, meanwhile, operates on a "pay-as-you-grow" model – the more you grow and the more features you need, the more it's going to cost.

Navigating their platforms? Gusto feels like a refreshing chat with a friend – intuitive and customizable. ADP is the more sophisticated counterpart; with its vast feature list comes a learning curve, so some might need a guiding hand.

Need help at 3 am? Or perhaps during the busy hours? Customer support can make or break your experience. Gusto wears a crown here, often lauded for its stellar, always-there-for-you support. ADP isn't far behind, though some folks have mentioned playing a tad bit of phone tag before connecting.

So, who should don the cape for your business? If you're a small enterprise longing for a straightforward, budget-friendly solution, Gusto might just be your superhero. But if you're on the larger side, or if your payroll needs read like a thick novel, ADP might be the seasoned guide you're looking for.

|

Factor |

Gusto |

ADP Workforce Now |

ADP Run |

|---|---|---|---|

|

Pricing |

Generally more affordable, especially for small businesses |

Generally more expensive |

Generally more affordable |

|

Features |

Similar range of features to ADP Workforce Now, but Gusto is generally more user-friendly and offers more customization options |

More comprehensive range of features than ADP Run |

More basic range of features than ADP Workforce Now |

|

Ease of use |

Generally more user-friendly than ADP Workforce Now or ADP Run |

More complex than Gusto, but easier to use than ADP Run |

More difficult to use than Gusto or ADP Workforce Now |

|

Customer support |

Excellent |

Good |

Good |

|

Integration |

Integrates with a wider range of third-party software applications than ADP Workforce Now or ADP Run |

Integrates with a wider range of third-party software applications than ADP Run |

Integrates with a more limited range of third-party software applications than Gusto or ADP Workforce Now |

Winner: Gusto

Let's talk money first. If you're a small outfit with just a few star players, Gusto might feel like a warm hug to your budget. Their pricing dances to the tune of how big (or small) you are and which shiny tools you'd like. Meanwhile, Paychex feels a bit like a riddle, weaving in factors like your team size, where you're stationed, and the bells and whistles you fancy.

Navigating the tech waters? Gusto is like a gentle stream – intuitive and filled with customizables. Even if you've never dipped your toes in the HR pool before, Gusto makes it feel like a day at the spa. Paychex is a tad more like white-water rafting; it's deeper, maybe trickier, and some smaller crews might want an experienced guide.

If you've ever screamed for help into the tech void, you'll know support is everything. Gusto's got a reputation here – think of them as the trusty friend who's always got your back. Paychex is also in your corner, though sometimes it might take a minute to flag them down.

A little tech magic worth sprinkling in? Integrations. Gusto loves playing well with your other software buddies, making it a breeze to mix and mingle platforms.

So, when the dust settles, who's your champion? If you're a young, spry business looking for both affordability and ease, Gusto could be your partner-in-crime. If your needs run deeper, have more intricate twists, or you have a particular software squad in mind, Paychex might just be the seasoned partner you seek.

|

Factor |

Gusto |

Paychex Flex |

Paychex Payroll |

Paychex PEO |

|---|---|---|---|---|

|

Pricing |

Generally more affordable, especially for small businesses |

More expensive than Gusto |

More expensive than Gusto |

Most expensive |

|

Features |

Similar range of features to Paychex Payroll, but Gusto is generally more user-friendly and offers more customization options |

More basic range of features than Paychex Payroll or Paychex PEO |

More comprehensive range of features than Paychex Flex |

Most comprehensive range of features |

|

Ease of use |

Generally more user-friendly than Paychex Flex, Paychex Payroll, or Paychex PEO |

More difficult to use than Gusto |

More difficult to use than Gusto |

More difficult to use than Gusto |

|

Customer support |

Excellent |

Good |

Good |

Good |

|

Integration |

Integrates with a wider range of third-party software applications than Paychex Flex, Paychex Payroll, or Paychex PEO |

More limited integration options than Gusto |

More limited integration options than Gusto |

More limited integration options than Gusto |

Winner: It depends... Both are great options, but if you are a QuickBooks user, you may want to stick with QuickBooks payroll.

Navigating the payroll landscape, Gusto and QuickBooks Payroll emerge as two standout favorites among small businesses. Both come packed with impressive features—from the basics of payroll and time tracking to nifty HR tools.

But here's the deal: Gusto, in many eyes, is the cost-effective buddy, especially for startups with just a few hands on deck. It’s intuitive, straightforward, and integrates seamlessly with a host of other software tools.

On the flip side, QuickBooks Payroll’s cost hinges on your team size and the toolkit you desire. While it's a powerhouse, some might find it akin to mastering a new board game. When you hit a snag and need help, Gusto’s support feels like a friend ready to jump in. QuickBooks Payroll offers aid too, though you might play a bit of phone tag first.

In essence, if you're after an affordable, user-friendly solution, give Gusto a whirl. But if you’re already in the QuickBooks ecosystem or need more intricate tools, QuickBooks Payroll might be your go-to.

|

Factor |

Gusto |

QuickBooks Payroll |

|---|---|---|

|

Pricing |

Generally more affordable, especially for small businesses |

Generally more expensive |

|

Features |

Similar range of features, but Gusto is generally more user-friendly and offers more customization options |

More complex platform, may be more difficult for small businesses to use without assistance |

|

Customer support |

Excellent |

Good |

|

Integration |

Integrates with a wider range of third-party software applications |

More limited integration options |

When it comes to payroll software options, there are several alternatives to Gusto that you may want to consider.

Here are some other payroll software options that you can compare:

OnPay

Rippling

Patriot Payroll

Square Payroll

Justworks

Paycor

PayrollMate

SurePayroll

When comparing these payroll software options, it's important to consider various factors:

Pricing: Compare the cost of each software and any additional fees, such as setup fees or per-employee fees.

Features: Evaluate the features offered by each software, including payroll processing, time tracking, benefits administration, and HR tools.

Ease of Use: Consider how user-friendly and intuitive the software is to navigate and understand.

Customer Support: Look into the quality of customer support provided by each software and how easy it is to get assistance when needed.

Integration: Check if the software integrates with other tools you use, such as accounting or HR software.

Reading reviews from other businesses can also provide valuable insights into the pros and cons of different payroll software options. By considering these factors and gathering feedback from other users, you can make an informed decision and choose the payroll software that best suits your business's needs.

First and foremost, let's face it, time is a precious commodity in the world of business. Every minute spent on payroll administration is a minute not spent on strategic planning, customer interaction, or product development. This is where Gusto Payroll shines. By automating the payroll process, Gusto saves you valuable time, freeing you to focus on the things that really grow your business.

But it's not just about saving time. Gusto Payroll can also save you money. Think about all the hours you burn trying to crunch numbers, decipher complex tax laws, and ensure everything is accurate. With Gusto, these tasks are no longer your responsibility, effectively cutting down on the costs associated with them.

Moving onto compliance—don’t we all just love staying updated on the ever-changing federal, state, and local tax laws? Well, Gusto does. Gusto keeps up with these changes so you don't have to. This way, you can rest assured that your payroll is always compliant, avoiding any potential legal issues down the line.

Finally, let's discuss employee satisfaction. Gusto’s easy-to-use interface allows your employees to access their payroll information, request time off, and manage their benefits with ease. This level of autonomy and transparency can greatly boost employee satisfaction.

If you're ready to dive into the world of Gusto Payroll, you're in the right place. Here's a step-by-step guide to get you started with setting up your account. Don't worry, it's as easy as pie (and nearly as satisfying).

First things first, you'll need to go to the Gusto Payroll website and click on the "Get Started" button. You'll be asked to enter your email address and create a password. We won't tell you to make it something memorable, but maybe don't make it "password123," okay?

Next, Gusto is going to need to know a bit about your business. This includes your legal business name, EIN or Tax ID, and the state your business operates in. You'll also need to provide your trade name (if it's different from your legal business name), the date your business was established, and your business's physical address.

Now, let's get down to the nitty-gritty: setting up your payroll. You'll need to enter information about your workweek, pay schedule, and your company's payday. Don't forget to include any pay rate details and the date of your next payday. Gusto is thorough, so it's going to ask you for your previous payroll history, too.

Time to add your team! For each employee, you'll need to enter their legal name, social security number, hire date, email address, and compensation details. If they're hourly, don't forget to add their rate and hours per week. And if they're salaried, you'll need to add their annual salary.

If there are any health benefits, retirement plans, or garnishments that apply to your employees, you'll add those next. Gusto makes it easy to add these deductions and contributions by providing straightforward forms and explanations for each.

Finally, double-check everything. Make sure all the information you've entered matches your records. Once you're sure everything is accurate, click the finish button. And voila! You've just set up your Gusto Payroll account.

That's it! You're now ready to run payroll with Gusto. Remember, at the end of the day, Gusto is there to make your life easier. So sit back, relax, and let Gusto take the payroll reins for a bit. You've got a business to grow, after all!

Navigating a new payroll software can be a daunting task for any small business owner. But don't worry, we've got your back. We're going to take a deep dive into how you can run payroll on Gusto, making it as easy as a walk in the park.

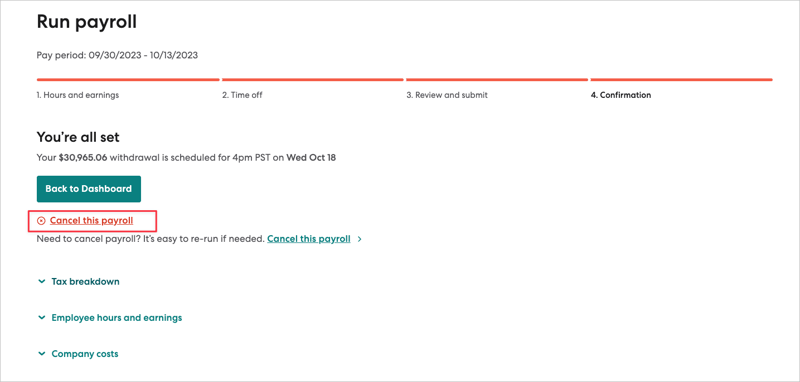

Running payroll in Gusto takes only 4 steps: Review Hours and Earning, Review Time Off, Review and and Submit, and Confirmation.

Let's go!

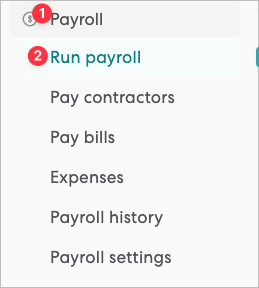

First, on the left sidebar, go to Payroll > Run Payroll.

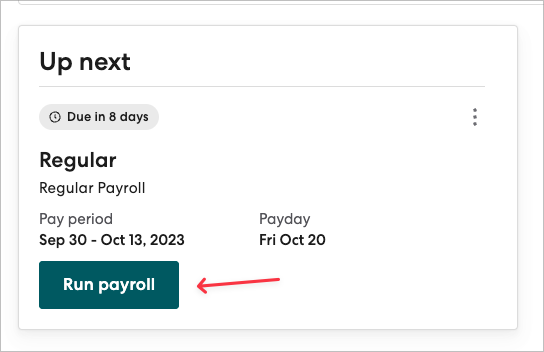

Verify the dates within the pay period and the payday. If the dates are correct, click Run Payroll.

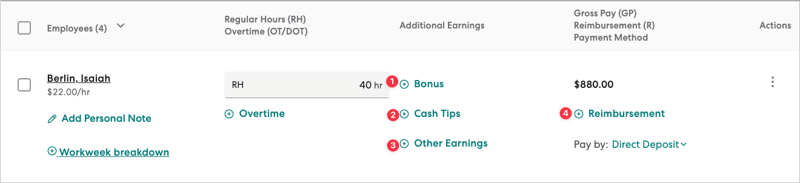

The hours and pay for salaried employees will be automatically calculated by Gusto. Here you can see that Gusto prorated this (fictitious) employee's salary because they were hired mid pay-cycle.

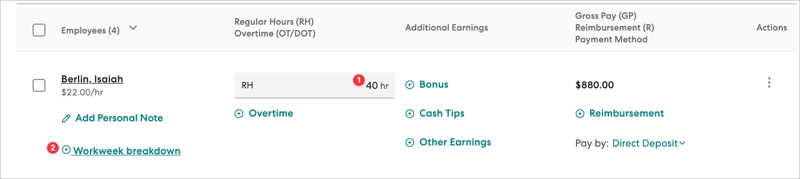

Next, you can review the approved hours for your hourly employees.

Note, these hours are first approved in Gusto's time tracking module which can be accessed by going to Time Tools > Time Tracking in the left sidebar.

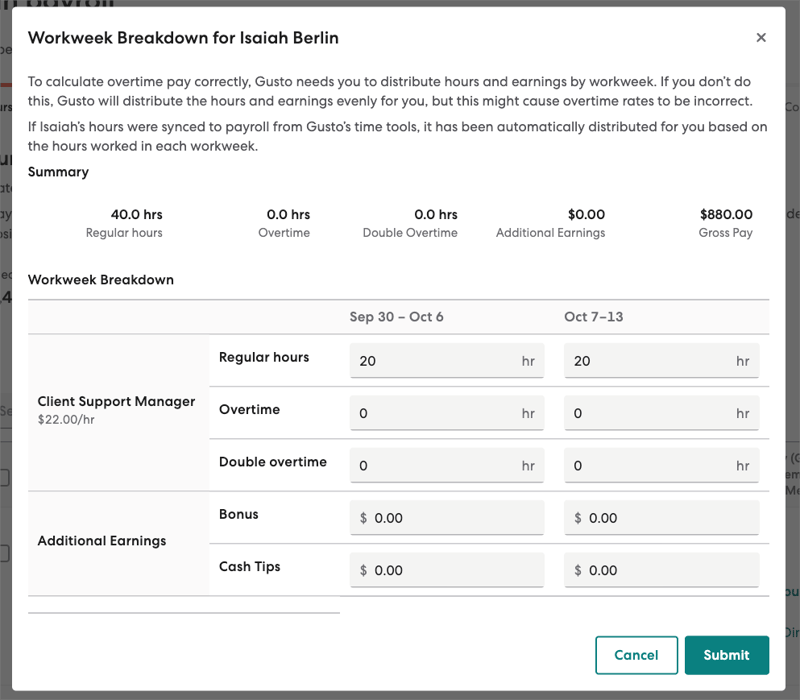

Should you want to see a bit more detail, click on the Workweek Breakdown.

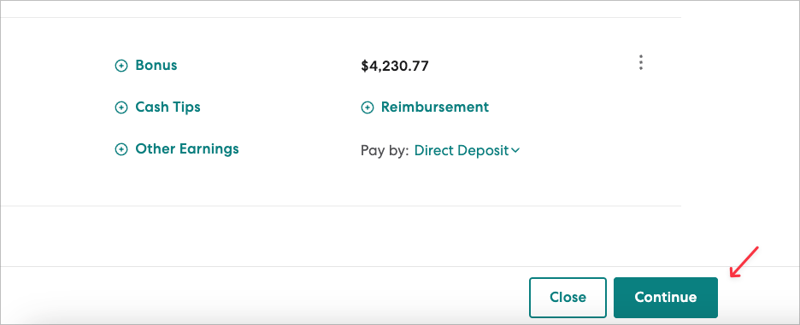

If anyone on your team has one-time payments to include, like bonuses, cash tips, other earning, or reimbursements, now is the time to pay up.

If everything looks good, click Continue.

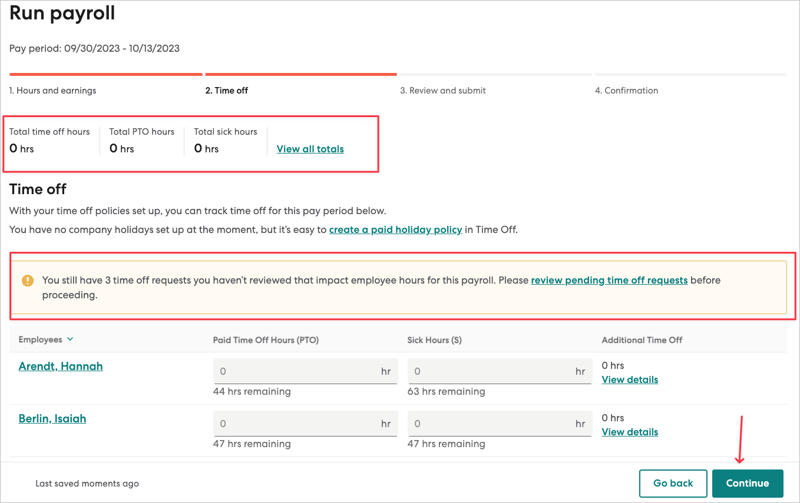

Next you should take a peek at time off that will be paid off during this payroll. Note the yellow box that is providing a bit of a warning for you. Pay attention to when Gusto warns you, so that you don't miss time that needs to be approved before paying your employee.

It's best to take a quick look at any time off awaiting approval before you run payroll; ideally as the requests come in.

Click Go Back if you need to make adjustments on the Hours and Earnings tab, otherwise Click Continue to move forward.

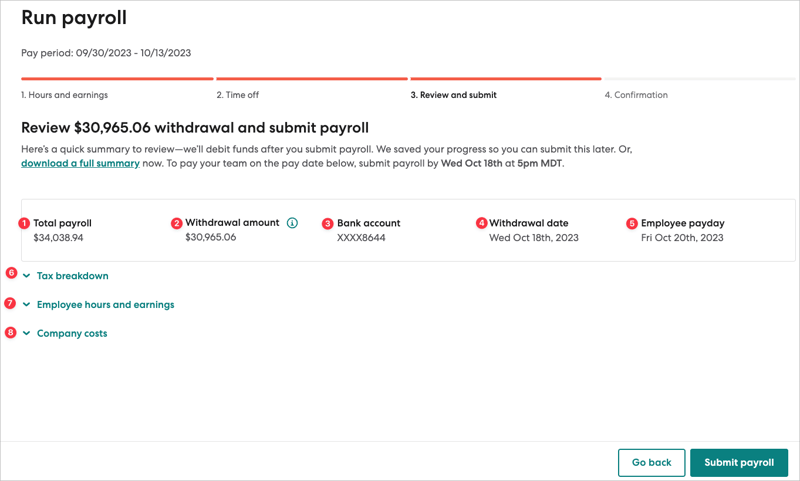

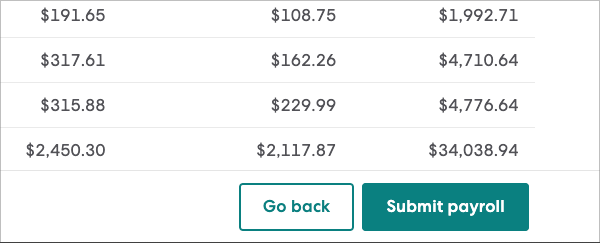

Gusto will work it's magic behind the scenes and then will show a (1) summary of total payroll amount, (2) the amount to be withdrawn, (3) the account that will be debited, (4) the date of the withdrawal, and the (5) date your team will receive their funds. Additionally, Gusto will provide the detail for (6) taxes to be paid, (7) hours and earnings, and (8) company costs.

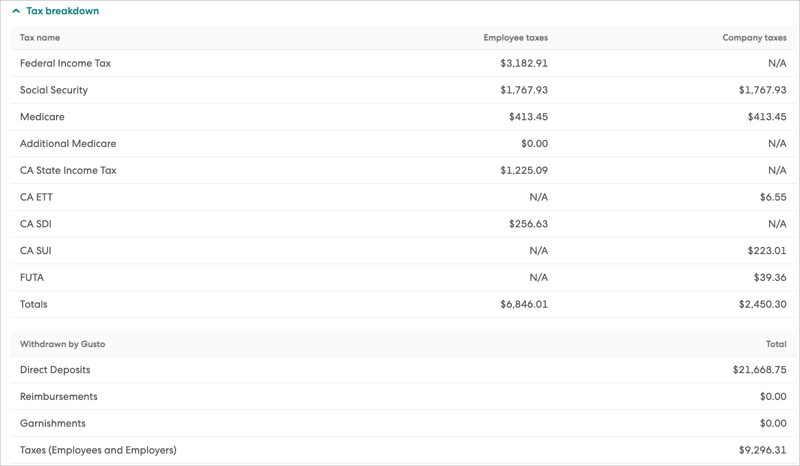

With Gusto, you don't need to worry about staying updated on the ever-changing tax laws. Gusto automatically calculates, pays, and files your local, state, and federal payroll taxes. If you expand the Tax Breakdown section, you will see the names of taxes to be paid, which is further broken down by who is responsible for paying the tax - the employer or the employee. The employee and the employer tax will be reconciled at the bottom of section next to "Taxes (Employees and Employers)."

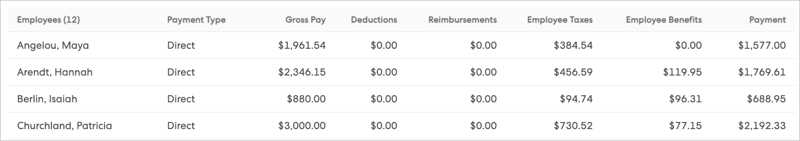

If you expand the Employee Hours and Earnings section, you can review your employees regular and over time hours, paid time off, and emergency leave. You can toggle from Hours to Pay to see how those hours convert to pay.

For example, Maya Angelou worked 48 hours and is paid $1961.54 on this paycheck.

Further down, you can see what payment types each employee has chosen. Gusto offers different payment methods for your employees, including direct deposit and check.

If you expand Company Costs, you can review gross pay, reimbursements, company paid taxes, and company paid benefits for each employee.

If all looks good, click Submit Payroll to move to the next step. If there are changes to be made, click Go Back to make corrections.

There isn't much for you to do when you get to Step 4. If you're happy and don't need to make any changes, you can simply navigate away and go work on something else.

If you have made a mistake and need to correct it, Click Cancel this Payroll, to start over.

Be mindful of Gusto's deadlines and do not wait until the last minute to run your payroll. Gusto currently offers next day, 2-day, and 4-day payments, but not all plans have the capacity to run next day payroll. Only those who are subscribed to the Plus or Premium plan are able to run next day payroll, and funds are deposited in the afternoon vs the morning.

Navigating the world of payroll can be a challenging endeavor, but with the right tools in hand, it becomes significantly more manageable. Gusto Payroll emerges as a powerhouse in this realm, with its cloud-based platform and extensive features tailored to ensure businesses run smoothly. Whether you're a small startup or a rapidly growing enterprise, there's a Gusto plan designed with you in mind. This guide has taken you through its top features, comparisons with other major players in the industry, and a detailed step-by-step on setting up and running payroll with Gusto. The onus now lies on you, the business owner, to take the leap.

Are you ready to streamline your payroll process and give your business the competitive edge it deserves? Let the pros at Accounting Prose take payroll off of your plate, so you can get back to doing what you love.

Navigating the waters of payroll costs is more than just a routine task for businesses; it's a pivotal element in the grand scheme of financial...

1 min read

As a small business owner, you wear many hats, juggling various responsibilities to keep your company running smoothly. One of the most important...

As businesses continue to embrace remote work arrangements, navigating the complexities of remote employee payroll tax compliance has become a...